Exchange Blog Cryptocurrency Blog

-

Posts

3,617 -

Joined

-

Last visited

-

Days Won

6

Posts posted by FXOpen Trader

-

-

On 2/20/2021 at 11:25 PM, gds221 said:

I believe that now there are a fairly large number of strategies, the main thing is to choose not the most risky option.

We should use such kind of Trading Strategy that is easy for us to understand and use in our trading.

-

On 2/20/2021 at 11:27 PM, gds221 said:

Choosing a good broker for the job plays a really important role for the trader. For example, I chose a broker from Amarkets to work, and this option seemed to me the most reliable.

I started my Forex Trading in the Year 2010 with the International Broker FXOpen.

-

On 2/20/2021 at 11:33 PM, gds221 said:

I would say that everyone has their own key to success, because many have different trading styles.

If we want to become a successful trader in this business then we will need to make more efforts and have Patience with us.

-

On 2/21/2021 at 2:18 PM, Vaabum said:

I studied on my own, on the demo account of the broker ExpertOption, with whom I began career as a trader. As for me, this is an interesting enough option for work.

We need to make Efforts so that we can start learning with the help of the Demo Trading accounts.

-

On 2/21/2021 at 2:29 PM, Vaabum said:

Forex is a really difficult option for earning money. It is a pity that some do not understand this, and simply lose money.

Forex trading is a type of business that requires efforts from the traders so that they can learn and prosper from this business.

-

2 hours ago, gds221 said:

I believe that it is extremely important to properly organize the work of the trader. From experience, I can say that this is quite difficult.

We need to do our trading with a proper Plan so that we can do our trades with good profits.

-

2 hours ago, gds221 said:

It is worth being as careful as possible about reviews, because they do not always reflect the truth there. When I started working with a broker from Amarkets, I also read reviews. From how different they are - I was very surprised.

I started doing my Forex Trading in the Year 2010 with the International Broker FXOpen.

-

2 hours ago, gds221 said:

Fear in this industry plays an extremely negative role. Usually because of this, traders often make avoidable mistakes.

We should not have any Fear in doing our trading and also understand that trading needs to be Fearless.

-

2 hours ago, gds221 said:

I can only say that this can lead to completely not the most pleasant results. From experience, I can say that ignoring these important factors is very harmful!

Forex Trading will give us the required profits when we will take advantage of the Market Trends and use them in our trading.

-

2 hours ago, gds221 said:

Working with the right broker, the trader is really more likely to get the desired result. When I worked with a broker from Amarkets, I was absolutely calm about the work.

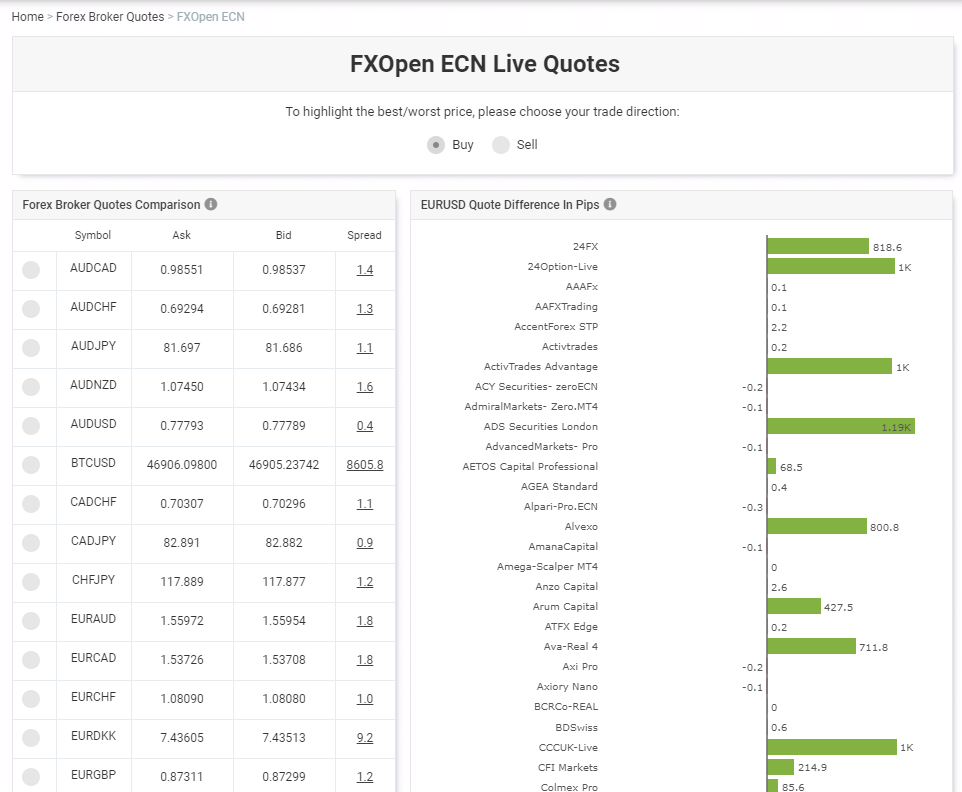

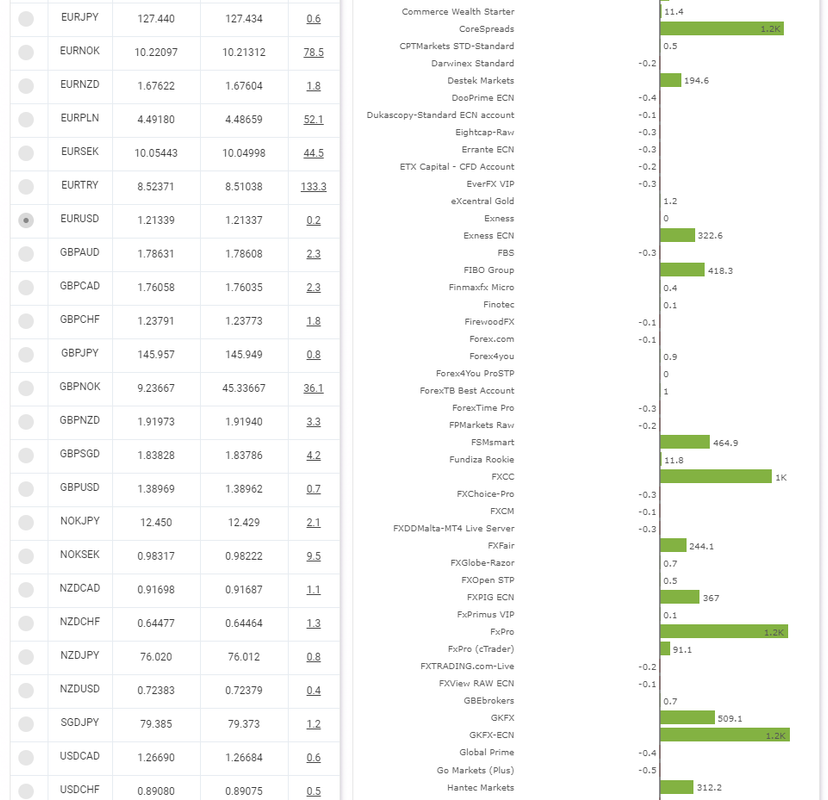

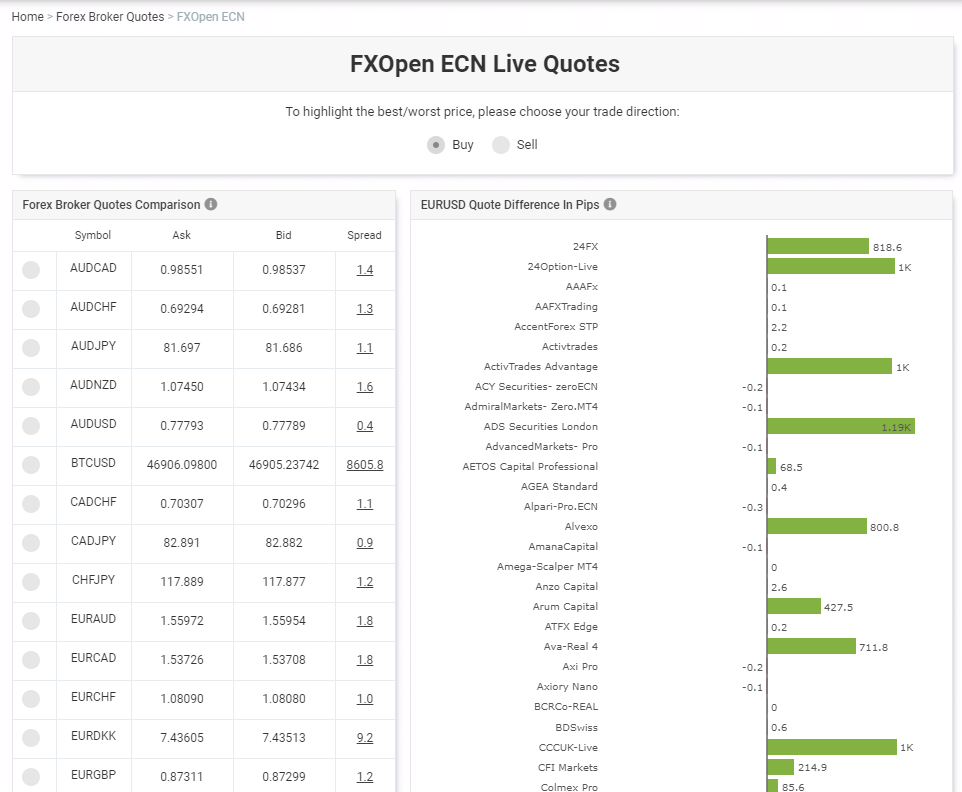

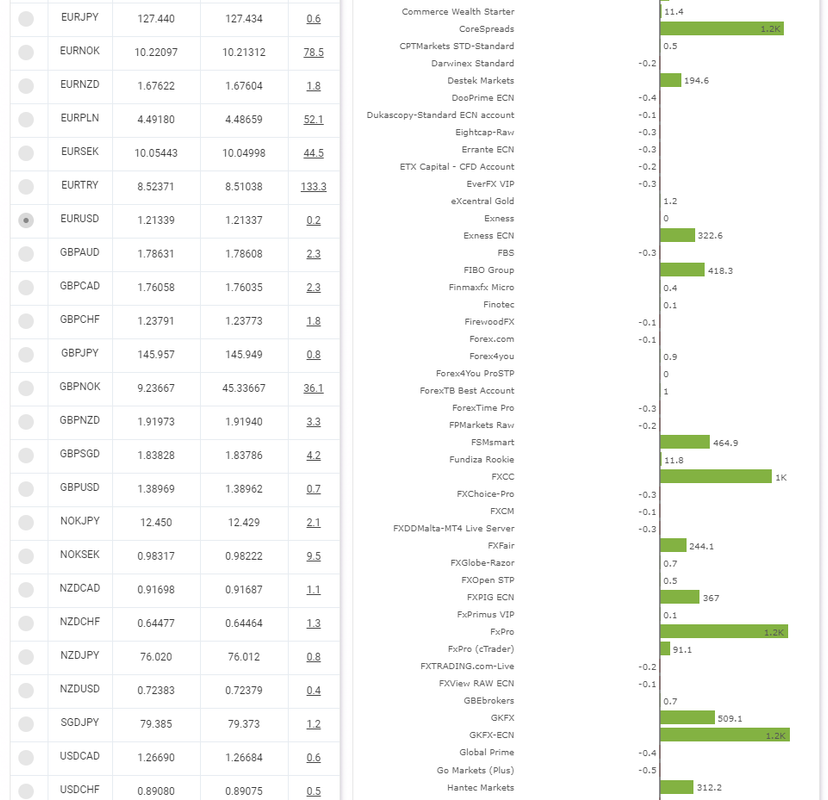

We need to do our Trading with the ECN Forex Broker FXOpen. It has the Lowest Inter Bank Spreads.

-

2 hours ago, gds221 said:

The best way to improve performance is to learn how to work in this industry with a demo account. When I started working with a broker from Amarkets, I did just that.

I started my Forex Trading with the International Forex Broker FXOpen as it is very Reputed and as the Lowest Spreads.

-

2 hours ago, gds221 said:

I can't say that I always use the same conditions for work.

We need to know which time frame is more beneficial for us so that we can take better advantages in our trading.

-

2 hours ago, gds221 said:

Usually I try not to work with the same strategy for a long time, because the market is not always so stable.

We should understand that if we will make use of the different types of Trading Strategies then we will get better Trading Results.

-

2 hours ago, gds221 said:

For some reason, beginners always think that scalping is as simple as possible, and will immediately bring profit. In fact, this is far from true, and they quickly understand this.

It is true that when we will start doing our trades with the Scalping techniques then we can earn the Profits Fast.

-

BTC and XRP – Correction or the end of the increase altogether?

BTC/USD

From its all-time high at $58,360, the price of Bitcoin has made a decrease of 22.8% today as it fell to $45,058 at its lowest spike. Currently, it is being traded at $47,251 and the price is in a steep downward trajectory.

Looking at the hourly chart, we can see that the price ended its 3rd wave out of the impulse that started on the 27th of January. This is why the seen decrease is still considered correctional in nature but is still unclear where this downfall could end. If this is the developing 4th wave would have seen its first sub-wave which is why now a short-term recovery would be expected.

But after a short-term recovery, we can see its 3rd sub-wave making a lower low, potentially somewhere around its all-time high of $40,000. But if the price goes to those levels it could indicate the possibility that the upward move has ended altogether. If this is true then we have seen the completion of the five-wave impulse at the $58,000 area in which case now a longer-term correction could play out.

For the signs of confirmation, we are going to look at what happens at the current levels as if this is the 4th wave the price should start an immediate recovery. But if it continues moving to the downside further in a straight line the second scenario would look more likely.

-

Join the “Money Managers” contest and win up to $5,000

FXOpen invites traders to participate in "Money Managers", a contest with real PAMM accounts. Don't miss your chance to win big money prizes totaling 10,000 USD!

The contest starts on March 1, 2021, and registration will be open for 2 months until May 1. -

Bitcoin Surge Continues as More Institutional Investors Turn to Digital Assets

The price of Bitcoin reached $57,000 over the weekend. The extent of the current bull run is so aggressive that earlier forecasts that Bitcoin will reach 200k and more in less than a year do not sound improbable anymore.

If that is going to be the case, it remains to be seen. What is important now is that the price of Bitcoin is disconnected completely from reality in the sense that the technology itself has no use and that the asset is purely speculative.

Why Do People Turn to Cryptocurrencies?

Distrust in the financial system appears to be the main reason. People are sick-entire of the same old “medicine” applied to broken economies (i.e., printing more money to solve for either excessive debt or economic recessions.

And they are right. Unfortunately, so are the policymakers. No one wished for two economic recessions less than ten years apart, but here we are. Moreover, the current one is far more impactful when compared to the 2008-2009 Great Financial Crisis for the simple reason that the health crisis affected the entire world and not just parts of it.

-

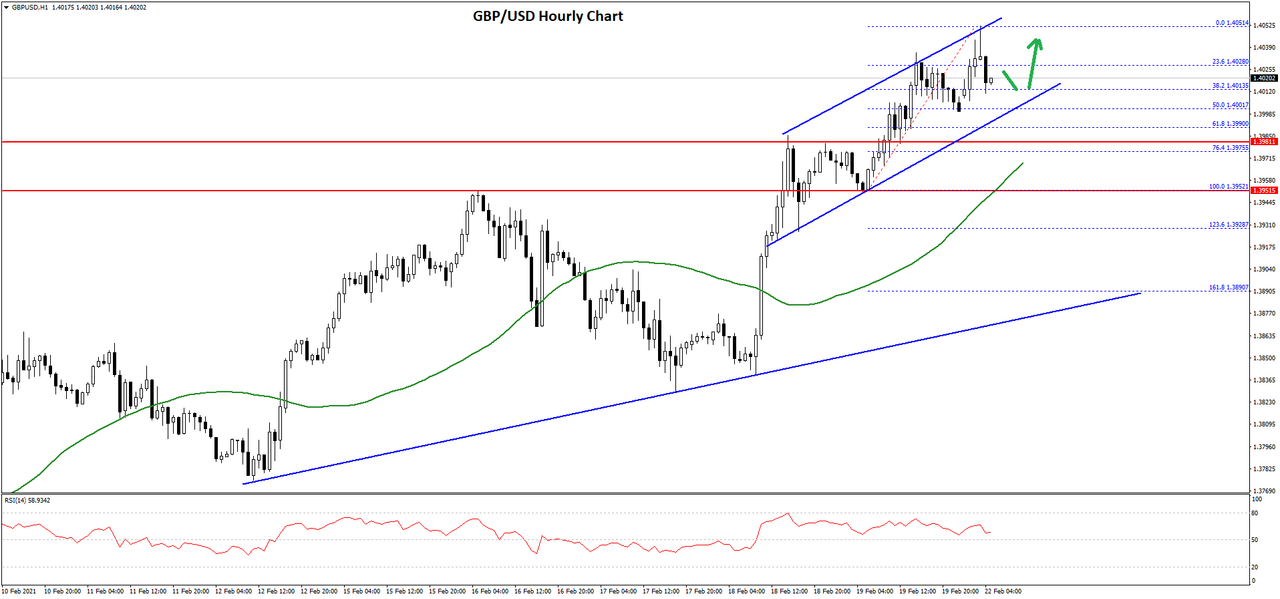

GBP/USD Climbs above 1.4000, USD/CAD Turns Red

GBP/USD gained momentum above the 1.3900 resistance and it even broke 1.4000. USD/CAD is declining and it traded below the 1.2650 support zone.

Important Takeaways for GBP/USD and USD/CAD

- The British Pound started a steady increase above the 1.3950 and 1.4000 resistance levels.

- There is a key rising channel forming with support near 1.4000 on the hourly chart of GBP/USD.

- USD/CAD started a steady decline below the 1.2700 and 1.2650 support levels.

- There is a major bearish trend line forming with resistance near 1.2710 on the hourly chart.

GBP/USD Technical Analysis

After forming a base above the 1.3800 level, the British Pound extended its increase against the US Dollar. The GBP/USD pair broke the 1.3900 resistance level to move further into a positive zone.

The bulls gained pace above the 1.3920 level and the 50 hourly simple moving average. As a result, there was a clear break above the key 1.4000 resistance level. The pair traded to a new yearly high at 1.4051 on FXOpen and it is currently correcting lower.

There was a break below the 1.4020 support level. The pair traded below the 23.6% Fib retracement level of the recent wave from the 1.3952 swing low to 1.4051 high.

On the downside, the first key support is near the 1.4000 area. There is also a key rising channel forming with support near 1.4000 on the hourly chart of GBP/USD. The trend line is close to the 50% Fib retracement level of the recent wave from the 1.3952 swing low to 1.4051 high.

If there is a break below 1.4010 and 1.4000, the pair could decline towards the 1.3980 support zone or the 50 hourly simple moving average. Any more losses might call for a test of 1.3920.

On the upside, an initial resistance is near the 1.4040 level. The main resistance is now near the 1.4050 zone, above which the pair is likely to accelerate higher towards the 1.4100 and 1.4120 levels.

-

On 2/19/2021 at 10:06 PM, gds221 said:

According to me, everything here depends only on the trader himself. To some, on the contrary, the stock market seems safer and more profitable.

Forex trading is not the same as trading in the Stock markets as the risks present in the Stocks are much higher.

-

On 2/19/2021 at 10:03 PM, gds221 said:

The best way to improve performance is training. The more knowledge a trader has, the more likely a positive result is.

We need to learn trading skills and also spend time in this business to become better Forex traders.

-

On 2/19/2021 at 1:18 AM, Juleenelya said:

the best strategy is the one with which you are comfortable working and which will bring you a good profit!

When we are doing our trading we have to use such kind of Trading strategy that is easy for us to understand and use in our trades.

-

On 2/19/2021 at 10:01 PM, gds221 said:

Now I prefer to use a broker from Amarkets to work. As for me, this is a really good option for work, which can bring great money.

We need to do our Forex Trading with a Regulated Broker like FXOpen.

-

On 2/19/2021 at 9:52 PM, gds221 said:

I learned to work myself. When he started working with a broker from Amarkets, he used the demo account of this company. For me, this is a great option for work.

When we are starting our trades we need to make use of the Demo Trading accounts so that the risks are minimal to us.

-

On 2/19/2021 at 1:19 AM, Juleenelya said:

if you work with a reliable broker who will not suit you with problems, it will be pleasant and profitable to work!

We need to do our trades with a Forex Broker that is True ECN like FXOpen.

I think forex trading is to risky like the stock market.

in Forex General Discussion

Posted

We should make the proper use of the Trading Opportunities that are available to us to make the Profits.