Exchange Blog Cryptocurrency Blog

All Activity

- Past hour

-

Discount on MetaTrader4 Server and Licenses for 2025

SaleMT4SRV replied to SaleMT4SRV's topic in Buying & Selling Section

Don't miss this exclusive opportunity! Today you can purchase MetaTrader4Server for only € 2600! This is a massive and unprecedented Non-Stop Sale that includes not only the server but also the MetaTrader4 License. We offer attractive discounts for wholesale buyers! Don't miss your chance to become part of a successful MetaTrader4 business. The number of offers is limited! We're having a sale on MetaTrader4Server for only € 2600! The new year 2026 is a year of financial opportunity. Get ready for change and success in the world of trading. Looking for a lower price on MetaTrader4 Server and MT4 license? We've heard you! We've made a multi-million dollar, world-class business accessible to everyone. Promotion Terms: - MetaTrader4 Server: only €2600 - MetaTrader4 License: only €60 per month! This is an unprecedented promotion, the first we've run in the history of brokerage equipment sales since 2011. Don't miss your chance. Contact us today. Our promotion continues for all customers: purchase one turnkey MetaTrader4 Server and get a second MetaTrader4 Server for free! Contact our managers for more details. Don't hesitate to contact us; all consultations are free. Contacts: Email: salemt4srv@gmail.com Telegram: @mt4srv https://teams.live.com/l/invite/FEAo849h-kwlEt7RwY?v=g1- 9 replies

-

- forex

- metatrader4 server

-

(and 1 more)

Tagged with:

- Today

-

AMOUNT: $8.25 Transaction Hash: 0xd8d88d203ba6d3fdcb2be187ef648a2571e098e6c50484e6d8899e65c2eb6106 Status: Success Block: 75581081 Timestamp: Jan-16-2026 09:34:40 AM UTC From: 0x7058A2Db110D796f98469df9ce37c3F53725F362 To: 0x9be82D8e471354b17FAcAbD82DE9Ea1bcaed3fE2 Thank you dear Loan ledger

-

I've spent the better part of two years exploring online gaming platforms, and I want to share what I've genuinely learned about live casino experiences in Australia. This isn't promotional material—it's my honest observations and the questions that have shaped my understanding. Why I Started Looking Into Live Casinos Back in 2024, I was curious about how online casinos could replicate the atmosphere of physical venues. I'd visited Crown Casino in Melbourne a few times, and while the energy was undeniable, the convenience factor of playing from home intrigued me. So I started researching what "live casino" actually meant beyond the marketing language. The distinction between regular online casinos and live dealer platforms became clear pretty quickly. With regular online casinos, you're playing against software. With live casinos, there's an actual person dealing cards, spinning wheels, and managing tables in real-time. That fundamental difference shaped everything else I discovered. Understanding the Real Dealer Experience Here's what genuinely surprised me: the production quality varies dramatically between platforms. When I first accessed a live casino setup, I expected grainy video feeds and awkward interactions. Instead, I found myself watching multiple camera angles, HD streams, and dealers who were genuinely professional. The experience typically includes: Multiple camera perspectives - You can see the dealer's hands, the table surface, and sometimes the entire room setup Real-time interaction - Chat functions let you communicate with dealers and other players Transparent gameplay - You watch every shuffle, every card placement, every spin Game variety - Different tables with varying betting limits and game variations What struck me most was how this transparency addressed my initial skepticism. When you can see the physical cards being dealt or the roulette wheel being spun, the trust factor changes entirely. My Observations About Australian Live Casino Platforms Australia has a unique position in the online gaming world. We have strict regulations, and platforms operating here need to navigate complex licensing requirements. I noticed that legitimate platforms operating for Australian players typically display their licensing information prominently. The platforms I examined generally offered: Localized experiences - Dealers and tables adjusted for Australian player preferences Local payment methods - Support for Australian banking options Responsible gaming tools - Deposit limits, self-exclusion options, reality checks Clear terms and conditions - Transparency about how games work and what players can expect One platform I spent considerable time exploring was https://crowngold3.net/live-casino. What differentiated it in my experience wasn't flashy marketing, but rather the straightforward presentation of what was actually available. Comparing Live Casino to Physical Casino Experiences I've tried to be honest about both sides of this comparison. Physical casinos offer something live casinos can't replicate: the sensory experience. The sounds, the ambient energy, the social dynamics of being in a room with other players—that's genuinely irreplaceable. However, live casinos offer practical advantages: Accessibility - No travel required, play on your schedule Lower pressure - Less social anxiety for some players Flexibility - You can play in your environment, take breaks easily Documentation - Hand histories and game records are automatically maintained But here's what I've observed that's important: live casinos don't make gambling "safer" or "smarter." They're just a different format. The mathematical odds remain the same. The house edge doesn't change. The risk of problem gambling exists equally. What I've Learned About Game Mechanics Through my exploration, I've developed a clearer understanding of how live casino games actually work. Let me break down what I've observed: Roulette - The wheel is physical and spun by the dealer. The outcome is determined by physics, not software. This is genuinely different from RNG (random number generator) roulette because you can see the actual spin. Blackjack - Cards are dealt from physical shoe or deck. You're playing against the dealer's actual decisions and the real cards in play. The strategy remains the same as traditional blackjack. Baccarat - Similar to blackjack in that physical cards are dealt, but with predetermined rules about when the banker or player draws additional cards. Poker variants - These vary significantly depending on the specific game, but generally involve community cards dealt by the dealer. The key insight I've gained: watching the physical action doesn't change the mathematical probabilities, but it does change the psychological experience. That matters for understanding your own relationship with gaming. The Responsibility Conversation I need to be direct here because this is important. In my exploration of live casinos, I've noticed that the immersive nature of live dealing can actually make it easier to lose track of time and money. The interaction with real dealers creates a social element that can feel less like gambling and more like entertainment. This is worth examining honestly: Time perception - Hours can pass without you noticing Social pressure - Interacting with dealers and other players can influence your decisions Continuous play - There's always another hand, another spin Emotional engagement - Real dealers create emotional investment Every legitimate platform I've examined includes responsible gaming tools. These aren't optional features—they're essential safeguards. Deposit limits, session time limits, self-exclusion options—these exist because the industry recognizes the genuine risks. My Questions That Remain Unanswered Even after extensive exploration, I have questions I can't fully resolve: How do different platforms ensure fair dealing when operating remotely? What's the actual experience like for dealers working these positions? How do regulations differ between various Australian states? What happens to player data and how is it protected? How do betting patterns differ between live and non-live casino players? These questions suggest that while I've learned a lot, there's always more to understand. That's honest. What I'd Tell Someone Starting Out If you're considering exploring live casinos, here's what my experience suggests: Start with education, not money. Understand the games before you play them. Watch free streams if available. Read the rules carefully. Set boundaries before you start. Decide on your budget, your time limit, and your loss tolerance. Write it down. Actually do this. Understand that "live" doesn't mean "better." It's different, not superior. The odds are what they are. Use the tools provided. If a platform offers deposit limits or session timers, use them. These aren't signs of weakness—they're tools for informed play. Be skeptical of your own thinking. If you find yourself rationalizing larger bets or longer sessions, that's a signal to step back. The Broader Context My journey into understanding live casinos has been part of a larger education about online gaming in Australia. The regulatory environment is complex, the technology is sophisticated, and the psychology is real. Platforms like those available through crowngold3.net/live-casino represent a significant evolution in how gaming is delivered. Whether that's positive or negative depends entirely on how individuals approach it. Final Reflection After two years of exploration and observation, I've concluded that live casinos are neither inherently good nor bad—they're tools that can be used responsibly or irresponsibly. The difference lies entirely with the individual player, their understanding of the odds, their financial situation, and their ability to maintain boundaries. The most important thing I've learned is that transparency matters. When you can see the actual cards, the actual wheel, the actual dealer—that transparency is valuable. It removes one layer of skepticism. But it doesn't remove the fundamental mathematics of gaming. If you're going to explore this space, do it with your eyes open. Understand what you're actually engaging with. Set your boundaries. Use the tools available. And be honest with yourself about your relationship with gaming.

-

Hidden Gems of Bulgaria: Secrets Unveiled

avgustincrr replied to katefair's topic in Sport Discussion

Un mio vecchio compagno di università che vive a Milano mi ha mandato un messaggio l'altro giorno suggerendomi di dare un'occhiata a un portale che usava lui. Ero un po' scettico all'inizio, ma navigando su ivy bet ho scoperto che il poker è davvero ben organizzato. È diventato il mio passatempo preferito dopo il lavoro. Mi piace molto l'interfaccia semplice e il fatto che si trovi sempre un tavolo disponibile senza dover aspettare troppo tempo. -

Een goede maat uit Gent vertelde me onlangs over zijn persoonlijke succes bij het spelen van poker. Ik had zelf een nogal slechte week achter de rug en dacht er serieus over na om mijn account overal te sluiten. Toch besloot ik rocky spin een kans te geven na zijn enthousiaste verhaal. Wonder boven wonder sloeg mijn geluk direct om bij de online casino weddenschappen. Het bedrag dat ik won was genoeg om al mijn eerdere verliezen ruim te compenseren en een mooi diner te betalen.

-

Date:16th January 2026. USDJPY: Intervention On The Table With US Support. Japan's finance minister tells journalists that the Japanese government is considering currency intervention to support the Japanese Yen. The Japanese Yen Index has already fallen more than 1.00% in the first 2 weeks of 2026. Though, the main concern for the Japanese Federal Government is the decline against the US Dollar, which at one point was almost at a 2% decline. The Japanese Yen is currently the second best performing currency during this morning’s Asian session, after the New Zealand Dollar. Will the Japanese Government Boost the Currency? Analysts cannot advise that a currency intervention is certain without any doubt. However, over the past week, the Japanese government has told journalists that they will support the currency. When asked about direct currency intervention, the finance minister said the option remains on the table. For this reason, many traders do believe the government will boost the currency with an intervention, or if they opt not to intervene directly, they will explore other options. It is important to note that the Bank of Japan is not likely to adjust interest rates without the snap elections ending first: the BOJ is due to announce their decision on Japan’s monetary policy next Friday, however, the snap election will most likely not take place until mid-February. Previously the government's interventions have not been successful other than a short-lived spike. However, according to Japan’s finance minister, on this occasion the move would be supported by the US. Will the Bank of Japan Increase Interest Rates? Some economists argue that with Japan’s new expansionary fiscal policy vision, the BOJ is more easily able to increase rates. Although, with the BOJ it's never that simple and they are traditionally known to move slowly. Market participants are reviewing December’s wholesale inflation data. Monthly inflation slowed from 0.3% to 0.1%, while annual inflation eased from 2.7% to 2.4%, mainly due to lower fuel prices. However, inflation remains above the Bank of Japan’s 2.0% target, which supports the case for maintaining a hawkish policy stance. According to a Reuters survey of leading economists, most expect the Bank of Japan to pause until July before raising interest rates again. Whereas, other economists believe the cut could come as early as April. The Bank of Japan will most likely raise rates by 0.25% and at most rise to 1.25% by the end of the year. If the Bank of Japan does not raise rates, the government will struggle to support the Japanese Yen in 2026. The Fed and Economic Data Support the US Dollar The US Dollar is trading lower this morning, but has been one of the best performing currencies of the week. The US Dollar Index has risen to its highest price since December 9th. Inflation has read more or less as per expectations, but economic data has been significantly higher. The Weekly Unemployment Claims fell to 198,000, the lowest in 6 weeks and lower than expectations. The US Retail Sales, Empire State Manufacturing Index and Philly Index have also all risen above expectations. Due to this, the market is expecting the Federal Reserve to pause in January and March unless data deteriorates. According to the Chicago Exchange, there is a 78% chance of no rate cuts in the first quarter of 2026. By the end of the year there is a 32% chance of 2 rate cuts, a 27% chance of 1 rate cut and a 21% chance of 3 rate cuts this year. However, the Federal Reserve’s hawkishness for the first quarter is supporting the US Dollar. USDJPY - Technical Analysis HFM - USDJPY 15-Minute Chart When it comes to government interventions, spreads tend to widen during the sudden spike in volatility and the price movement happens relatively quickly. Therefore, traders may consider an earlier entry with a medium-term view. On a 2-hour chart, the USDJPY has retraced back to the 75-bar Exponential Moving Average which can act as a support level. However, if this level is broken, sell signals may materialise on this timeframe. The MACD and RSI on the 2-hour chart are indicating downward price movement. On the 5-Minute timeframe the 200-bar Simple Moving Average and VWAP are indicating a bearish bias. According to the 200-bar EMA, sell signals are likely to remain as long as the price remains below 158.400. The main support level can be seen at 157.760. Key Takeaways: Japan’s finance minister says currency intervention remains an option as the Yen weakens against the US Dollar. Traders expect government support, but the Bank of Japan is unlikely to change interest rates until after the snap election. Economists see limited rate hikes in 2026, with policy rates likely peaking near 1.25%. Strong US economic data and a hawkish Federal Reserve continue to support the US Dollar. Technical indicators suggest downside risk for USDJPY unless prices move back above key resistance levels. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Michalis Efthymiou HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

-

Bestchange - BestChange.com

BestChange replied to BestChange's topic in Online E-Currency Exchangers

Route recalculated: how to use the ‘Multistage exchange’ tool Can’t find any options for a direct exchange in your chosen currency pair? Don’t worry—it’s not a dead end. Try building an alternative route with the help of Multistage Exchange. Why is the Multistage exchange useful? This tool helps you find a more complex exchange route via one or several intermediary currencies. In some cases, this alternative path can result in a noticeably better final amount, which is why it’s worth checking even when direct exchange offers are available on BestChange. What should you keep in mind when using the Multistage exchange? A multi-step route usually involves several exchangers. Be sure to carefully review each one—exchange rates, reserves, operating conditions, and user reviews. This will help you avoid unexpected issues and choose the most efficient and reliable option. Have you tried finding the Multistage exchange route? Share your thoughts and experience in the comments. -

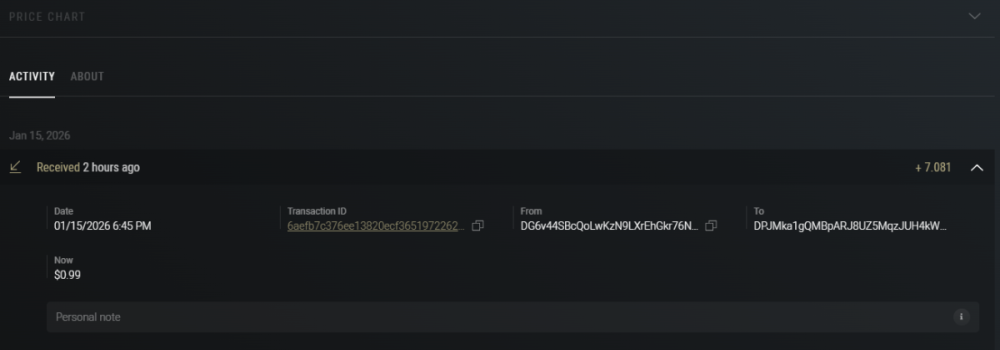

Program Pays!!! Thanks Admin. January 15, 2026 Transaction number No. 1000-26108 Doge Withdraw 7.081039 ($0.99) Batch: 6aefb7c376ee13820ecf365197226249908fd7b2

- Yesterday

-

Beste mensen, hoe gaat het ermee? In een lokale Facebookgroep voor inwoners van Namen zag ik iemand praten over een platform dat ideaal was voor een ontspannen avondje. Na wat klikken kwam ik uit op spin granny en de pokeromgeving sprak me direct aan. Het is niet altijd makkelijk om een plek te vinden waar je op je eigen tempo kunt spelen, maar hier voelde het direct goed. Ik heb er inmiddels al flink wat uurtjes doorgebracht en de interactie op de site is echt top.

-

Na een lange werkdag in het drukke Brussel heb ik vaak nood aan wat ontspanning om mijn hoofd volledig leeg te maken. Onlangs kwam ik via een vrij simpele advertentie op sociale media terecht bij lolo spin en de pokeromgeving sprak me direct aan. In plaats van de gebruikelijke stress van de stad, kon ik me even focussen op een tactisch spelletje. De interface is erg overzichtelijk en ik voelde me direct op mijn gemak bij de eerste inzet. Het is voor mij inmiddels een vaste prik geworden om even te relaxen voor het slapengaan.

-

Gegroet! In een artikel over technologie in Kortrijk las ik over de snelle uitbetalingen van bepaalde platforms. Dat is voor mij cruciaal, dus ik ben direct gaan kijken. Op moja bet vond ik een uitstekend aanbod voor ONLINE CASINO BETS POKER. Na een frustrerende week waarin niets lukte, won ik plotseling een serieus bedrag. Het heeft mijn financiële situatie direct verbeterd en ik ben zeer te spreken over de gebruiksvriendelijkheid van deze omgeving.

-

¡Saludos a la peña! Estaba en Málaga buscando alguna distracción para el fin de semana y vi un banner en una web de noticias locales. Me picó la curiosidad por las opciones de casino que tenían allí porque buscaba algo fiable. Al usar spinmacho logré romper una racha negativa de muchos meses. Pude recuperar todo el dinero que había invertido y salir con ganancias gracias a las slots online y el póker. Todo salió perfecto.

-

Estaba en Gijón disfrutando de la costa cuando vi un banner en una página de noticias regionales que me llamó la atención. Llevaba una racha de derrotas deprimente y ya no esperaba nada bueno del azar este mes. Me decidí a entrar en https://royals-tiger.es/ para distraerme un poco con las máquinas de azar online. Para mi sorpresa, gané una cantidad importante que borró mis pérdidas del póker anteriores. Me siento muy contento con la experiencia y los premios logrados.

-

Gegroet, ik hoorde op een feestje in Knokke iemand opscheppen over zijn winsten met online casino bets en dat maakte me een beetje jaloers. Ik besloot zelf ook mijn geluk te beproeven om te zien of het echt zo makkelijk was. Via play jonny begon ik aan de slots online en binnen tien minuten had ik mijn eerste grote prijs te pakken. Mijn eerdere twijfels zijn als sneeuw voor de zon verdwenen. Het is een prettige manier om wat extra spanning in je leven te brengen met een mooi resultaat.

-

Date:15th January 2026. From ETFs to Technicals: What’s Fuelling Silver’s 2026 Rally. The best-performing asset in 2026 so far is Silver. Silver paused during the Asian session this morning after rising for four consecutive days. However, technical analysis is not yet indicating a prolonged downturn. So, why is Silver the best-performing asset of 2026, and what are analysts predicting for 2026? Factors driving Silver’s Bullish Momentum The increase that Silver is experiencing is largely due to demand from institutional investors rather than physical demand. According to the latest reports and projections, demand for physical Silver is likely to slightly decrease over the next 12 months. Institutions are buying Silver for similar reasons to Gold, however, Silver is much more volatile and cheaper to purchase. The slightly lower inflation readings from this week, projections for more frequent interest rate cuts, and questions over Fed independence are increasing demand. Economists are not expecting the Federal Reserve to cut interest rates this month, nor in March 2026. For this reason, the US Dollar has slightly risen while stocks have fallen. However, economists do believe that in the second and third quarters of the year, the Fed will need to make frequent rate cuts. On average, economists believe the Fed will need to cut by 0.75% by the end of the year. This would take the Federal Fund Rate to 3.00%, the lowest since the summer of 2022. For this reason, investors expect the Federal Reserve to delay cuts in the first quarter but eventually cut rates later in the year. At the same time, investors are incorporating political risks into their strategy, which is resulting in a need for Gold and Silver. These include the Federal Reserve’s independence and US global intentions such as within Greenland. In addition, investors are also treading cautiously as the US Midterms will take place later in the year. Investors Buying Silver ETFs Market participants are reviewing the Silver Institute’s early 2025 outlook, which expects global industrial silver demand to fall 2% to 665 million ounces. The decline reflects trade policy uncertainty and reduced use in electronics and photochemical applications. Demand for physical bars and coins is also expected to drop to a seven-year low, down 4% from 2024. However, strong investment inflows into Silver ETFs rose 18%, with net inflows of 187 million ounces. This is likely to offset weaker physical demand and help support prices, particularly as investors seek protection from inflation and currency volatility. On the CME, Silver trading activity spiked on 7 January, with volumes reaching 195,000 contracts, well above the early-month average. XAGUSD - Technical Analysis HFM - 15-Minute Chart Due to the bullish price movement, indicators and price action are understandably pointing towards Silver’s trend continuing. Even with the current retracement, the price fell to the previous low and did not necessarily form significant breakouts. When looking at the 2-hour timeframe, the price of the metal remains above the key Moving Average, above the neutral area of the RSI, and the MACD. For this reason, indicators continue to point towards buyers maintaining control. Fundamental analysis also indicates this, with inflation reading slightly lower. The main risk for Silver and Gold is the rise in the US Dollar. If the US Dollar declines, Silver can potentially strengthen further. The only indicators currently pointing towards a downward price movement are the 200-bar Moving Average on the 5-minute timeframe. The price currently remains below this level, giving a bearish bias. However, the price is currently rising and trading close to this level. If the price forms a bullish breakout at $90.185, the bearish bias is likely to fade. Key Takeaways: Silver leads 2026 performance. It’s the top-performing asset so far, despite a brief pause after four consecutive days of gains. Institutional demand drives momentum. Growth is fuelled by ETFs and institutional buying rather than physical silver demand. Fed rate expectations influence buying. Investors anticipate rate cuts later in 2026, boosting silver and gold as hedges. Physical demand is declining. Industrial use and coins/bars are projected to drop, but ETF inflows (up 18%) support prices. Technical indicators remain bullish. Silver’s price is holding above key moving averages and RSI/MACD signals, suggesting buyers remain in control. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Michalis Efthymiou HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

-

Paid us 12.82 USDT: (Jan-14-2026 12:51:20 PM UTC) https://bscscan.com/tx/0xd145bd92ae9fd65d40bdd8b2d2ac7aa1964d049cf5c0e80fb8bf9342cf3f48a4