Exchange Blog Cryptocurrency Blog

armygera

-

Posts

94 -

Joined

-

Last visited

Posts posted by armygera

-

-

this promo will be stopped ?? ohh,,, so sad..

but,, wait,, in next promo FBS guarantee a complete return of our deposit if we lose it ?? really ?? wow,, what's the promo,, I really want to know it soon...

[/center]

[/center]You must be kidding.. but I hope it so..

-

Only a week to go.. the end of 999 FBS Contest..

Scoreboard report taken at 8:45 PM GMT +7

-

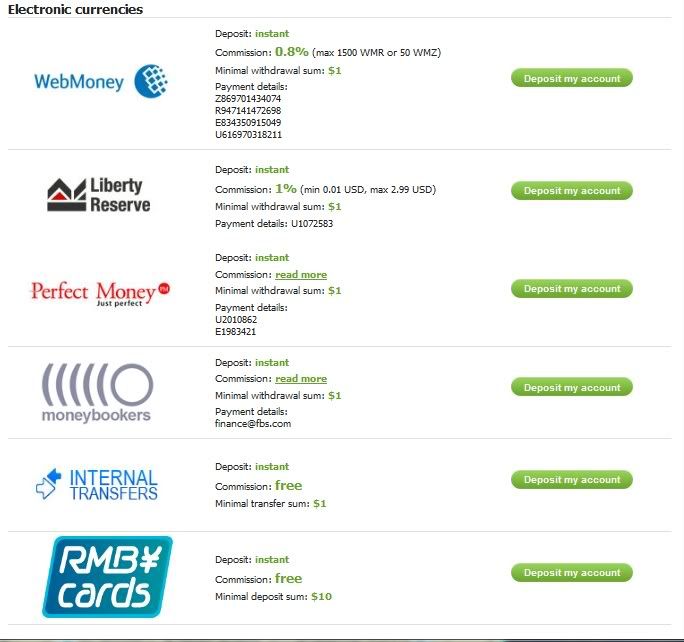

FBS offers the most popular and easy-to-use account deposit and withdrawal options, such as :

I only use Libertyreserve. I only know it. How about other electronic currencies? Anybody can give me some info?

-

FBS Master Card Club Promotion - Promotions - FBS

Dear clients!

We do know you take decisions rapidly, easily adapt to constantly changing environment and value your time. We here at FBS have done

our best to simplify the payment solutions for you and make your FBS MasterCard receipt faster and easier.

If you deposit your account to 500 or more USD you can instantly join FBS MasterCard Club and get a free FBS

MasterCard!

FBS MasterCard advantages include:

• Instant deposit and withdrawal

• An easy way to buy online, pay for online services

• Easy use of ATMs to cash out your funds

• Low commissions

How to get a FBS MasterCard?

To get a FBS MasterCard please login to your Personal Area and visit this link: https://my.fbs.com/w...mastercard/help. You

will be redirected to Payoneer website and offered to submit a card registration form. Please make sure to input correct data. Please note

that the card issuance is worth 20 USD, which will be deducted from your trading account during the registration. After the form is submitted you will be

returned back to your FBS Personal Area.

Deposit your account to 500 or more USD and you will get your FBS MasterCard for free!

https://my.fbs.com/w...mastercard/help

I have received my FBS MasterCard.. Thank You FBS for being my lovely broker..

-

The contest is run tightly, because of forex volatility, here is an update only several hours from above uploaded report.

-

Update Demo Contest FBS.................

http://www.fbs.com/contest/999/participants the one competitive Contest in this time..........

http://www.fbs.com/contest/999/participants the one competitive Contest in this time..........Wow what haven to Mr Yudhie? His balance drop more than 30%

-

«FBS Green Drive» winner got his Audi A4!

06 Dec 2011, 16:18

Dear friends!

On the 11th of November “FBS Green Drive” contest was completed. The happy trader who won the super prize from FBS is Andrey Pak from Russia. As a result of his successful trading the contestant won a luxurious car from FBS: Audi A4.

Award ceremony took place in Saint Petersburg. During the grand event we presented Andrey the keys of his new luxurious car and asked him to share his impressions with us.

FBS team prepared video interview with the winner sharing his feelings and secrets of successful trading with FBS. Watch and enjoy!

http://www.youtube.com/watch?v=ldgiSHmXu5E

FBS team sincerely congratulates the winner and wishes him continued success!

Take part in contests by FBS! Don’t miss a chance to win!

-

I imagine if FBS give their loyal trader with a service to make free EA building.. hehehe..

-

“Predict Nonfarm Payrolls” contest (November 2011) result

Result Actual for Non-Farm Employment Change are 120K

The winner of the contest that post the right number is : Ryan

Congratulations!

Work with FBS , be friends with FBS and be successful!

Best Mini Forex Broker 2010 - 2011

Huft.. my guess is not yet goin closer to the fact..

Congratulation to Ryan!

-

Follow us on Facebook and Twitter and add FBS as friend !!!

Facebook

The most large-scale social network Facebook lets you meet activity of the FBS . Communicate, take part in our contests, share your experience with traders from all over the world and have fun.

Twitter

Be hip to the latest news from FBS on-line. Microblogging service Twitter gives you an opportunity not to miss all the innovations from FBS . Follow FBS in Twitter and you will be always the first to know everything.

-

We do appreciate all our clients

-

It is important for us to know all the feedbacks, because we always listen to your advices and recommendations.

-

We want the work with us to bring you maximal satisfaction. That is why we do our best to know your better.

-

We strive to let you know more about our work and give you the possibility to address us in a friendly way. We are always there for you.

-

We will be happy to communicate with you in official pages of FBS in social networks, receive your feedbacks and commentaries in blogs.

-

We offer you to add FBS as Friend in Facebook, follow us in Twitter and participate in our special contests:

-

We do appreciate all our clients

-

-

Representative office of FBS is opened in Shanghai

Dear traders!

We are happy to announce that new representative office is opened in Shanghai. If you are in China you can get all the answers to any questions about your trading in Forex and professional support for your work with FBS. In addition, special educational seminars will be conducted and peculiar promotions will be offered to all the people from China.

FBS continues its active development in Asian countries with opening office in Shanghai. FBS plans to extend its regional expansion and improve trading services.

Trade with FBS and be successful!

All the specialists of new office of FBS in Shanghai are always ready to answer your questions:

+86 21 28909094 or 400 1 200 507 (all the calls are free from China).

You are welcome!

Chinese version of FBS website: FBS Markets Inc. Forex CFD Futures

Congratulation of Chinese trader, the best forex broker is now near you. Congratulation of FBS too..

Have a good day everyone

-

-

Try out FBS Advantages !!!

Open your real account and get a free 5 USD welcome bonus!!!

FBS offers its customers a free opportunity to try out our real account trading! Open your real account and get a free 5 USD welcome bonus!

How to get free 5 USD bonus ? (video Tutorial)

What are you waiting for?

FBS wishes you Finance,Freedom and Success in trading!

(Best mini Forex Broker of 2010 - 2011)

Stay connected with FBS because its all about you!

It's real promo, I've got this promo..

-

-

-

UBS: forecasts for British pound

In the short term the specialists see British pound under pressure versus the greenback as the Bank of England went through additional QE last month.

In the medium term, however, UBS expects demand for sterling increase as the UK will act to reduce its budget shortfall and the declining inflation will make the real rates in Britain higher.

The bank lifted up its 3- and 6-month forecasts for GBP/USD from $1.48 to $1.52 and from $1.62 to $1.65 respectively. The estimates of EUR/GBP future rate were lowered from 0.88 to 0.85 in 3 months and from 0.83 to 0.81 in half a year.

Source: http://www.fbs.com/analytics/news_markets/view/11206

-

Commerzbank: comments on EUR/USD

Technical analysts at Commerzbank note that euro’s decline versus the greenback paused ahead of support provided by the level of 78.6% Fibonacci retracement in the $1.3380/60 area.

The specialists think that EUR/USD will correct upwards rising to $1.3835/80. Then the bank expects the pair to resume decline moving down to $1.3270 (support line) and $1.3145 (October 4 minimum).

Resistance is seen in the $1.4250/85 zone. The long-term target remains at $1.20.

Source: http://www.fbs.com/analytics/news_markets/view/11178

-

Options market expects euro’s slump

Wall Street Journal reports that 1-month risk-reversal indicator, which measures the weight of the bearish options bets on the single currency on the bullish ones, surged to 4 volatility points overcoming the level of 3.5 volatility points where it was seen at the peak of the financial crisis in 2008. That means that investors expect a sharp fall in EUR/USD during the next month.

Analysts at ING underline that rising yields on European bonds stirs up the market’s concerns. Specialists at Brown Brothers Harriman think that euro will react to the growing concerns about France, Belgium, Austria and other core countries that threaten to take the sovereign debt crisis to a new level.

Source: http://www.fbs.com/analytics/news_markets/view/11174

Citigroup: scenarios for US dollar after the Supercommittee

Analysts at Citigroup believe that investors’ attention that so far has been focused on the situation in the euro zone will turn next week to the United States where the so-called Supercommittee which consists of Democrats and Republicans is trying to reach a deal on deficit reduction. The specialists note that according to the survey they have conducted among investors, fewer than 20% of the respondents expect the committee to reach agreement on how to proceed with the cuts. It will be recalled that if the parties fail to agree, the nation will face automatic cuts.

Citigroup economists are more optimistic. In their view, approaching election will urge the lawmakers to compromise. If these projections come true, Australian dollar will be able to make significant advance. Talking into account the fact that trading volumes will likely be small ahead of the Thanksgiving holiday on November 24, the bank thinks that AUD/USD could add 2-3% on the positive outcome.

At the same time, the strategists warn that the odds are that the Supercommittee fails to come up with an agreement are rather high. In such case the greenback will get a 1-2% lift as a safe haven. The biggest gains of US currency will be seen versus euro and Canadian dollar. Specialists at RBC Capital Markets, however, don’t agree with the latter, they think that in the latter case US dollar will weaken as it did in July and August.

Source: http://www.fbs.com/analytics/news_markets/view/11178

-

Analysts are still negative on euro

Spain’s borrowing costs rose to the maximal level since 1997 – the nation’s 10-year bond auction today has fueled concerns about the spreading of the European crisis to France and other core euro zone economies, such as the Netherlands and Finland.

Short-term forecasts

Morgan Stanley: negative outlook for the single currency. The specialists advise to sell euro targeting $1.31 lowering stops to $1.3580.

UBS: if EUR/USD breaks below support at $1.3406, it will begin declining to $1.3346.

Middle-term forecasts

Nomura: euro will slip to $1.30 by the end of the year, so it’s recommended to sell EUR/SUD.

Brown Brothers Harriman: the pair will finish 2011 at $1.29.

Mizuho Corporate Bank: euro will fall to $1.30 by the year-end, trading will be very volatile.

Citigroup: EUR/USD will decline to $1.31 by the end of 2011 and to $1.25 in the first half of 2012.

Source: http://www.fbs.com/analytics/news_markets/view/11168

-

Wells Fargo: negative forecast for EUR/USD

Analysts at Wells Fargo are bearish on the prospects of the single currency versus the greenback during the next 12 months. The specialists believe that euro will be affected by the increasing borrowing costs for the peripheral euro area nations and the risk of recession in the region.

According to the bank, EUR/USD will fall to $1.3000 in 3 months, to $1.2800 in 6 months and to $1.2600 in 9 months and hit $1.2400 in November 2012.

Source: http://www.fbs.com/analytics/news_markets/view/11144

HSBC, Rabobank on the factors influencing EUR/USD

Analysts at HSBC claim that the fair value of the European currency is in the $1.20/$1.30 area. However, even despite the escalating crisis euro keeps trading above these levels. The specialists see 2 reasons for that.

Firstly, euro is supported by monetary inflows even though some of them are the result of European banks bringing capital home in an effort to defend themselves against possible losses on their holdings of euro-zone bonds. The current account of the euro area as a whole is almost balanced and there are positive portfolio and merger and acquisition inflows.

Secondly, as the consequences of the currency union’s break up are expected to be terrible, investors are betting that the policy makers will find a way to save the bloc. In addition, there is also a chance that the member nations will move to closer fiscal coordination.

Analysts at Rabobank add that much may be explained by the weakness of US dollar which showed the worst performance among the other major this year but has regained some safe haven status because of the European turmoil. At the same time, there are pairs with much stronger downtrend for the common currency: EUR/JPY fell from April maximum at 123.32 yen to the levels in the 103 yen area.

Source: http://www.fbs.com/analytics/news_markets/view/11152

-

Euro area: political situation

Italy

New Italian Prime Minister-designate Mario struggles to get political parties to agree to take part in his technocratic Cabinet as it would be hard for the government without political representation to pass unpopular laws through the government.

Monti has to convince investors that the nation is able to reduce its 1.9 trillion debt ($2.6 trillion) and stimulate economic growth which was below euro area average during the last decade.

Greece

New Greek Prime Minister Lucas Papademos underlined that the country’s future is in the euro area. According to Papademos, the membership in the currency union guarantees Greece “monetary stability and creates the right conditions for sustainable growth”, reports Bloomberg.

The new government formed on November 11 has to implement budget measures necessary to obtain the second bailout package of 130 billion euro ($177 billion) adopted on October 26 and conduct a voluntary debt swap by the end of February.

For now the main goal is to secure the payment of an 8 billion-euro tranche of the first bailout program. In order to avoid default Greece needs this money before the middle of December.

The EU waits for all Greek parties to give written commitment to structural reforms and austerity measures. So far opposition leader Samaras has been declining to do that.

Germany

German Finance Minister Wolfgang Schaeuble said that Merkel’s government wants Greece to remain a member of the European Monetary Union. At the same time, Christian Democratic Union party led by the Chancellor voted to allow euro states to quit the currency area.

Source: http://www.fbs.com/analytics/news_markets/view/11137

-

FBS Corporate info

FBS is an international brokerage house providing top quality financial and investment services all over the world. Our aim is to develop and implement top-notch technologies and service level standards that would satisfy needs of the most demanding investor. We base our work on transparency, honesty and professionalism. Our dedicated team of highly educated and experienced professionals constantly works on the development and enhancement of FBS services.

Whenever you have questions please contact our 24-hrs Clients’ Support Center and our staff will be glad to answer any of your questions and inquiries.

Missions and statement

What makes FBS different from rivals - is our devotion to the business and industry we all work in. FBS is the first customer-oriented brokerage in the world. Our mission is to provide the highest service level, set the highest goals and reach them. We are enhancing our services every day and satisfy the needs and concerns of our customers. In today's rapidly evolving world this is the only right strategy to develop the business and provide services.

-

Let us remind you for Pre-registration <<999>> Demo Contest.

The contest will take place during 23.11.11-23.12.11

Pre-registration for the contest will be open since 07.11.11 till 22.11.11.

Contest rules

* A contestant can have only one contest account

* To take part in the contest, please follow this link

* Initial contest account deposit is 9999 USD

* Contest account leverage is 1:100

* It is prohibited to open or set any orders on the contest account before and after the contest. In case there are any opened positions on the demo account before the contest – they will be automatically closed.

* It is prohibited to use the same IP address on 2 different contest accounts. In case IP match is detected both accounts will be disqualified.

* It is prohibited to work via proxies or any other software modifying the real IP address.

* Logins and passwords for contest demo accounts lost by the participants can not be restored

* The prizes are paid to the contestants’ real account and are withdrawable. Each contestant must have a real account in order to take part in the contest.

* Any Contest Rules violation is a subject to disqualification

* In case a participant provides intentionally false registration data, the contest account will be disqualified and no prizes will be paid. FBS reserves a right to demand real account authorization BEFORE paying the prizes.

* If there are 2 or more winners in the contest, they will share the prize equally

* A contestant can win (1st,2nd or 3rd prizes) only once. If a he/she becomes a winner again, only 10% of the prize is paid to him/her.

* In case the prize funds are used for real trading, the limit of withdrawable profit from an account is 300% of the prize (including the prize funds).

* The contest will be started with no less than 50 participants

FBS - FBS.COM

in Forex Brokers

Posted

Wow wow wow two thumbs up to FBS if it come true..