Exchange Blog Cryptocurrency Blog

-

Posts

3,619 -

Joined

-

Last visited

-

Days Won

6

Posts posted by FXOpen Trader

-

-

GBP/USD Could Decline Further, USD/CAD Is Eyeing Upside Break

GBP/USD started a fresh decline after it failed to clear the 1.3700 resistance. USD/CAD is rising and it is currently eyeing an upside break above 1.2750.

Important Takeaways for GBP/USD and USD/CAD

- The British Pound started a major downside correction from well above 1.3650.

- There is a major bearish trend line forming with resistance near 1.3610 on the hourly chart of GBP/USD.

- USD/CAD started a fresh increase after forming a support base near the 1.2660 level.

- There was a break above a key bearish trend line with resistance at 1.2700 on the hourly chart.

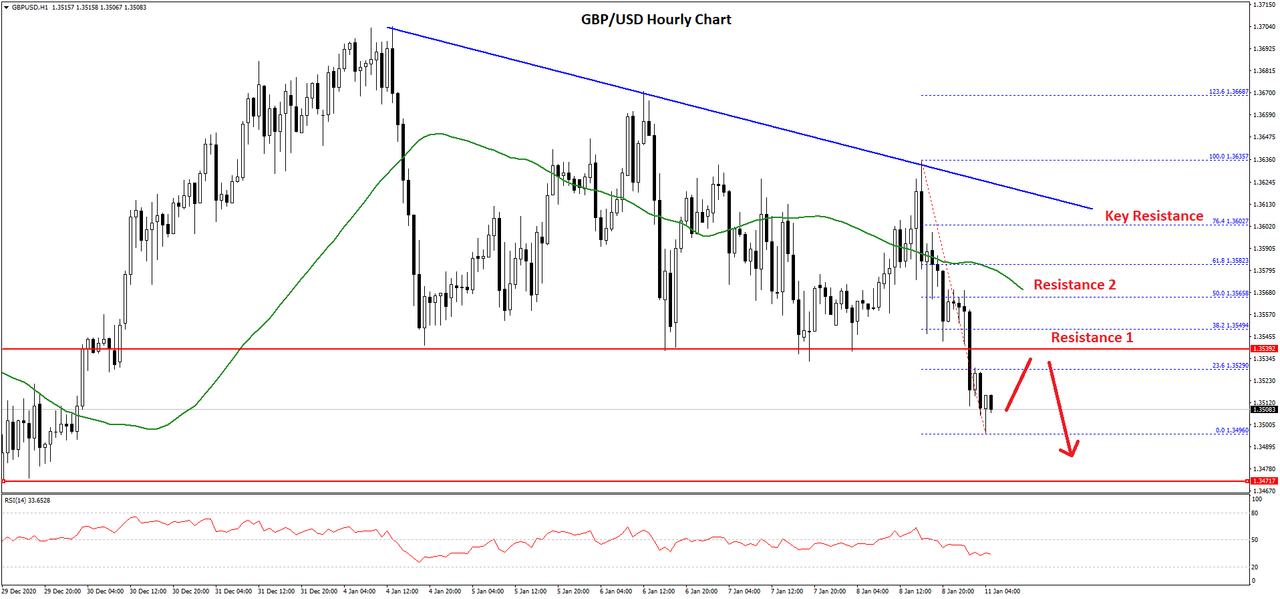

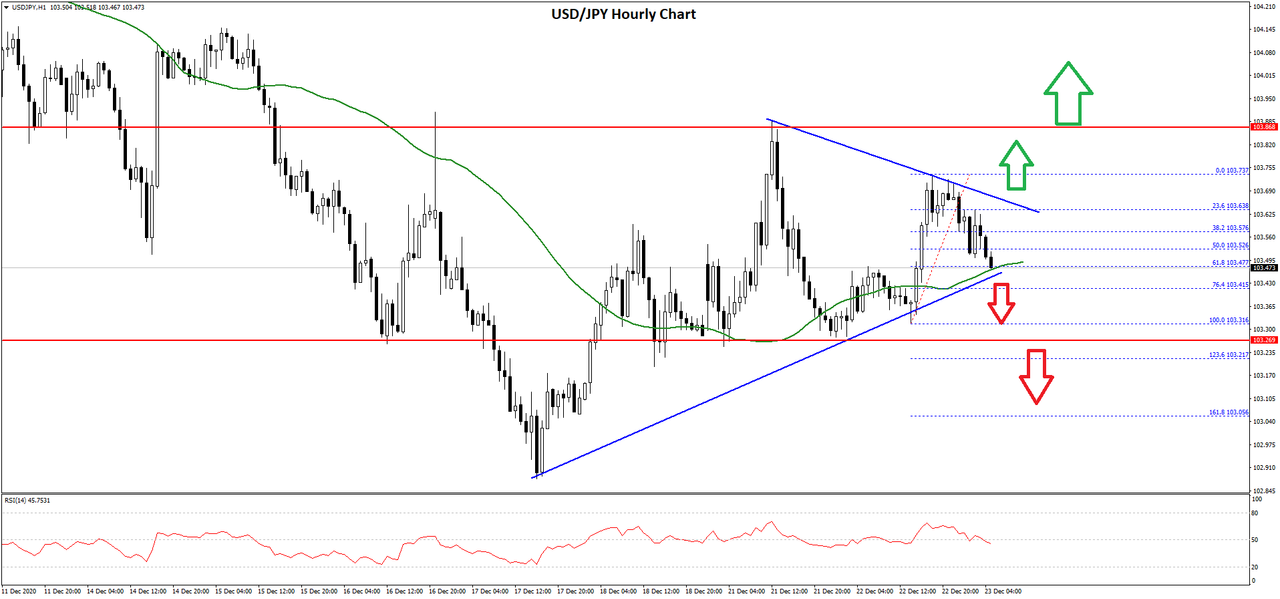

GBP/USD Technical Analysis

After a decent increase, the British Pound faced resistance near 1.3680-1.3700 against the US Dollar. As a result, the GBP/USD pair started a fresh decline and broke a couple of important supports near 1.3650.

The pair gained bearish momentum below the 1.3600 level and the 50 hourly simple moving average. It even broke a major support zone at 1.3540 to move into a bearish zone. It traded as low as 1.3496 on FXOpen, and the pair is currently consolidating losses.

An initial resistance on the upside is near the 1.3525 level. It is close to the 23.6% Fib retracement level of the recent decline from the 1.3635 high to 1.3496 low.

The first major resistance is near the 1.3540 level (the recent breakdown zone). The next resistance is near the 1.3565 zone and the 50 hourly simple moving average. It is also close to the 50% Fib retracement level of the recent decline from the 1.3635 high to 1.3496 low.

Finally, there is a major bearish trend line forming with resistance near 1.3610 on the hourly chart of GBP/USD. Clearly, the pair is likely to face many hurdles if it starts an upside correction from the recent low of 1.3496.

On the downside, the first key support is near the 1.2500 area. The next major support is near the 1.3470 level, below which there is a risk of a sharp decline.

USD/CAD Technical Analysis

The US Dollar traded as low as 1.3629 before starting a decent upward move against the Canadian Dollar. The USD/CAD pair broke the 1.3650 and 1.3665 resistance levels to move into a short-term bullish zone.

The pair gained pace above the 1.3700 level and the 50 hourly simple moving average. Moreover, there was a break above a key bearish trend line with resistance at 1.2700 on the hourly chart.

The pair even broke 1.2720, and climbed above the 50% Fib retracement level of the downward move from the 1.2797 high to 1.2629 swing low. It is now attempting an upside break above another bearish trend line with resistance at 1.2750 on the same chart.

The next key resistance is near the 1.2760 level. It is close to the 76.4% Fib retracement level of the downward move from the 1.2797 high to 1.2629 swing low.

A clear break above the 1.2750 and 1.2760 resistance levels may possibly increase the chances of a strong upward move in the coming sessions. The next key resistance sits at 1.2800.

Conversely, USD/CAD might start another decline if it fails near 1.2750. An initial support is near the 1.2700 level and the 50 hourly SMA. The main support seems to be forming near 1.2665.

-

Gold Price Trims Gains While Oil Price Turns Bullish Above $50

Gold price started a downside correction after surging towards $1,960. Conversely, crude oil price is following a strong bullish path and it settled above $50.00.

Important Takeaways for Gold and Oil

- Gold price started a fresh increase towards $1,950-$1,960 and recently corrected lower against the US Dollar.

- There was a break below a major bullish trend line with support near $1,920 on the hourly chart of gold.

- Crude oil price surged above the $48.00 resistance and it even broke the $50.00 barrier.

- There is a key rising channel forming with support near $50.60 on the hourly chart of XTI/USD.

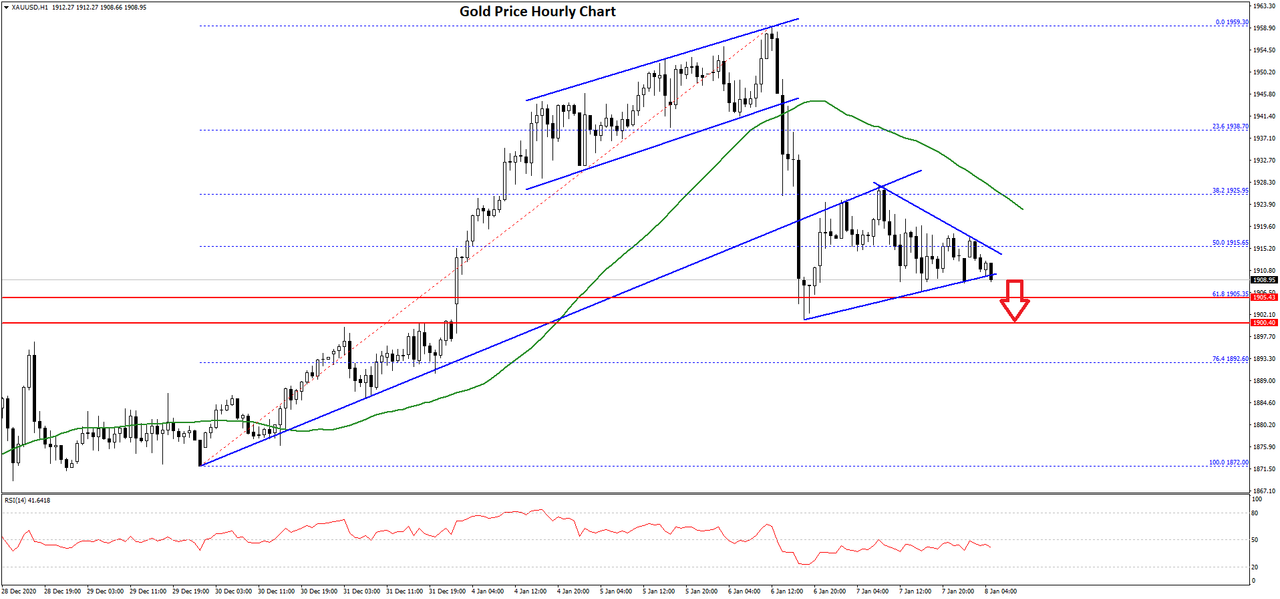

Gold Price Technical Analysis

Gold price started a fresh increase above the $1,910 resistance level against the US Dollar. The price broke the $1,925 and $1,950 resistance levels to move into a positive zone.

The price even traded close to the $1,960 before it faced sellers. A swing high was formed near $1,959 on FXOpen before the price started a downside correction. There was a sharp decline below the $1,950 and $1,940 levels.

During the decline, there was a break below a major bullish trend line with support near $1,920 on the hourly chart of gold. The price traded below the 50% Fib retracement level of the upward move from the $1,872 swing low to $1,959 high.

It even settled below the $1,920 level and the 50 hourly simple moving average. It seems like the price is approaching the $1,905 and $1,900 support levels. The 61.8% Fib retracement level of the upward move from the $1,872 swing low to $1,959 high might also provide support.

Any more losses could lead the price towards the $1,880 support level. Conversely, the price could attempt a fresh increase above the $1,915 and $1,920 resistance levels.

A successful close above the $1,920 and the 50 hourly simple moving average could open the doors for a decent increase in the coming sessions. The next major resistance is near the $1,950 level.

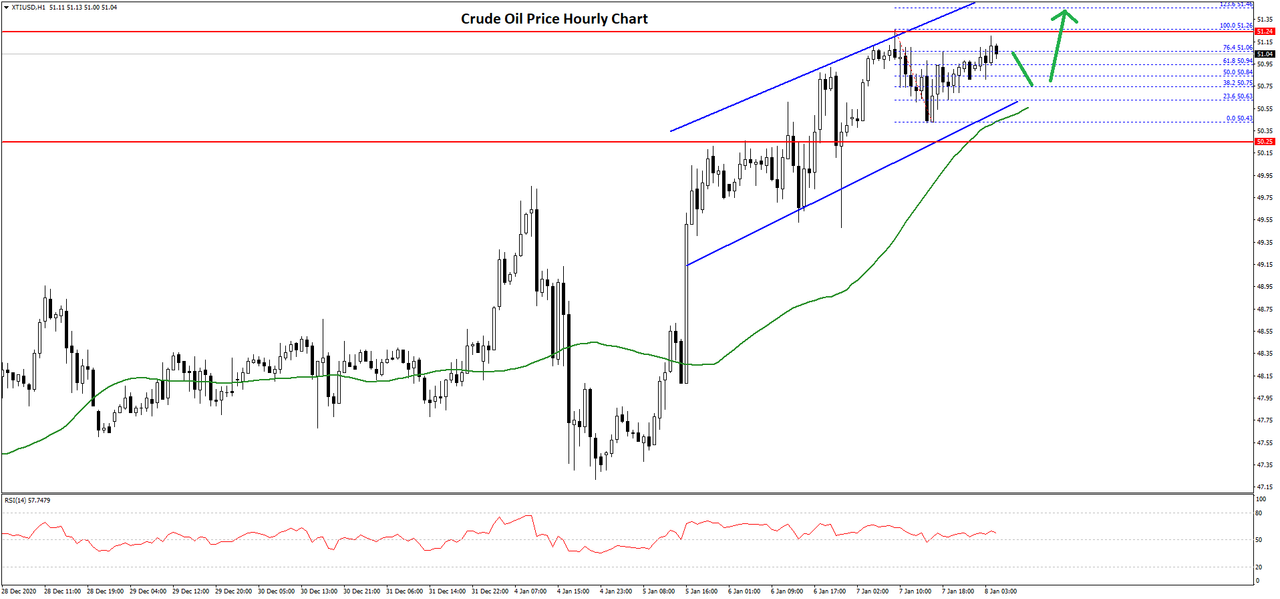

Oil Price Technical Analysis

Crude oil price started a steady rise after it broke the key $48.00 resistance zone against the US Dollar. The price broke many hurdles near $50.00 to move further into a positive zone.

The price even broke the $51.00 level and settled above the 50 hourly simple moving average. It traded to a new multi-month high near $51.26 before starting a downside correction. It declined towards $50.50 level and it is currently rising.

There was a break above the $50.80 resistance. The price recovered above the 50% Fib retracement level of the recent decline from the $51.26 high to $50.43 low.

It is now trading above the 76.4% Fib retracement level of the recent decline from the $51.26 high to $50.43 low. Therefore, there are high chances of a break above the $51.20 and $51.50 resistance levels in the coming sessions.

On the downside, an initial support is near the $50.80 level. There is also a key rising channel forming with support near $50.60 on the hourly chart of XTI/USD.

If there is a downside break below the channel support trend line, the price could decline towards the $50.00 support level. The next major support sits near the $49.55 level.

-

LTC and EOS – Establishing support before new highs

LTC/USD

The price of Litecoin has been increasing since last week and came up from $124.2 at its lowest point on Saturday to $170 at its highest on Monday. This week has started with a pullback to $147.2 but the price is back on the same levels as on Monday.

Looking at the hourly chart, you can see that the price made an interaction with the horizontal resistance found at the $170 level and fell back to its ascending trendline. As it found support there again it is currently making another breakout attempt.

If the price makes a higher high and continued moving past the $170 level it would serve as an early indication that the price is going to continue its bullish trajectory past the upper ascending trendline as well.

But if it fails to do so we might be seeing the completion of the higher degree ending diagonal which formed on the 24th of December. If this is the case then the currently seeing breakout attempt might end as a slightly higher high just making an interaction with the upper ascending trendline before we see a downturn.

However, currently, there are more signs of bullishness than bearishness which is why the uptrend continuation looks more likely.

EOS/USD

From the start of January when the price of EOS was sitting at $2.55 we have seen an increase of 35.68% measured to its highest point at $3.4617 made yesterday. Since then the price made a minor pullback to $3.11 but is now back above $3.315 again.

On the hourly chart, you can see that the price action made a cup and handle formation since the 20th of December and has now made a higher high compared to the one then. We are now seeing the formation of the handle pattern which is set to consolidate the price and establish support before it can move to the upside again.

From the start of the year, the price has moved parabolically to the upside so its upward trajectory would be expected to continue, but not before it makes a revisiting to the zone below $3.27. It could continue to its more significant horizontal zone at around $2.9 but that doesn’t look as likely considering the bullish momentum seen. More likely we are to see another spike to the downside like we have from yesterday’s high potentially coming to the $3 mark which is both a psychological level and the local horizontal support.

After this, a further upside would be expected for the price of EOS in the same impulsive manner as it did from the start of the new year. The next significant price point would be at $3.84 where the price made the previous high on November 25th.

-

GBP/USD and EUR/GBP: British Pound Could Correct Lower

GBP/USD extended its rise towards 1.3700 before starting a downside correction. EUR/GBP is showing positive signs and it could surge if it breaks the 0.9050 resistance.

Important Takeaways for GBP/USD and EUR/GBP

- The British Pound traded towards the 1.3700 zone, where it faced a strong selling interest.

- There is a key bullish trend line forming with support near 1.3580 on the hourly chart of GBP/USD.

- EUR/GBP started a fresh increase and it broke the 0.9000 resistance zone.

- There is a major bearish trend line in place with resistance near 0.9045 on the hourly chart.

GBP/USD Technical Analysis

In the past few days, there was a steady increase in the British Pound above the 1.3500 resistance zone against the US Dollar. The GBP/USD pair broke the 1.3600 zone to continue higher.

The pair gained momentum above 1.3620 and it even spiked above the 1.3700 resistance. A new multi-month high was formed near 1.3703 on FXOpen before the pair started a downside correction. It traded below the 1.3650 support level and the 50 hourly simple moving average.

There was a break below a key rising channel with support near 1.3680 on the hourly chart of GBP/USD. It opened the doors for more losses and the pair dived below 1.3600. It traded as low as 1.3540 and it is currently correcting higher.

There was a break above the 50% Fib retracement level of the downward move from the 1.3703 high to 1.3540 low. There is also a key bullish trend line forming with support near 1.3580 on the same chart.

On the upside, the pair is facing a strong resistance near the 1.3620 level, the 50 hourly simple moving average, and the 1.3650 zone. A clear break above the 1.3650 zone is needed for a fresh move towards 1.3700 or even higher.

Conversely, the pair could break the trend line support and continue lower below 1.3580. The next major support is at 1.3540, below which the pair could test the 1.3500 support.

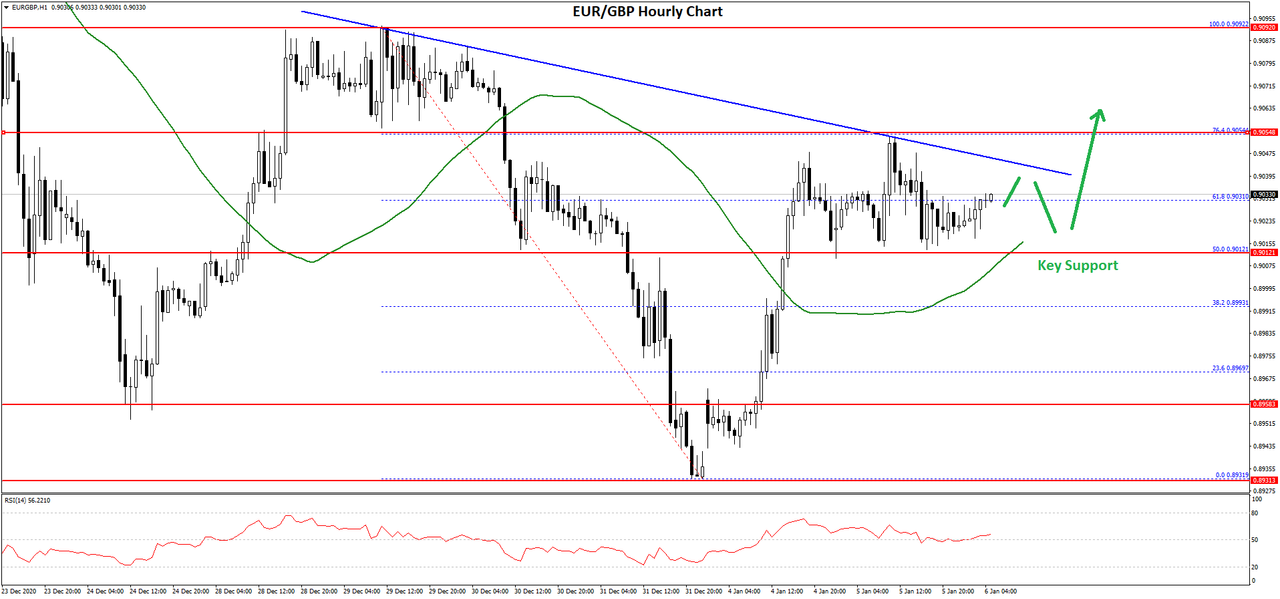

EUR/GBP Technical Analysis

The Euro traded as low as 0.8931 before it started a fresh increase against the British Pound. The EUR/GBP pair broke the 0.8980 and 0.9000 resistance levels to move into a positive zone.

The pair gained pace above 0.9000 and it even settled above the 50 hourly simple moving average. There was a break above the 50% Fib retracement level of the key downward move from the 0.9092 swing high to 0.8931 low.

The pair even tested the 0.9050 resistance zone, and the 76.4% Fib retracement level of the key downward move from the 0.9092 swing high to 0.8931 low.

On the upside, there is a major bearish trend line in place with resistance near 0.9045 on the hourly chart. The main resistance is near the 0.9050 level. A clear break above the trend line resistance may possibly increase the chances of a strong rise towards the 0.9100 level.

Conversely, the pair could start a fresh decline. The main support is forming near the 0.9000 area and the 50 hourly SMA. If there is a downside break below the 0.9010 and 0.9000 support levels, the pair could continue to move down towards the 0.8950 level in the near term.

-

BTC and XRP – Consolidation developing but for how long?

BTC/USD

The price of Bitcoin has been in a decline since Sunday when it reached $34,716 at its highest point. We have seen a downfall to $30,367 but the price spiked further to $27,774 at its lowest wick before snapping back above the 0 Fib level. Currently, it is being consolidated above it and is moving sideways, sitting at $31,901 and is in an upward trajectory.

Looking at the hourly chart, we can see that the price completed another five-wave impulse to the upside that started on the 21st of December. This rise was most likely the ending wave of the higher degree count which is why now we are seeing some consolidation. The price action may continue to move sideways for some time now but if the 5th wave of a higher degree is in, then the price is now likely to decline further in a corrective manner.

From Sunday’s high, we have seen a three-wave decrease which could have been a local correction which would mean that another minor higher high could come, but in that case, the current move should be the developing lower degree impulse which doesn’t look like one. This is why it is more likely that now we are seeing a corrective increase before further impulsive moves to the downside.

XRP/USD

The price of Ripple has been in a recovery attempt since the 29th of December when it fell to the $0.18 area, but it hasn’t moved that much to the upside, only reaching $0.2588 on yesterday’s high. Since then another move to the downside was made to around $0.225 level, slightly above which it is currently being traded.

On the hourly chart, you can see that the price of Ripple is moving around its significant horizontal support zone as its attempting to establish support. This lookout for support is being made after a sharp and impulsive decline ended which was the Z wave from the complex correction count.

This is why now another wave to the upside is to start, but it is still uncertain whether or not it’s going to be an impulsive move or another corrective increase before a further decline. Considering the amount of decrease we have seen prior it is more likely that the price is now going to make a recovery but the bearish sentiment is still holding it behind the general market. This is why the price now has to establish a new bottom, potentially revisiting the lower range of the support zone in order to activate buying and chasing of the price that could cause a recovery.

-

Guess the currency rate and get money!

We are continuing a series of contests among our subscribers.

This week we will give away $50 to those, who will provide the closest forecast for the BTC/USD pair

Full Details about the Contest on the FXOpen official page Facebook

-

Bitcoin Rollercoaster Price Action Continues

Bitcoin held the headlines into the end of the trading year. It rose from $10,000 in October to $35,000 in late December, tripling in value in less than two months.

Much of the advance, though, came in low liquidity and when “no one was looking”. Just like in 2017 when Bitcoin reached close to $20k, the advance in late 2020 happened during the thin trading environment caused by the end of year holidays.

What Causes Bitcoin Bullishness?

Recently, more and more institutional investors turn to Bitcoin. Viewed as a safe-haven asset and a store of value that competes with gold, the digital alternative investment opportunity offered by Bitcoin appeals to more and more people.

Scarcity is one attribute that many investors value. As the number of Bitcoins is limited, the scarcity makes it possible for the price of it to advance so fast and so aggressive.

But the same is valid in downturns. As 2021 just started, Bitcoin is down 15% from the highs, trading below $29k at the time of writing this article after it was as high as $35k in late December. Anyone happy with such drawdowns should not have any problem in owning Bitcoin – though few investors are willing to take such an asset into a professional portfolio.

Risks for Bitcoin

The risks for Bitcoin moving into 2021 trading come from regulation. We saw at the end of last year’s trading that Ripple suffered from the SEC in the United States initiating a lawsuit against its founders, causing the price of Ripple to collapse instantly. If the allegations of illegally selling securities are extended to other crypto assets, the risk is that Bitcoin will suffer from collateral damage too.

Already at this point, many public companies and institutional investors announced huge investments in Bitcoin. We talk about billions, as MicroStrategy is just an example of a company that invested most of its treasury in Bitcoin.

Should the price of Bitcoin continue to retrace from the highs, some weak hands may be forced to liquidity. This may also be exacerbated by a possible reversal in the USD. If that happens, then Bitcoin has more room to correct.

-

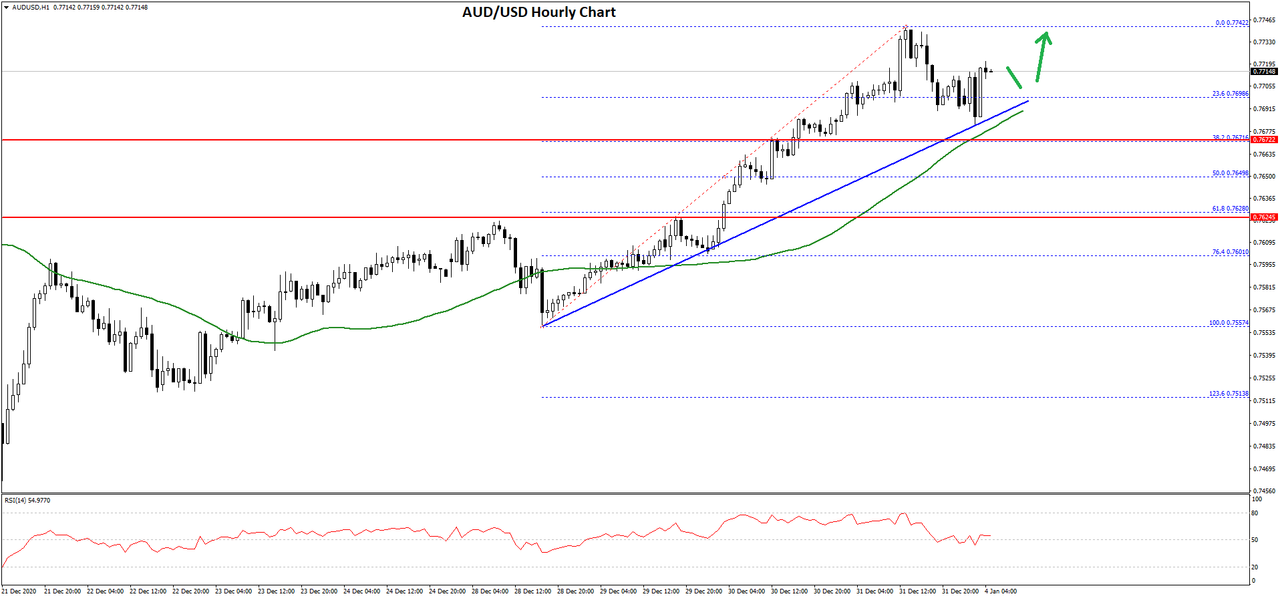

AUD/USD and NZD/USD Signaling Upside Continuation

AUD/USD remained in a positive zone and climbed above the 0.7700 resistance. NZD/USD is also showing positive signs and it is likely to continue higher above 0.7220.

Important Takeaways for AUD/USD and NZD/USD

- The Aussie Dollar extended its rally above the 0.7600 and 0.7700 resistance levels against the US Dollar.

- There is a major bullish trend line forming with support near 0.7695 on the hourly chart of AUD/USD.

- NZD/USD climbed higher towards the 0.7240 level before correcting lower.

- A key bullish trend line is forming with support near 0.7160 on the hourly chart of NZD/USD.

AUD/USD Technical Analysis

In the past few weeks, the Aussie Dollar remained in a bullish zone above the 0.7500 pivot level against the US Dollar. The AUD/USD pair even broke the 0.7650 resistance level to move further into a positive zone.

The pair followed a bullish path and it even broke the 0.7700 resistance and the 50 hourly simple moving average. A new multi-month high is formed near 0.7742 on FXOpen and the pair is currently correcting lower.

There was a break below the 0.7720 support level. The pair even spiked below the 23.6% Fib retracement level of the recent wave from the 0.7557 swing low to 0.7742 high.

However, the pair is finding a strong support near the 0.7700 zone. There is also a major bullish trend line forming with support near 0.7695 on the hourly chart of AUD/USD. The 50 hourly simple moving average is also following the trend line at 0.7690.

If there is a downside break below the trend line and the 50 hourly simple moving average, there is a risk of more downsides towards the 0.7670 support. The next major support is near 0.7650 or the 50% Fib retracement level of the recent wave from the 0.7557 swing low to 0.7742 high.

On the upside, the 0.7740 level is a decent resistance. A clear break above the 0.7740 and 0.7750 levels may possibly open the doors for a larger increase in the coming sessions.

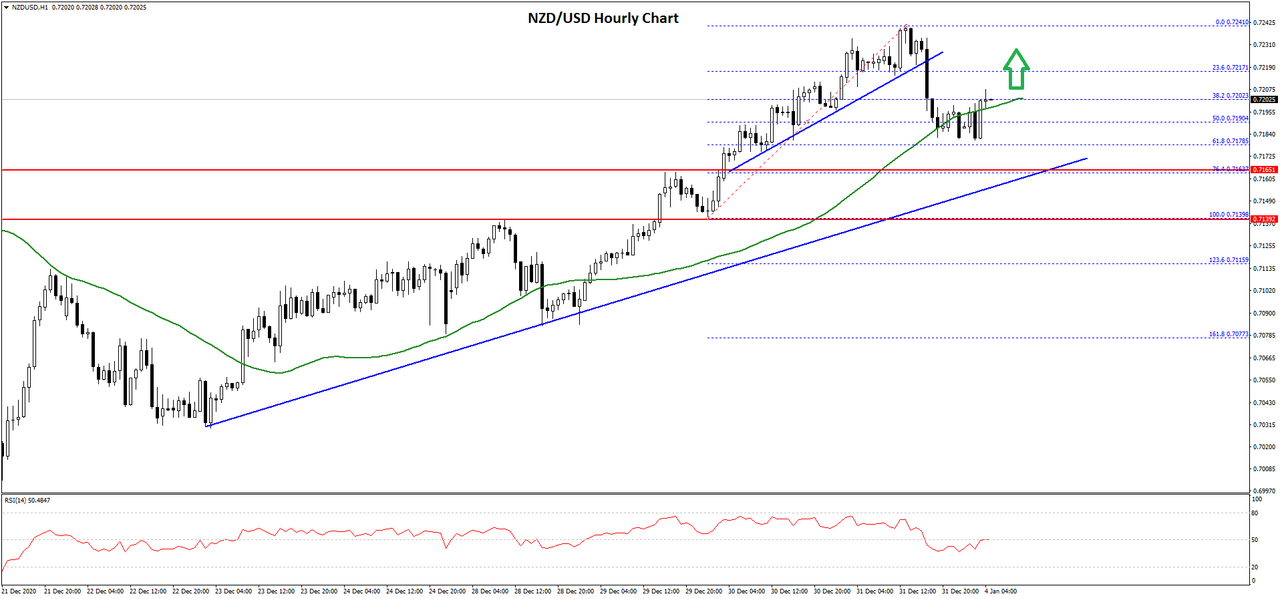

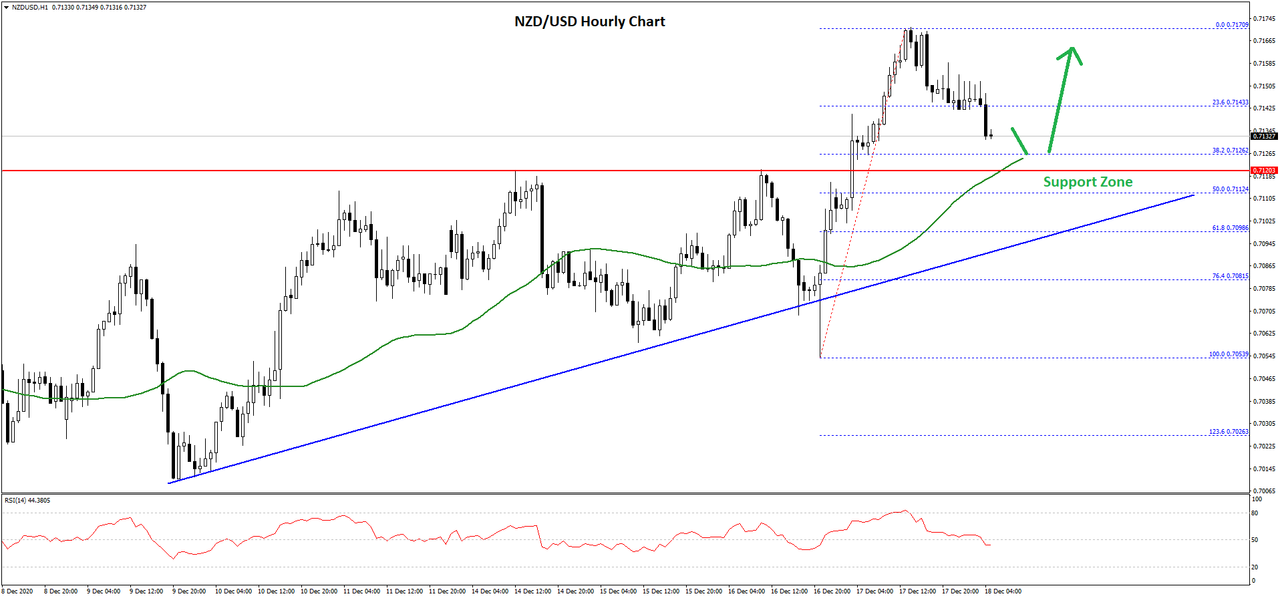

NZD/USD Technical Analysis

The New Zealand Dollar also followed a bullish path above the 0.7100 region against the US Dollar. The NZD/USD pair remained well bid and it even climbed above the 0.7200 resistance.

The pair traded close to the 0.7250 level and a new multi-month high was formed near 0.7241. Recently, there was a downside correction below the 0.7220 support. The pair traded below a connecting bullish trend line with support at 0.7220 on the hourly chart.

There was also a spike below 0.7200, the 50 hourly simple moving average, and the 50% Fib retracement level of the upward move from the 0.7139 swing low to 0.7241 high.

However, the pair remained well bid near the 0.7180 level. It also remained stable above the 61.8% 50 hourly simple moving average. There is also a key bullish trend line forming with support near 0.7160 on the hourly chart of NZD/USD.

If there is a downside break below the trend line support, there is a risk of more losses towards the 0.7140 and 0.7120 support levels.

Conversely, the pair could start a fresh increase above the 0.7220 and 0.7225 resistance levels. In the stated case, NZD/USD might even test the 0.7300 level in the coming days.

-

Cryptocurrency CFDs TRADING

TRADE CRYPTO CURRENCY with CFD Instruments

FXOpen lets you trade all the most popular cryptocurrencies like Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH), Litecoin (LTC), Dash (DSH), Ripple (XRP), Monero (XMR), IOTA, EOS, NEO, OMNI in the form of CFDs without having to hold any cryptocurrency directly.

WHY TRADE CRYPTOCURRENCY WITH FXOPEN?

- ONE OF THE LARGEST BITCOIN CFD BROKERS - We use top Liquidity providers (Exchanges) to aggregate liquidity and hedge the risks of client's exposure. Our order execution is based on the ECN Aggregator.

- TRUE ECN ENVIRONMENT - You can trade cryptocurrencies on MT4 Platform and enjoy all the benefits of ECN execution: you trade against other market participants, not against the broker.

- LOW SPREADS AND COMMISSIONS - You get tight market spreads and low trading commissions (0.5% half-turn), while the broker benefits as your traded volume and profits grow.

- TRADE THE WAY YOU LIKE - All the popular Forex trading styles including scalping, hedging and all the types of expert advisors are allowed.

- THE MOST POPULAR TRADING PLATFORM - Buy or sell instantly with one-click trading on MT4.

- GO LONG OR SHORT ON ANY CRYPTOCURRENCY CFD - Take a position when you expect a cryptocurrency to fall in value, as well as rise. No actual crypto assets are required.

- ENJOY PEACE OF MIND TRADING WITH A TRUSTED BROKER - FXOpen is a reliable Forex broker with a 10+ years' history.

-

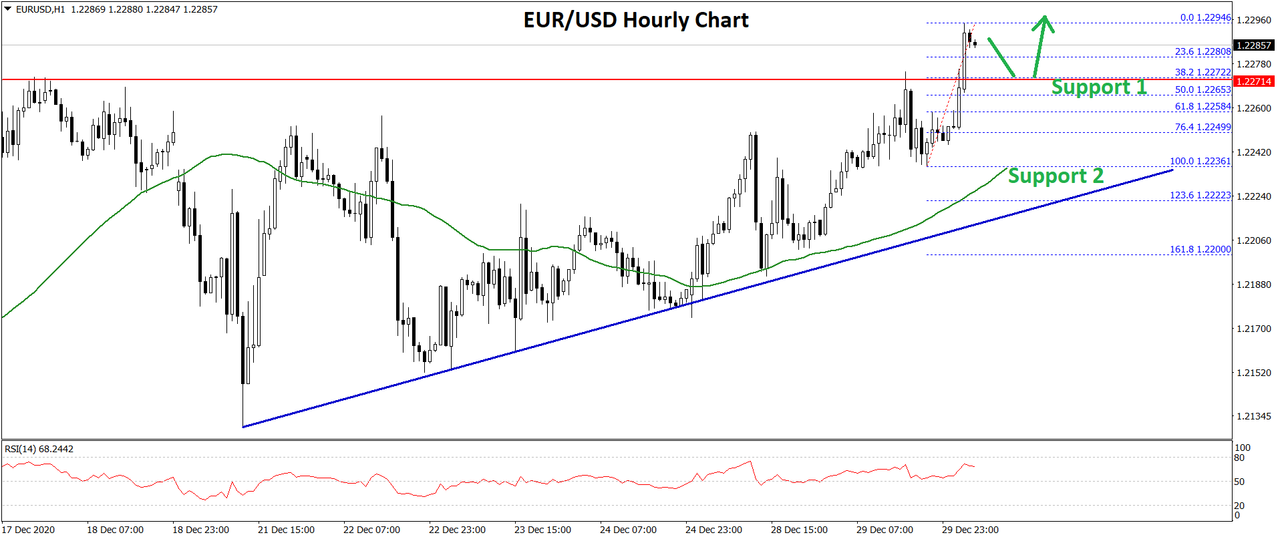

EUR/USD and EUR/JPY: Euro Gains Bullish Momentum

EUR/USD gained bullish momentum and traded to a new multi-month high above 1.2290. EUR/JPY is also showing positive signs and trading nicely above the 126.80 support.

Important Takeaways for EUR/USD and EUR/JPY

- The Euro started a strong increase above the 1.2150 and 1.2200 resistance levels.

- There is a key bullish trend line forming with support near 1.2235 on the hourly chart of EUR/USD.

- EUR/JPY followed a similar pattern and broke the main 126.65 resistance.

- There was a break above a major bearish trend line with resistance near 126.35 on the hourly chart.

EUR/USD Technical Analysis

In the past few days, the Euro remained in a positive zone above the 1.2080 and 1.2120 levels against the US Dollar. The EUR/USD pair even broke the 1.2200 resistance zone to move further into a positive zone.

It settled nicely above the 1.2220 level and the 50 hourly simple moving average. There was an upside continuation above the 1.2250 level. The pair traded to a new multi-month high at 1.2294 on FXOpen and it is currently consolidating gains.

An initial support on the downside is near the 1.2280 level. It is close to the 23.6% Fib retracement level of the recent increase from the 1.2236 swing low to 1.2294 high.

The first major support is near the 1.2270 level. The next support is near the 1.2265 level or the 50% Fib retracement level of the recent increase from the 1.2236 swing low to 1.2294 high. There is also a key bullish trend line forming with support near 1.2235 on the hourly chart of EUR/USD.

Any more losses could lead the pair towards the 1.2220 level in the near term. On the upside, the 1.2300 zone is likely to act as a major resistance. A clear break above the 1.2300 zone could open the doors for a steady increase in the coming days towards 1.2340 or 1.2350.

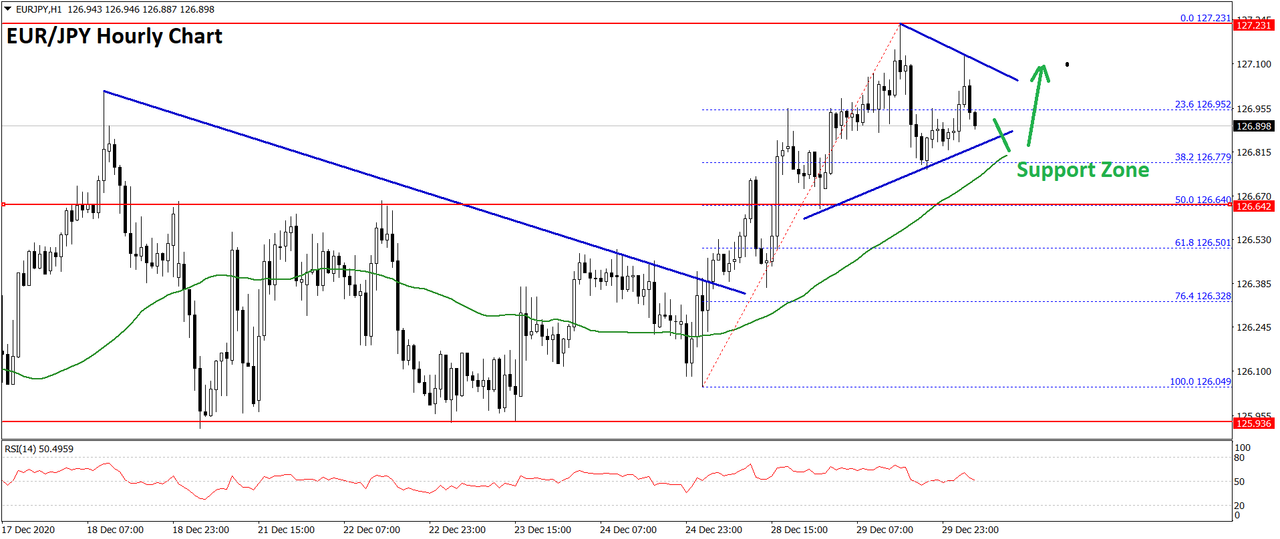

EUR/JPY Technical Analysis

The Euro also followed a bullish path above 126.00 against the Japanese Yen. The EUR/JPY pair broke the main 126.65 resistance level to move into a positive zone.

There was also a close above the 126.80 level and the 50 hourly simple moving average. To start the current increase, there was a break above a major bearish trend line with resistance near 126.35 on the hourly chart.

The pair traded as high as 127.23 before correcting lower. It traded below the 23.6% Fib retracement level of the recent increase from the 126.04 swing low to 127.23 high.

There is a currently a contracting triangle forming with resistance near 127.00 zone. A clear break above the 127.00 and 127.10 levels could open the doors for a sharp increase. The next major resistance for the bulls could be near the 127.50 level.

Conversely, there could be a downside break below the triangle support at 126.85. The next key support is near the 126.65 level (the breakout zone). It is close to the 50% Fib retracement level of the recent increase from the 126.04 swing low to 127.23 high.

If the pair breaks the 126.65 support zone and the 50 SMA, there are chances of a push down towards the 126.20 support zone. The next major support sits near the 126.00 zone.

-

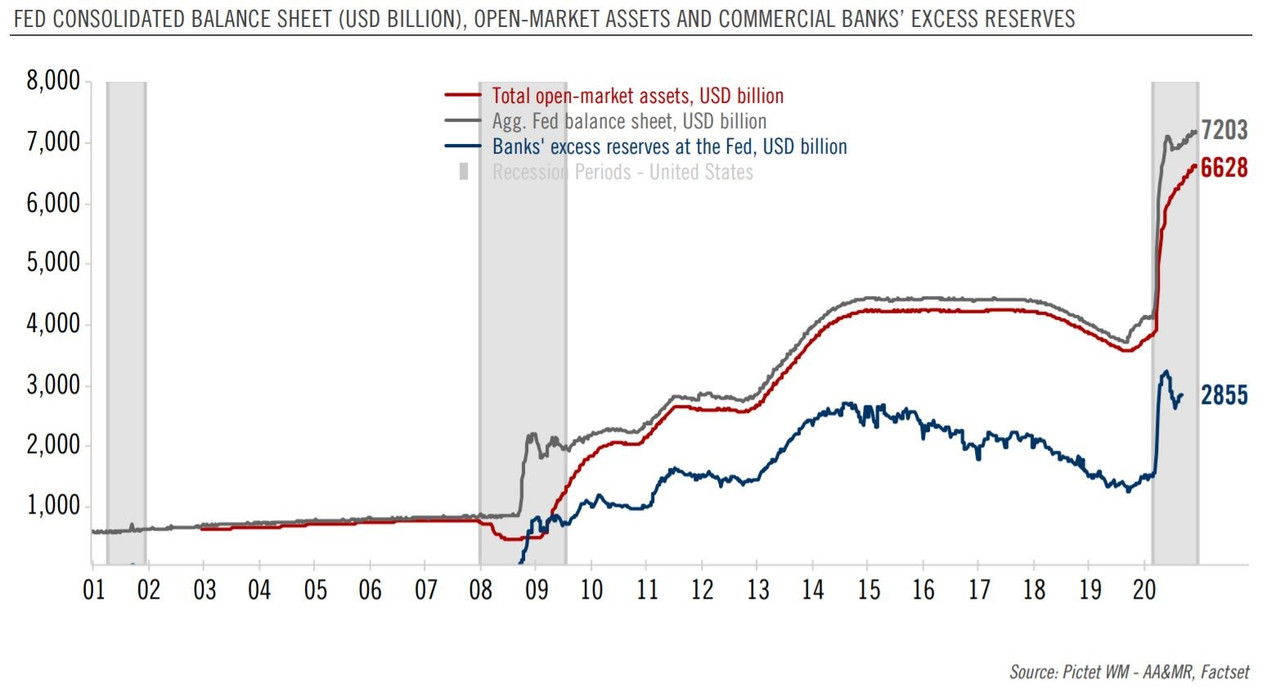

What to Consider in 2021 Global Financial Markets?

While the year is not over yet, everyone looks at what lies ahead. But how to better prepare for the next year’s trading opportunities without looking back at the events that marked 2020?

So many things happened that it is impossible to discuss them all in this article. Instead, let’s have a look at what influenced financial markets in 2020 and can also have a say in what the markets will do in 2021.

COVID-19 PandemicUnfortunately, 2020 will be a year remembered for the coronavirus pandemic and everything that it brought with it. Caught completely by surprise, the world reacted with a lag. Lives were lost, and industries were disrupted. Small businesses were affected the most, with many closing their doors indefinitely.

Governments and central banks reacted the only way they knew – by printing money and offering loans to incredibly low interest rates. Brave wannabe entrepreneurs took a chance in the hope that 2021 and beyond will be better.

Hope does exist. Vaccines are rolled out all over the world. Studies show that the efficacy of the many vaccines that already exist is enough to stop the pandemic in the second half of 2021.

2020 Financial Events to Impact 2021

For financial markets, 2020 brought some incredible developments. First, it brought the fastest dive from a bull to a bear market in history. By definition, when the stock market corrects more than 20% from the highs, it reaches a bear market – in March 2020, the drop came so fast as never before.

Second, the price of oil settled into negative territory. For the first time in history, investors learned that the price of a commodity could settle for negative values. Basically, producers paid for someone to come and take the oil off their hands as no storage facilities existed anymore.

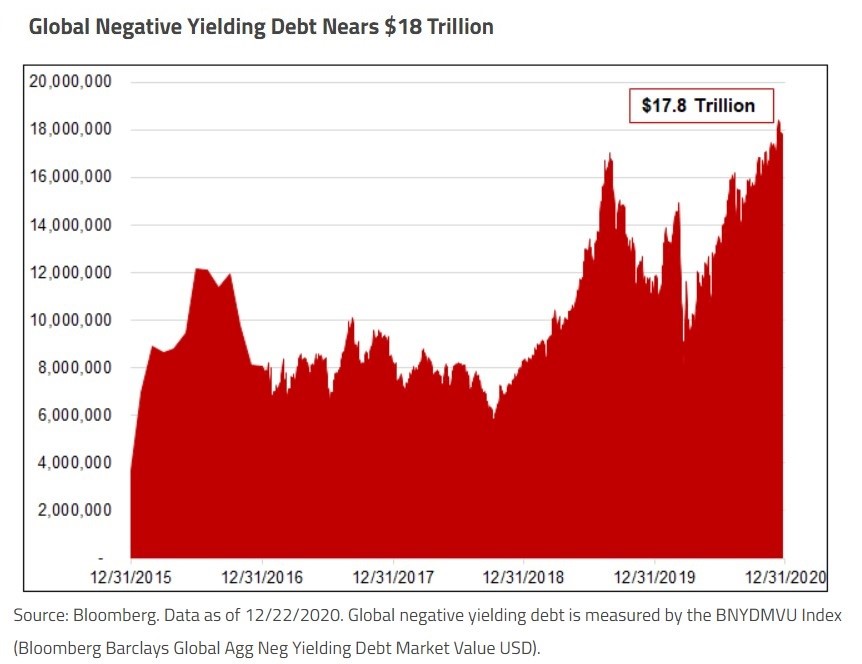

Third, the global negative-yielding debt surged close to $20 trillion. As the chart above shows, the trend stalled somehow during 2015 and 2017 but closed the year at record highs. Debt with negative yields show investors willing to lend money to an entity (e.g., sovereign, corporation) that pays them back less than the original amount invested.

Fourth, Brexit came to an end a few days ago. The United Kingdom and the European Union reached a trade deal that was responsible for much of the price action swings in the GBP pairs for the entire year. Starting with January 1st, 2021, trade between the two takes a new dimension. It is hard to envision now the benefit of Brexit for both the United Kingdom and the European Union. Perhaps it will become obvious somewhere in the future, perhaps not – but at this point, Europe looks weak.

Finally, the United States prepares for a new administration at the White House. It brings new air after four years of controversial policies run by Trump’s administration. It also brings a new head of the Treasury, none other than the former chairwoman – Janet Yellen.

If and when the pandemic ends, the world’s economies have a long way to full recovery. The events mentioned above left deep wounds that cannot heal easily.

-

GBP/USD and GBP/JPY: British Pound Gains Bullish Momentum

GBP/USD started a strong increase above the 1.3500 resistance zone. GBP/JPY also gained traction and it gained pace above the 140.00 resistance zone to move into a positive zone.

Important Takeaways for GBP/USD and GBP/JPY

- The British Pound climbed higher above the 1.3500 and 1.3550 resistance levels.

- There is a key bullish trend line forming with support near 1.3555 on the hourly chart of GBP/USD.

- GBP/JPY also climbed higher steadily above the 139.50 and 140.00 resistance levels.

- There is a major bullish trend line forming with support near 140.30 on the hourly chart.

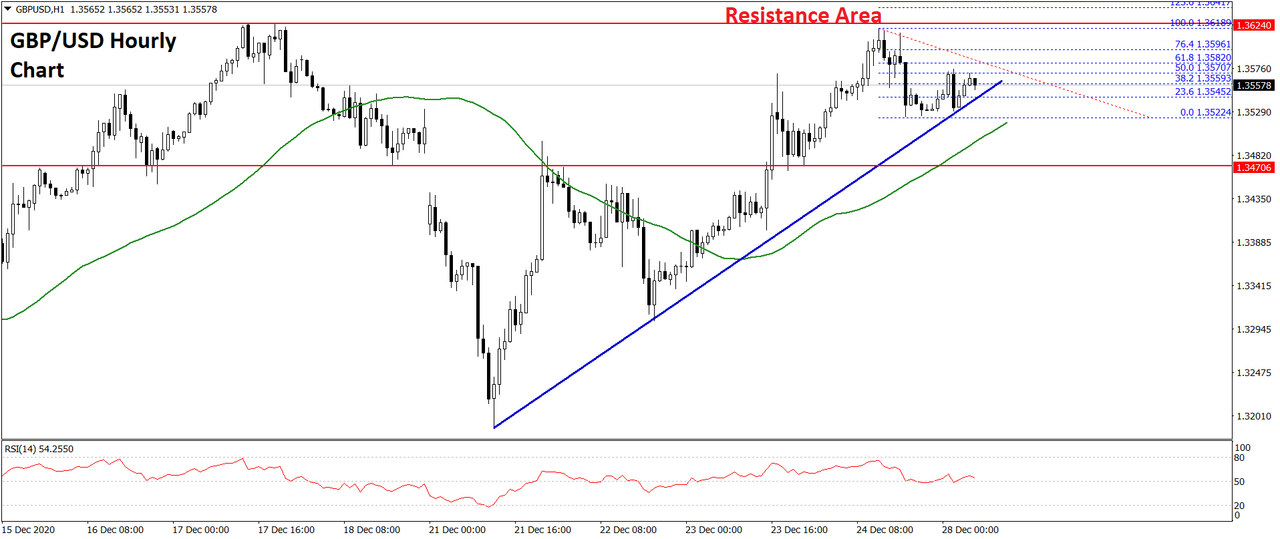

GBP/USD Technical Analysis

This past week, the British Pound saw a strong increase from the 1.3300 support zone against the US Dollar. The GBP/USD pair broke the 1.3500 resistance zone to move further into a positive zone.

The upward move was such that the pair even broke the 1.3550 resistance and settled above the 50 hourly simple moving average. It traded as high as 1.3618 on FXOpen and it is currently consolidating gains.

It corrected lower towards 1.3520 and traded as low as 1.3522. Recently, there was a minor increase above the 1.3540 level. The pair climbed above the 1.3550 level, and tested the 50% Fib retracement level of the recent decline from the 1.3618 high to 1.3522 low.

The first major resistance is near the 1.3580 level. It is close to the 61.8% Fib retracement level of the recent decline from the 1.3618 high to 1.3522 low.

On the upside, a clear break above the 1.3600 resistance level is needed for more upsides. The next major resistance is near the 1.3650 level, above which the pair could rise towards the 1.3680 and 1.3700 levels.

On the downside, there is a key bullish trend line forming with support near 1.3555 on the hourly chart of GBP/USD. If there is a downside break below the trend line support, the pair could continue to move down towards the 1.3500 support level in the near term.

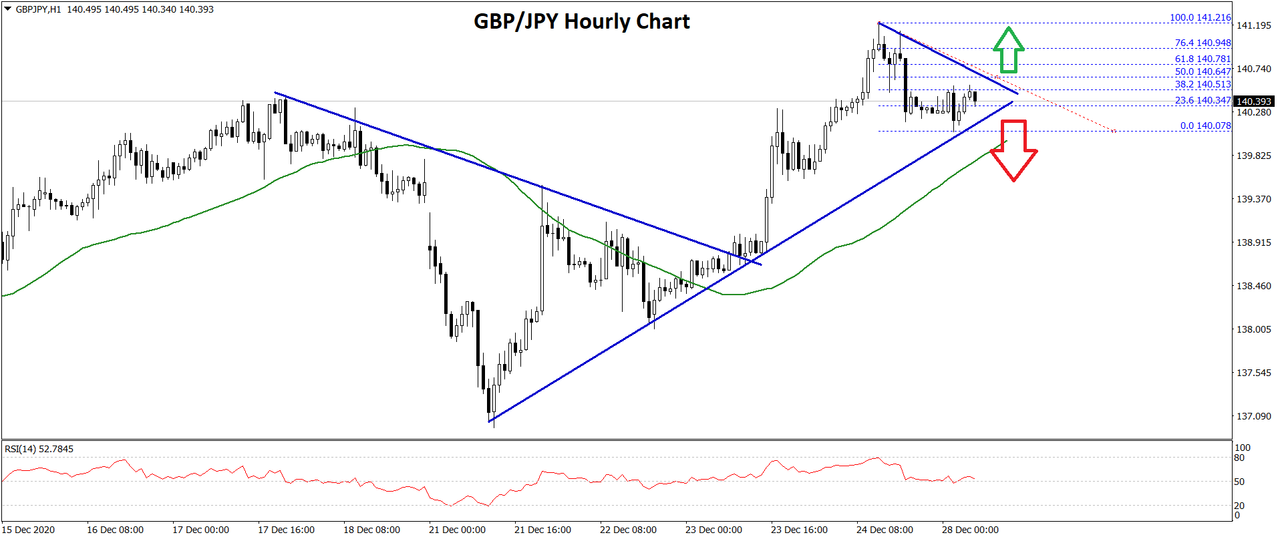

GBP/JPY Technical Analysis

The British Pound also climbed nicely from the 137.50 support level against the Japanese Yen. The GBP/JPY pair climbed above the 138.50 level to start a steady increase.

It gained pace above the 139.20 resistance and settled above the 50 hourly simple moving average. It even spiked above the 141.00 level and traded as high as 141.21 before correcting lower. There was a break below the 140.50 support level.

However, the pair remained stable above 140.00 and a low is formed near 140.07. The pair is currently rising and trading above the 23.6% Fib retracement level of the recent decline from the 141.21 high to 140.07 low.

The pair is now facing hurdles near the 140.50 and 140.60 levels. The 50% Fib retracement level of the recent decline from the 141.21 high to 140.07 low is also near the 140.60 zone.

A clear break above the 140.60 resistance could open the doors for a fresh increase. In the stated case, the pair could rise above the 141.00 and 141.20 resistance levels.

On the downside, there is a major bullish trend line forming with support near 140.30 on the hourly chart. If there is a downside break below the trend line support, GBP/JPY could retest the 138.50 support level.

-

13 Mistakes Almost Every Trader Makes

Human beings make mistakes, but not every mistake costs money. In the world of Forex, every mistake has a price tag on it. To help you learn more from others’ failures rather than your own, we’ve picked out 13 of the most common mistakes of traders according to forums. Make a good use of this list!

- The lack of a systematic approach - No matter how godlike your trading style is, you won’t always do well without a cheat sheet. There should always be a plan, the other thing is that your plan can and should be adjusted under changing conditions.

- Lack of algorithm - Without the algorithm, the risk of losing the deposit increases manifold. A clear algorithm implies a step-by-step sequence of your actions depending on the trading situation.

- Not placing stop-loss orders - With this approach, the trader is sure to be knocked out of the market sooner or later. The more profit you make in the beginning, the harder the blow will be when you lose it all. A good trader never takes a risk and puts a stop loss where it’s needed.

-

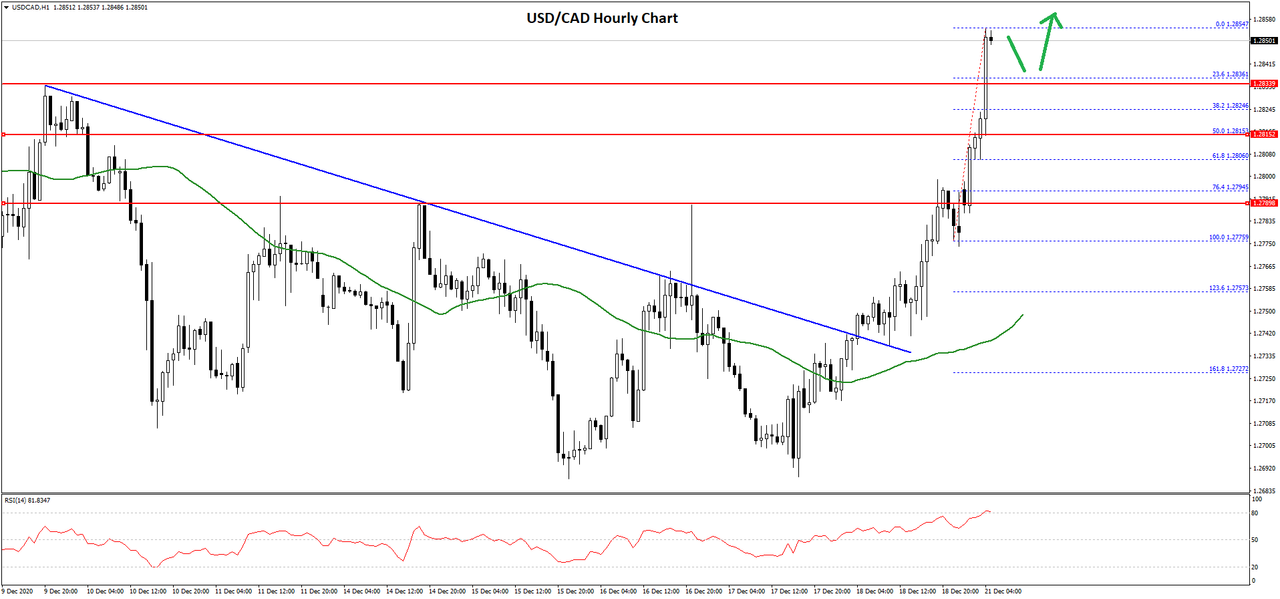

EUR/USD and USD/JPY Approaching Next Crucial Breakout

EUR/USD corrected lower after it struggled to clear the 1.2250 resistance level. USD/JPY is trading above 103.20 and it is likely setting up for the next major move.

Important Takeaways for EUR/USD and USD/JPY

- The Euro seems to be facing a strong resistance near 1.2250 and 1.2260.

- There is a major bullish trend line forming with support near 1.2160 on the hourly chart of EUR/USD.

- USD/JPY is rising steadily and it is well above the 103.20 support level.

- There is a key contracting triangle forming with support near 103.45 on the hourly chart.

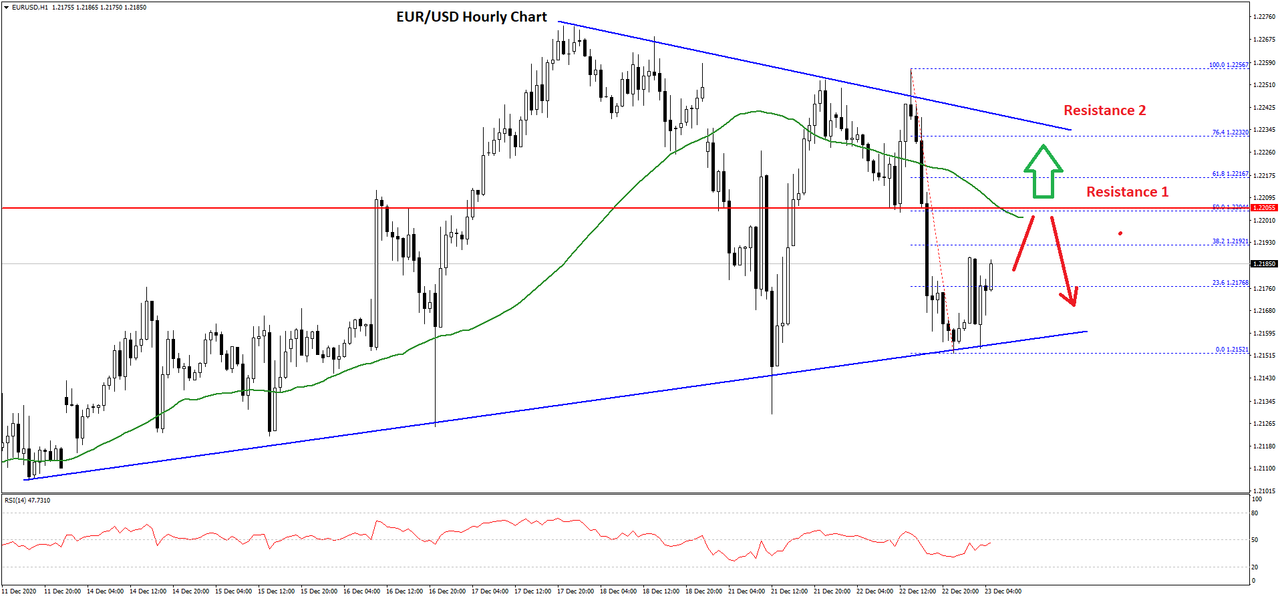

EUR/USD Technical Analysis

In the past few days, there were swing moves in the Euro above 1.2200 against the US Dollar. The EUR/USD pair made a couple of attempt to gain strength above 1.2250 and 1.2260, but it failed.

The recent swing high was formed near 1.2256 on FXOpen before the price started a fresh decline. There was a break below the 1.2200 support level and the 50 hourly simple moving average. The pair even broke the 1.2180 support, but it stayed above the 1.2150 zone.

A low is formed near 1.2152 and the pair is currently rising. It broke the 23.6% Fib retracement level of the recent decline from the 1.2256 high to 1.2152 low.

On the upside, the first major resistance is near the 1.2200 level and the 50 hourly simple moving average. The 50% Fib retracement level of the recent decline from the 1.2256 high to 1.2152 low is also near 1.2205.

A clear break above the 1.2200 resistance zone could lead the pair towards the main 1.2230 level and a connecting bearish trend line. Any more upsides might increase the chances of a break above 1.2260.

Conversely, the pair could start a fresh decline below the 1.2165 support. The main support is near the 1.2150 zone, and a major bullish trend line forming with support near 1.2160 on the hourly chart of EUR/USD. A break below the trend line support could lead the pair towards the 1.2100 level.

USD/JPY Technical Analysis

The US Dollar started a fresh increase from the 103.00 support zone against the Japanese Yen. The USD/JPY pair broke the 103.20 zone to move into a positive zone.

The pair even broke the 103.50 level and the 50 hourly simple moving average. The recent high was formed near 103.73 before the pair started a downside correction.

There was a break below the 103.55 level. The pair also declined below the 50% Fib retracement level of the upward move from the 103.31 low to 103.73 high. It is now trading near a major support at 103.45. There is also a key contracting triangle forming with support near 103.45 on the hourly chart.

If there is a downside break below the trend line, there is a risk of a larger decline towards the 103.20 and 103.00 levels.

On the upside, the first major resistance is near the 103.65 level. A clear break above the 103.65 zone is needed to start a steady rise towards the 104.00 and 104.20 levels.

Any more gains could lead the USD/JPY pair towards the 104.50 level, where the bulls are likely to face a strong resistance in the near term.

-

BTC and XRP – Correction developing but for how long?

BTC/USD

The price of Bitcoin has continued increasing from last week and came to $24,310 at its highest points yesterday from which it decreased by 10.11% at first, but is now making a recovery and is currently sitting at $23,478 level. This minor pullback we have seen yesterday could have been the beginning of the higher degree descending move as the prior impulse to the upside ended but since the price is starting to increase again we are yet to see.

On the hourly chart, you can see that it came up in a five-wave manner from the 11th of December when it was sitting at $17,500 at its lowest point which was a higher low compared to the one made on the 26th of November.

This higher lower could have been the ending point of the corrective 4th wave from the higher degree in which case the price has formed now the 5th wave. In that case, we are now to see the start of the descending move, but another possibility would be that this higher low on the 11th was the 2nd sub-wave of the new higher degree impulse. If the second is true, then the five-wave impulse from the 11th is the 3rd wave which means that the current corrective structure is the 4th wave and that the price is going to continue increasing again after.

Now as the price is making a recovery we are going to see the validation of either scenario from its behavior. If it manages to exceed yesterday’s high it would indicate that another increase is going to the develop before the starting higher degree decline, but if finds resistance here and starts decreasing again it would mean that the increase ended.

XRP/USD

The price of Ripple has been in a decline from the 17th of December when it was sitting at $0.66413 and fell to $0.4509 today, which is a decrease of 32.1% but has since started making a minor recovery and is currently sitting at $0.4943.

Looking at the hourly chart, we can see that the price made an impulsive rise after the completion of the descending triangle like expected and has broken out above the prior lower high. This was a bullish sign but however, it made it back to the same levels from which it started its upward trajectory.

This could indicate that the correction is still in place with the previous impulsive rise being the second wave X from the prolonged WXYXZ complex correction. If this is true then the price is now going to make another lower low for the development of the Z wave.

Another possibility could be that this is another starting five-wave impulse with the last decline being its 2nd sub-wave.

-

Financial Markets at Risk as the Virus Locks Europe Down

The markets opened with a bearish tone as there is a new turn of events on the pandemic course. Over the weekend, the news that a new virus’ variant circulates in the United Kingdom caused panic in Europe. According to the UK authorities, the new variant spreads faster, and that poses a risk for the period ahead.

Quickly after the announcement, several European countries suspended their flights to the United Kingdom, in a move that signals the harsh lockdown in place in Europe. As such, the market is at risk of declining due to the lack of liquidity characteristic this time of the year.

The Fed Remains Dovish

Last week’s main event was the Federal Reserve meeting and interest rate decision. The Fed chooses to do nothing at this meeting, but it kept a dovish tone.

During the press conference, the Fed’s Chair Powell said that the central bank reopened the USD swap lines and that it will keep the Quantitative Easing (QE) program at the same pace of $120 billion. Much of the focus of last week’s meeting was to see if the Fed hints at changing the focus of the bond-buying. So far, the focus was on shorter-term maturities, but rumors in the market suggested that the Fed may switch to longer-term maturities.

By targeting longer-term bonds, the Fed aims at lowering the yields further, in a move destined to ease financial conditions even more. However, it did not do so, but it hinted that it represents a tool it may use in the future.

Risk-Off Market Moves

Moving forward, there is the danger of a risk-off move that could grip markets this week. In a risk-off, the USD rises, and the stock market falls. Risk-off market moves are coordinated and have the tendency to affect all markets in a correlated manner. In other words, it does not matter what market one is trading, as they are all affected.

Because the USD is the world’s reserve currency, how it trades this week is key to risk. As such, expect a more volatile trading week than otherwise.

-

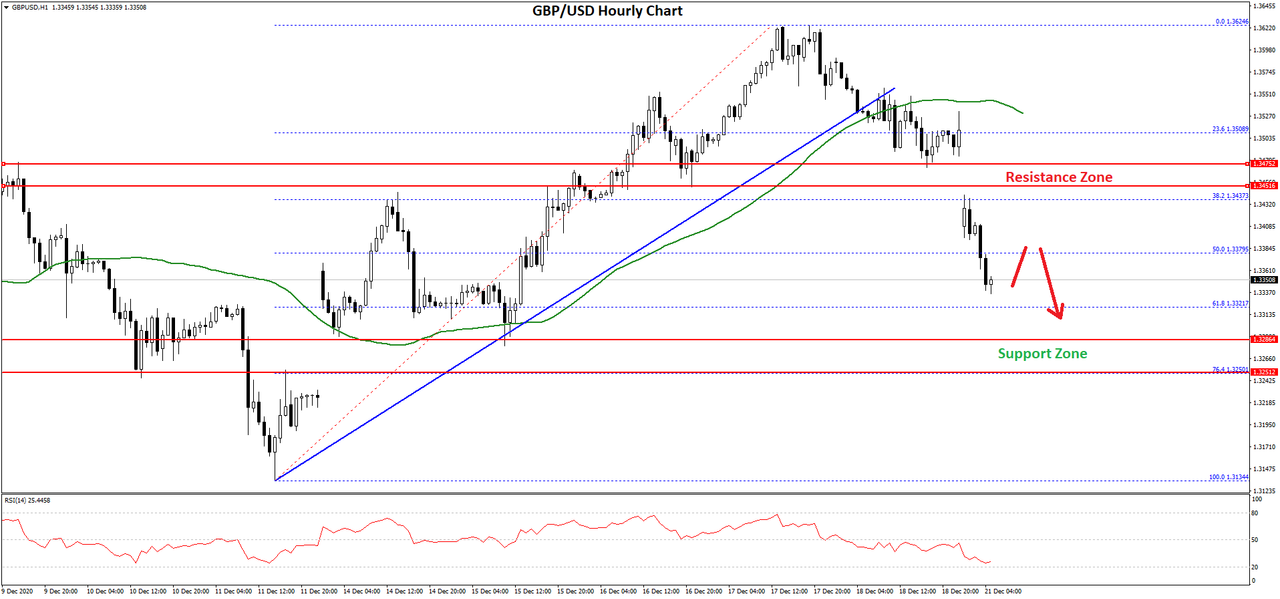

GBP/USD Corrects Lower, USD/CAD Extending Gains

GBP/USD started a fresh decline after testing the 1.3625 zone. USD/CAD is rising and it is showing a lot of positive signs above the 1.2800 level.

Important Takeaways for GBP/USD and USD/CAD

- The British Pound started a fresh downside correction from the 1.3624 high.

- There was a break below a major bullish trend line with support near 1.3530 on the hourly chart of GBP/USD.

- USD/CAD started a strong increase from the 1.2700 support zone and climbed above 1.2800.

- There was a break above a key bearish trend line with resistance near 1.2740 on the hourly chart.

GBP/USD Technical Analysis

This past week, the British Pound gained momentum above the 1.3500 resistance level against the US Dollar. The GBP/USD pair broke the 1.3550 and 1.3560 resistance levels to move into a positive zone.

The pair even broke the 1.3600 resistance and traded as high as 1.3624 on FXOpen. This week, it opened with a gap lower and traded below the 1.3520 support zone. There was a close below the 1.3500 level and the 50 hourly simple moving average.

Moreover, there was a break below a major bullish trend line with support near 1.3530 on the hourly chart of GBP/USD. The pair even traded below the 50% Fib retracement level of the upward move from the 1.3134 swing low to 1.3624 high.

An immediate support is near the 1.3320 level. It is close to the 61.8% Fib retracement level of the upward move from the 1.3134 swing low to 1.3624 high.

The next major support is near the 1.3280 level. If there are more downsides, the pair could dive towards the 1.3200 support zone in the near term. On the upside, an initial resistance level is near the 1.3400 level.

The main resistance is now forming near the 1.3500 zone and 50 hourly simple moving average. A close above 1.3500 could open the doors for a push towards the 1.3624 high.

USD/CAD Technical Analysis

The US Dollar formed a strong support base near 1.2700 and started a fresh increase against the Canadian Dollar. The USD/CAD pair broke many important hurdles near 1.2750 to move into a positive zone.

There was also a break above a key bearish trend line with resistance near 1.2740 on the hourly chart. The pair settled nicely above the 1.2800 level and the 50 hourly simple moving average.

It even spiked above 1.2850 and traded as high as 1.2854. It is currently consolidating gains above the 1.2820 support level. An initial support is near the 1.2835 level. It is close to the 23.6% Fib retracement level of the recent wave from the 1.2775 swing low to 1.2854 high.

The main support is forming near the 1.2815 level. It is close to the 50% Fib retracement level of the recent wave from the 1.2775 swing low to 1.2854 high. Any more losses might call for a break below the 1.2800 support zone.

On the upside, the 1.2850 level is a key resistance. Therefore, a successful break and close above the 1.2850 resistance level could spark another strong upward move.

The next key resistance is near the 1.2885 level, above which the bulls are likely to target more upsides above the 1.2900 level.

-

Trading Hours Schedule for the 2021 Christmas and New Year Holiday Period

Dear Traders,

Please note the changes in trading session times on Christmas and New Year 2021.

Please consider these changes when planning your trading activities during the festive season.

-

AUD/USD and NZD/USD Set New Multi-Month Highs, Dips Likely Limited

AUD/USD extended its rise above 0.7500 and traded to a new multi-month high above 0.7600. NZD/USD also followed a similar path and climbed towards the 0.7200 zone.

Important Takeaways for AUD/USD and NZD/USD

- The Aussie Dollar gained pace above the 0.7500 and 0.7550 resistance levels against the US Dollar.

- There is a major contracting triangle forming with resistance near 0.7620 on the hourly chart of AUD/USD.

- NZD/USD climbed higher nicely and surpassed the 0.7150 resistance level.

- A key bullish trend line is forming with support near 0.7100 on the hourly chart of NZD/USD.

AUD/USD Technical Analysis

In the past few weeks, the Aussie Dollar followed a bullish path after a proper close above 0.7350 against the US Dollar. The AUD/USD pair even broke the 0.7500 resistance level to move into a positive zone.

The upward move gained pace above the 0.7550r resistance and the pair settled well above the 50 hourly simple moving average. The pair even spiked above the 0.7600 level and it traded to a new multi-month high at 0.7639.

Recently, there was a minor downside correction below the 0.7620 level. The pair traded below the 23.6% Fib retracement level of the recent increase from the 0.7538 swing low to 0.7639 high.

The pair is now testing the 0.7600 support level. There is also a major contracting triangle forming with resistance near 0.7620 on the hourly chart of AUD/USD. The triangle support is near the 0.7600 zone and acting as a strong support.

The next major support is near the 0.7590 level and the 50 hourly simple moving average. The 50% Fib retracement level of the recent increase from the 0.7538 swing low to 0.7639 high is also near the 0.7590 level to provide support.

If there are more losses and a downside break below 0.7575-0.7580, the pair could extend losses towards the 0.7550 support. Conversely, the pair could start a fresh increase above the 0.7620 resistance zone.

The first major resistance is near the 0.7640 level, above which AUD/USD could accelerate higher towards the 0.7680 level.

NZD/USD Technical Analysis

The New Zealand Dollar also followed a bullish path above the 0.7000 pivot level against the US Dollar. The NZD/USD pair even surged above the 0.7100 resistance zone.

The pair climbed above the 0.7150 level and settled well above the 50 hourly simple moving average. It traded to a new multi-month high at 0.7170 before starting a downside correction.

There was a break below the 0.7150 level. The pair even broke the 23.6% Fib retracement level of the upward move from the 0.7053 swing low to 0.7170 high. The pair is now approaching the key 0.7120 support level and the 50 hourly simple moving average.

There is also a key bullish trend line is forming with support near 0.7100 on the hourly chart of NZD/USD. The trend line is close to the 50% Fib retracement level of the upward move from the 0.7053 swing low to 0.7170 high.

If there is a downside break below the trend line support, there is a risk of more losses towards the 0.7080 and 0.7050 support levels. Conversely, the pair could start a fresh increase above the 0.7150 and 0.7160 resistance levels.

-

LTC and EOS – Consolidation Expected Before Further Upside

LTC/USD

The price of Litecoin has been increasing since the start of the week and from Monday’s low at $79.215 we have seen a rise of 29.75% measured to its highest point today at $102.781. Currently, the price is being traded slightly lower as a minor pullback was made and is sitting just below the $100 mark.

On the hourly chart, you can see that Monday’s low was a corrective move made after the interaction with the $84 horizontal level which was the end of the first impulse wave out of a five-wave move that started on the 11th. The second wave established support on the $78.44 level from which we have seen a parabolic rise with the price breaking significant resistance with a strong bullish moment.

As this increase was the 3rd wave which appears completed as it can be sub-divided in lower degree five-wave count, we are now likely to see a pullback to around $92 where the prior local resistance level might get tested for support. But after the pullback ends further upside movement would be expected and a higher high compared to today’s one. This expected increase would be the 5th wave that is set to push the price for a higher high and potentially to the $109.35 where the next significant horizontal resistance level is.

EOS/USD

From Monday’s low at $2.8 the price has increased by 13.46% as it came up to $3.182 at its highest point today. It is still in an upward trajectory and is showing strong bullish momentum.

Looking at the hourly chart, you can see that the price made a breakout above the $2.9 resistance zone with a significant rise made in one hour and continued moving to the upside, further increasing inside the upper range. Like in the case of Litecoin, this increase seen from Monday is the 3rd wave out of the next five-wave impulse to the upside. Today we have seen a spike to the downside but shortly after the price continued increasing from which we can see that an attempt for the support to be established has successfully done.

Now we are likely to see the 3rd wave ending its development which is why shortly a corrective 4th wave would start. This would only be a minor consolidation before further upside movement as the 5t wave would follow to develop but it is still uncertain where the 3rd wave could end. Considering the vicinity of the $3.27 horizontal level we might see interaction with it before the end of the current inrease. But in either way the price of EOS would be expected to surpass it before the completion of the entire five-wave rise.

-

EUR/USD Approaching Key Resistance, USD/CHF Remains At Risk

EUR/USD is trading in a positive zone above 1.2100, but it is facing hurdles near 1.2170. USD/CHF is struggling to hold the 0.8850 support and it could decline heavily.

Important Takeaways for EUR/USD and USD/CHF

- The Euro started a fresh increase above the 1.2050 and 1.2100 resistance levels against the US Dollar.

- There is a connecting bullish trend line forming with support near 1.2140 on the hourly chart of EUR/USD.

- USD/CHF remains in a bearish zone below the 0.8950 and 0.8920 resistance levels.

- There are two major bearish trend lines forming with resistance near 0.0.8870 on the hourly chart.

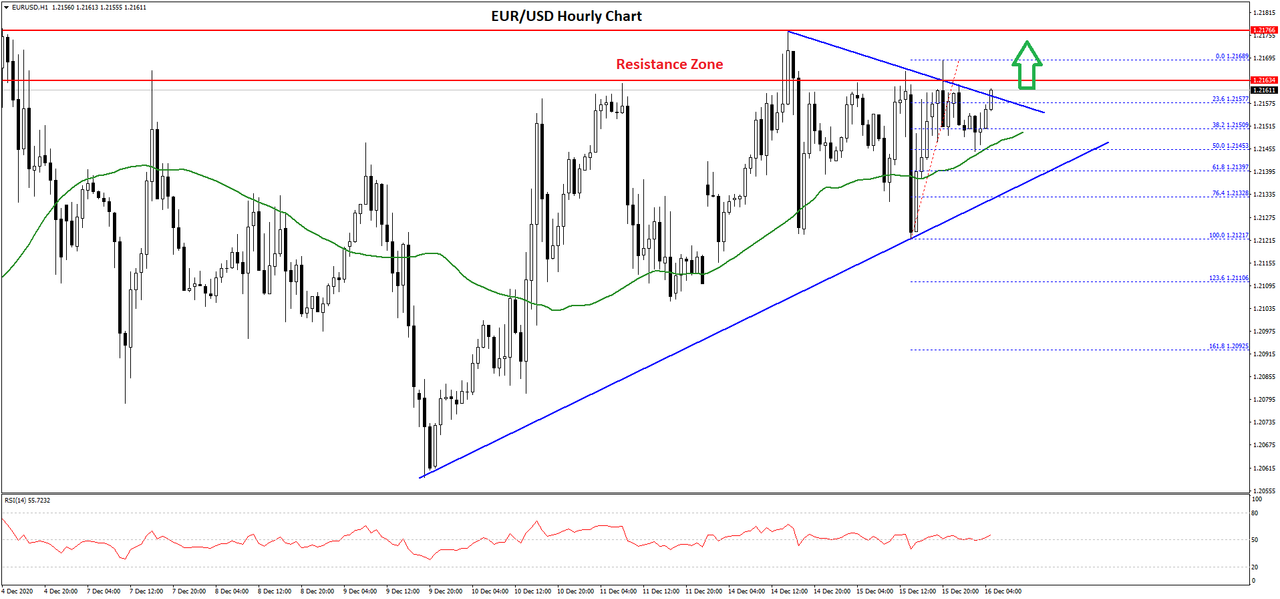

EUR/USD Technical Analysis

In the past few days, the Euro remained in a positive zone above the 1.2050 support zone against the US Dollar. The EUR/USD pair gained pace above the 1.2100 resistance to move into a positive zone.

The upward move was such that the pair broke the 1.2120 resistance and settled above the 50 hourly simple moving average. However, the pair seems to be facing a strong resistance near the 1.2165 and 1.2170 levels.

The recent high was formed near 1.2168 on FXOpen before there was a downside correction. There was a break below the 1.2155 level, and the pair traded below the 23.6% Fib retracement level of the upward move from the 1.2121 low to 1.2168 high.

The decline found support near the 1.2145 and the 50 hourly simple moving average. The 50% Fib retracement level of the upward move from the 1.2121 low to 1.2168 high is also acting as a support.

There is also a connecting bullish trend line forming with support near 1.2140 on the hourly chart of EUR/USD. On the upside, the pair could gain bullish momentum once it clears the 1.2165 and 1.2170 resistance levels.

Conversely, there is a risk of a downside break below the trend line and 1.2145. The next major support is near the 1.2120 level. Any more losses could spark a major decline below the 1.2100 support zone in the coming sessions.

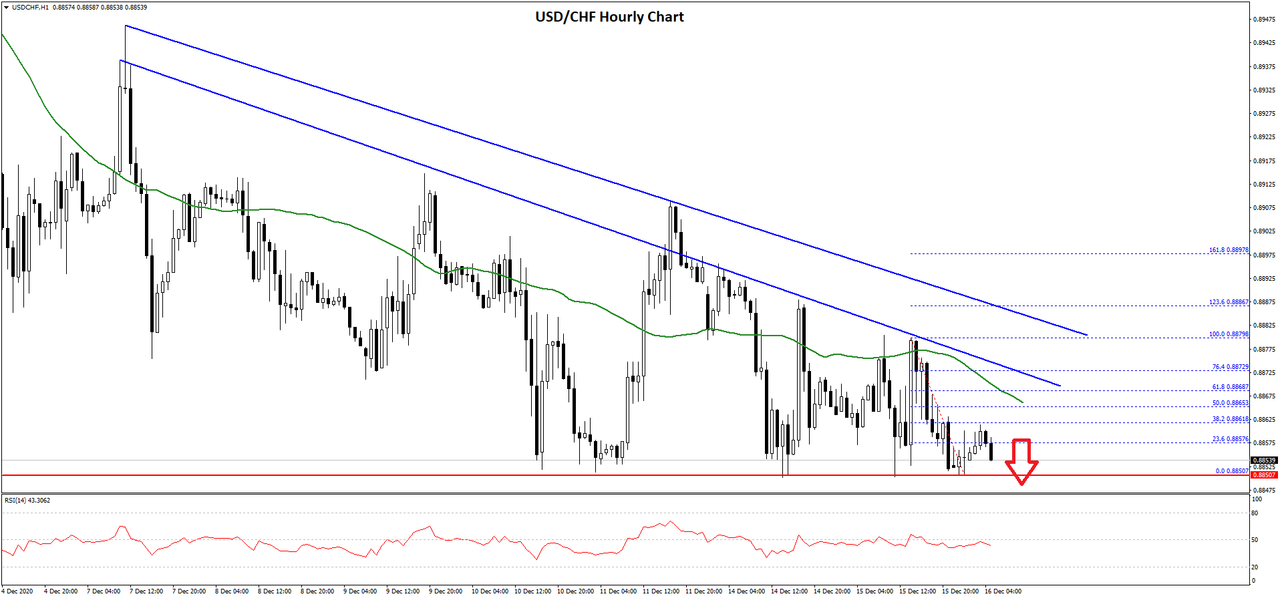

USD/CHF Technical Analysis

The US Dollar started a major decline below the 0.8950 support zone against the Swiss franc. The USD/CHF pair even settled below the 0.8900 level to move into a bearish zone.

The decline gained pace below the 0.8880 level and the 50 hourly simple moving average. The pair is now consolidating above the 0.8850 support level, with a bearish angle. The recent low was formed near 0.8850 before the pair corrected above the 23.6% Fib retracement level of the recent decline from the 0.8878 high to 0.8850 low.

On the upside, an initial resistance is near the 0.8865 level and the 50 hourly simple moving average. The 50% Fib retracement level of the recent decline from the 0.8878 high to 0.8850 low is also near 0.8865.

More importantly, there are two major bearish trend lines forming with resistance near 0.0.8870 on the hourly chart. The pair must climb above 0.8865 and 0.8870 to increase the chances of a decent recovery.

The next major resistance is near the 0.9000 and 0.9005 levels. Conversely, a clear break below the 0.8850 support may perhaps open the doors for a larger decline.

The next major support is near the 0.8820 level, below which the pair could test 0.8800. Any further losses could lead USD/CHF towards the 0.8750 support level in the near term.

-

Guess the currency rate and get money!

We are continuing a series of contests among our Facebook subscribers.

This week we will give away $50 to those, who will provide the closest forecast for the AUD/USD pair.

Full Details about the Contest on the FXOpen official page Facebook

-

BTC encounters resistance while XRP finds support

BTC/USD

The price of Bitcoin has been increasing from last Friday when it was sitting at $17,570 at its lowest point and came up by around 11.4% measured to its highest point today at $19,570. Now the price is being traded at $19,316 as it fell from today’s high and is now making a recovery.

On the hourly chart, you can see that this is a struggle for the price to keep up its bullish momentum above the lower horizontal level at $19,191 which represents the daily candle close from the 2017 all-time high. Since the start of the month, we have seen the price in a decline, forming a descending channel from the 1st of December. Last Friday the price found support on the 0.618 Fib level and started increasing again, breaking out from this descending formation and coming above the significant lower horizontal level.

Now as the price is getting close to the vicinity of the high made on December 1st it has started moving sideways which indicates that resistance has been found. If this is the uptrend continuation after the descending channel was a higher degree retracement, the price is now headed towards is higher high, effectively making a new all-time high. But first, it needs to break this resistance zone in between the two horizontal resistance levels, so we are yet to see if the price manages to do so.

If the price gets rejected once more at this range we could see a lower low compared to the one made last Friday which would mean that the corrective move from the 26th of November hasn’t developed fully, but if it manages to surpass the $19,677 level it would indicate that is headed toward the $21,000 mark.

XRP/USD

The price of Ripple has been on a decline since the start of the month, coming down from $0.68 at its highest to $0.47656 at its lowest point today, which is a decrease of around 30%. Currently the price is being traded at $0.4839 but is still in a downward trajectory.

Looking at the hourly chart, we can see that the price has formed a significant corrective pattern from the 24th of November when it spiked to $0.79. First, we have seen a three-wave descending move with strong momentum, followed by a three-wave upward ABC a bit less steep, and after that a five-wave move to the downside which was developed slowly and wasn’t impulsively developed. These movements are constituting a higher degree WXY correction, which if we are now seeing the E from the five-wave move ABCDE correction is coming to a completion.

There is still a bit more room to go to the downside, to the interrupted support level and the $0.46 low made on the 26th of November before the correction ends, but after it does it would be expected that the price of Ripple continue moving to the upside again in an impulsive manner and potentially surpass its November’s high.

-

ECB Disappointed Markets – Why?

Last week’s main event, the European Central Bank (ECB) meeting, disappointed the market. The central bank pre-committed to ease the financial conditions already from October, but the markets remained with the feeling that the ECB did not do enough.

Yes, the central bank further eased the policy – it extended the Quantitative Easing (QE) program and offered better terms on its TLTROs. However, it was less than the market expected. Moreover, the market pushed the EURUSD exchange rate above the 1.20 level a week before the ECB, and the central bank did not give any clue that it is bothered by the move.

What Was Priced In?

The market expected the PEPP program, which basically is the QE program during the pandemic, to be extended by June 2022. Instead, the ECB extended it only by March 2022. The three months between the two dates when the ECB will not buy bonds represent a tightening rather than easing. As such, the market took the message as hawkish rather than dovish.

Moreover, the new TLTRO conditions for commercial banks to get access to the funds are tougher. In other words, few commercial banks will be able to meet the ECB’s terms so that they will get the funds needed. As a result, the ECB managed to deliver another hawkish message during a dovish statement.

Finally, the central bank suggested that it expects inflation to reach 1.2% in 2023, using the “core” approach, the one that does not consider energy prices. But that is well below the 2% threshold established by its mandate and may suggest that the ECB has a problem bringing inflation below but close to the target.

How About the EURUSD?

The EURUSD and a strong Euro represent such a problem. It is economics 101 that a stronger currency weighs on inflation. Thus, the ECB would have an easier task of reaching its inflation-targeting mandate if the Euro will not be that strong. In particular, the EURUSD is an ongoing concern for the ECB.

However, by only delivering more easing measures wrapped in hawkish statements, the ECB does nothing but fueling a stronger EUR. As such, we should not be surprised by the fact that the EURUSD rate at the 2020 highs two days after the ECB press conference ended.

Daily Market Analysis By FXOpen

in Technical Analysis

Posted

The USD Reverses Course as the NFP Misses Expectations

Last week brought some troubling events in the United States, as protesters took the Capital by assault. Lives were lost, and the nation faces an identity crisis.

Shortly after the order was restored, President Trump recognized President-elect Biden’s victory and ensured people that there would be a peaceful transition of power on the 20th of the month when the new administration takes charge.

But it was too little too late. In the meantime, Twitter suspended the President’s account, and America is on a race to identify each and every one of the protesters.

As such, the economic data paled in the face of the political events. However, the USD did move, as it seems that it reversed course, easing from the highs.

What Did the NFP Show?

The NFP report released last Friday showed the data for the month of December 2020. The U.S. economy lost 140k jobs, much worse than the expectations of adding 60k.

Unsurprisingly, the leisure and hospitality sectors were responsible for most of the job losses, as the pandemic continues to take its toll. However, the November numbers were revised higher, and the unemployment rate remained stable, somehow diminishing the impact of the December report.

ISM Manufacturing Above 60

One of the most striking pieces of economic data released last week was the ISM Manufacturing. It climbed above 60, and most of the time, when it did so in the past, the dollar strengthened in the following one hundred days.

The thing is that all investment houses predict a lower dollar in 2021. Whenever such a consensus exists, the danger is that exactly the opposite happens.

So far, the dollar reflected the risk-on environment, as it moved hand in hand with the U.S. equities. As the new administration prepares to run America, the dollar may be in the grasp of a sharp reversal.

The EURUSD is already down two big figures from the highs, and AUDUSD and GBPUSD correct as well. If the dollar’s strength continues, the world risks being caught on the wrong side of the market, as most traders are positioned for a weak dollar.

FXOpen Blog