Exchange Blog Cryptocurrency Blog

-

Posts

71 -

Joined

-

Last visited

Posts posted by asiaforexmentor

-

-

Forex Secret Trading: The Super Power Forex Trading Secrets.

FOREX SECRET TRADING.

A lot of new traders are always looking for forex secrets | forex secret trading | forex trading secrets.

They always think that there must be a secret out there which they do not know of.

True enough, the so called “Forex Secret” lies in the forex trading system.

But that’s not the topic i’m going to touch on today.

Today i’m going to touch on a “Forex Secret Trading Strategy”.

This forex secret trading strategy or should i say: Price action setup is one of my most reliable and delivers great consistent result.

Forex Secret Trading: The Super Power Forex Trading Secrets

As seen in the chart above (highlighted blue box)

It’s a Double Pin Bar.

If you already know. A price action single pin bar is already powerful enough.

But when it forms a double pin bar. Bang!

The magic happens.

And in combination with the direction of the trend. (Very Important)

As you can see in the chart above, its currently in a down trend.

=

PROFITS

Forex Secret Trading: The Super Power Forex Trading Secrets

The double pin bar is a very powerful entry signal.

And of course when combine with confluence – It increases the winning probability.

I can totally rely on this price action setup alone and make good profits every month.

This is one of my Forex Secret Trading Strategy which i really like.

Go ahead and play around with it.

Check out our online forex trading AFM winning Forex Price Action Forex Course where i teach you the exact FULL Forex Trading Strategies | system (Forex Secret Trading Strategies) that i personally use to be consistently profitable.

See you on the other side my friend,

Ezekiel Chew

-

Price Action – Double Pin Bar

Forex Trading : Usd Cad h4

One pin bar right after the after pin bar. This is in confluence with the 365 moving average.

If you missed the first pin bar, you should have seen the 2nd one.

Price is giving you a second chance to get into the move. It is already gearing up.

Bang! Off it went. How could we had missed it?

And if we looked further for more confirmation and confluence.

Lets look at the 1hr chart

Need we say more? Price is also meeting resistance at the 150 and the 200 moving average. This coincides with the same level of the 4hour 365 moving average.

How can we not win on these kind of trades, if there is a holy grail. This is it!

Ezekiel Chew

-

Forex Trading – Gaps

Gaps happen when the forex market closes and the forex market have some movements before the market opens.

When the gap forms, What will they happen.

If you had read out previous post about gaps.

It will come as no surprise to you.

Ans: Gaps usually closes. The market will usually close back the gap that is formed.

There are plently of gaps the formed when monday opened, such a wonderful thing.

Got quite a number of pips just by closing the gaps.

These 2 charts are some of the example of the gaps these week, but there were plenty besides these 2.

Ezekiel Chew

-

Forex trading strategies – Should we or should we not take this trade?

Today’s post is one of the forex trading questions that i got over the weekend which i thought would be helpful to share

Question:

I spotted a pin bar pointing down with the 150ema supporting the

cadjpy. The daily chart seem to be heading down but the weekly chart seem to be going

up. In these case, is it safe to sell as the day seems to be heading down

although the weekly still seems to be pointing up?

My Reply:

No, when i trade the daily forex chart, i will make sure the daily and the weekly are

in the same side of the trend.

Although its a price action pin bar off the 150, but the pin bar looks too small to

take away the strength of the uptrend. I may be wrong on this, but given the

small pin and the weekly uptrend. i will skip this trade.

Forex Trading Strategies – Here’s the recent Forex chart update on CadJpy

Follow up:

True enough, the price action pin bar failed to take price down and its stoploss was triggered. Had we placed our stoploss at the top of the pin, we would have gotten stop out.

Take away Tip:

Pin bars happen & form all the time, it is by picking the right ones to trade in. There are several criterias which we use to call for a good trade and that is taught in our Winning Asia Forex Mentor Price Action Forex Course.

Ezekiel Chew

-

How do you trade the news in forex trading?

A lot of people have been asking on how to trade the news.

although i strongly do not recommend just trading based on news only, but here’s some pointer.

1. News are categorised into the level of impact. low, medium, high

just like the word high, high impact news can change the trend of the market. changing a downtrend into an uptrend and vice versa.

some medium impact news do have such capability too.

2. watch out for the upcoming important news weekly and daily.

and note which pair will the news affect.

3. if you are in a position and there will be an upcoming high impact news in 2hrs time.

take either half your profits first as the market will start going frenzy usually 2hrs before the news. shift your stoploss to breakeven. this way, if you are going long and the news impact reversed the market, you still got half your profits and broke even on the other half.

4. if you are not already in position before the news. wait for 10 mins after the news is out before entering. as in the first 10 mins, you will see price go spiking around and it happens alot of time when once the news is out, price goes spiking up real fast. you will be there thinking if you don’t catch the boat now, you are going to miss a hell lots of pips. and when you got in at the high, price went spiking even faster downwards. what the..?!

did this happen before to you? Don’t worry,it happens to every one.

this is how the market works.

one reason is that when the news is out, major players throw in a sum of money enough to move the market up. when people sees the market moving up, they jump in to push it even higher as they went in with the ‘fake’ movement. the major players then wait for price to go up high enough and then they step in to throw in large influx of money to short it. gaining great amount of pips in a short period of time. i know this happens, and it happens a lot of times.

the other reason is that, the market is based on sentiments. even though the news is positive, and people start buying it long. making the market move up. but if the general market feel that the news is not as good as expected or for some other reason. the big players and professional traders will start shorting it. leaving the losses to those who just traded on positive news.

therefore, one way to go around it is to wait for 10 mins after the news is out to evaluate the REAL market movement before entering.

but as always, i highly recommend adding price action confirmation to it. then you have a high probability winner.

i hope this article helps and leave me a comment to let me know how you feel or any additional input you would like to add are welcome.

Ezekiel Chew

-

Forex Trading Psychology: Levels of FEAR

FOREX TRADING PSYCHOLOGY

People can always relate FEAR to forex trading.

The fear of losing money.

The fear of losing that trade which is too much for you to handle.

However what most people do not realise is that there are different levels of fear.

Eg.

When you can afford to lose that trade, (which you still do feel fear)

you are still able to think rationally and life goes on.

(ALTHOUGH YOU STILL DO NOT WANT TO LOSE THAT TRADE)

In the example above, fear is definitely in our emotions.

But because the level of fear is low, we are able to handle the fear and still think rationally.

HOWEVER,

Eg. your forex trading capital is $10k.

Your current open trade is now losing -$5000.

And that’s half of your capital.

Or worst to say, that’s half of your life asset. (Money you can’t afford to lose)

Forex Trading Psychology – Fear kicks in. (This time in higher dosage)

Then you start seeing your open trade grows to negative -$6000.

Your Fear level increases, you can feel your heart beat racing.

And sure enough, your worst fear arrived,

The trade increases to negative -$7000.

Forex Trading Psychology: Levels of FEAR

Your level of fear had reached its final peak level.

(you know it when you feel):

- Desperation

- Your face turn black

- You isolate yourself

- You start blaming people, things, events

- You pray

When you feel this level of highest fear.

You can’t think rationally any more.

You know that you can’t think rationally any more when:

- You have decided to increase lot size on your next trade

- OR You decided to go ALL IN on the next trade

You want to get revenge on the market.

You now feel HATE and ANGER.

Forex Trading Psychology: Levels of FEAR

And sure enough, when you start to do things irrationally.

That is the downfall of your trading career.

So you see, there are different levels of fear.

And the highest fear can lead to other emotions like ANGER & HATE.

When you start to do all the above.

You know you have reached your highest level of fear.

It is time to stop trading for a while.

Go get a rest, a shower, a walk.

When you feel that you have calm down and begin to accept things.

I want you to think of what went wrong. (not to blame others)

but what mistake did you made in the trade.

Good chance is that you are risking too much.

And i want you to WAIT and NOT trade until your feeling of hatred, anger and revenge is gone.

That is when you are able to think rationally and go back to fix the problem.

Remember, forex is a journey and not a one time success.

Most traders want to make big bucks in a few trade. But eventually lose it all.

Professional full time traders are ones who trade consistently and happy with reasonable profits.

Let me know if you had experience the above before and what you did, or what happen?

Ezekiel Chew

-

3

3

-

-

Follow up on previous post “How to take this Price Action Pin Bar”

Follow up:

As we had set the pending buy order at the top of the pin bar (marked by the orange line)

Our buy order got triggered by the 2nd bar after the pin.

Our take profit would be the previous high (marked by the turquoise line) and we have gotten our full profits.

Risk reward 1:1.5

Thats not too bad.

As you can see, by just a simple method of placing a pending order instead of entering right at the close of the pin bar.

1) we did not get our stoploss triggered and instead taken full profits.

This is a simple way of looking at how we trade, Check out our Winning Asia Forex Mentor Price Action Forex Course where i teach you the exact FULL Forex Trading Systems that i personally use.

See you on the other side my friend,

Ezekiel Chew

-

i don't think so , that it should be taught in university . it is useful for those who want to build their career in forex trading.

-

Forex Trading Course – How to take this Price Action Pin Bar

Forex trading pair: Gold (Xau usd)

A forex price action pin bar formed as showed in the blue highlighted box.

Lets Analyze this price action pin bar:

1) Pin bar formed off the 25 moving average (yellow line)

2) Pin bar protrudes out from surrounding prices. But the nose could be longer.

3) The past few bars before the pin were all bearish bars. Which would make me doubt on whether the small pin has the strength to take on the previous bearish bars

4) The over trend is in an uptrend

Forex Trading Course – How to take this Price Action Pin Bar

So this is a retracement pin bar. To play this pair, i would have placed a pending buy order on the break of the pin. (marked by the dotted orange line)

Stoploss would be below the pin (marked by the dotted red line)

As we can see the next bar would have triggered our stoploss had we entered the trade right at the close of the pin.

This is the power of pending orders.

So by placing pending orders in such a scenario. We would not miss out on trades that go our way, and we will miss taking trades that didn’t go our way.

As always – Trade with a plan and if there isn’t a plan. Skip the trade.

Ezekiel Chew

-

Forex Trading System – Damn i just missed this trade!

FOREX TRADING SYSTEM

It was just yesterday when i was watching this trade and intended to enter it long.

I was just waiting for the bar to close in around 5 mins time.

However, nature calls! Damn i had this terrible tummyache that needed immediate release. lol.

so off i went. (you do not want to hear the story in the toilet)

When i was back around 10 mins later.

Bang! The trade i wanted to enter shot right up.

It would have been a great profit.

Forex Trading System – Damn i just missed this trade!

Have you had similar experience happen to you before?

Where you wanted to enter a trade and for certain reasons you didn’t. And then it shot right to your direction you wanted.

Yes?

Yes! This happens and will still continue to happen.

However, it is really such a normal thing that comes once in a while that you should not take this “Missed Profits” to heart.

I know some traders really take this badly and they will like “ooohh. it ruin my day, that would have been this much profit” And they will start swearing..

Please don’t do that.

Forex Trading System – Damn i just missed this trade!

This is part and parcel of forex trading.

You win some, you lose some and you miss some.

Take it with a pinch of salt.

Because you know that if you can spot that trade, you will spot others too.

This stuffs still happens to me and i’m immune to it.

You should never take any wins too happily, any losses too seriously and any misses too hardly.

When you are trading forex.

You are like someone who have put on a bulletproof vest.

Impenetrable! (in terms of emotions)

Ezekiel Chew

-

Forex trading strategies:SOMETHING THAT I HAVE BEEN FOR YEARS IN FOREX TRADING.

I would like to share with you guys a “secret” which is not. =)

By just entering on the arrows shown, we have no surprise on where to enter and where to take profit.

If we miss to enter at the peak on the 2nd arrow, we would also have entered on the price action bar: pin bar

These are knowledge to let you know that price is heading down – to: our low of the consolidated box

This is something i have been doing all these years, these are my daily incomes. And they are GOOD incomes!

Ezekiel Chew

-

Are we just plain scared to trade the lower time frames in forex trading?

Are we just plain scared?

Here’s the fact:

Most of the full time forex traders out that trade the HIGHER Time Frame.

Not the 1min, the 5 min, the 15min or the 30min.

Most people have the misconceptions that to be successful in forex, the trader must trade the lower time frame.

Hell NO!

In fact its the newbies that trade the lower time frame and the professionals that trade the higher time frame! lol..

New guys who enter the forex market thinking that they could make a killing in it within minutes. But to realise that it is not as easy as it seems yea?!

Like every pair, the lower the time frame, the higher the volatility.

Now with that kind of volatility, it really takes years of experience to do those shit.

If one started off with the 5 min chart, i can’t tell you how many times will his/her account blow before they even realised what hit them.

Start off with the higher time frame Eg. the daily chart. Which has way lower volatility than the 5 min chart.

If one cannot even conquer the daily chart, what makes them think they can conquer the 5 min chart?

And now for those who had mastered the daily chart, the pips are good, the lifestyle is good as little screen time is needed.

Do you think they will crack their brain cells to go down the 5 min time frame?

Forex Trading is like a GAME.

Higher time frame = Easy Mode

Lower the time frame = Difficulty level increases.

But here’s the catch, there’s no reward for playing the Difficult mode compared to the Easy mode.

The profits you get will NOT be higher. But your white hair will grow faster due to the high speed stress and reaction involved in the lower time frame.

So Now Its your choice to choose the Difficulty level in playing the Forex Game…

Talk soon,

Ezekiel Chew

-

Forex Trading Strategies – How to be consistently profitable in forex trading

FOREX TRADING STRATEGIES

I always get the same questions from forex traders around the world:

“Ezekiel, I can’t seem to be consistently profitable in forex trading”

then they may follow on by “I know my forex trading strategy works.. but i just can’t get profits month after month..”

These are the questions that i get frequently. And this is my general answer to them.

I will usually ask them back:

“So, are you keeping track of your trades?”

You see, to be consistently profitable. You cannot forgo this important step.

That is TRACKING.

All successful businessman tracks their own and their company’s performance.

This also applies to successful forex traders.

You must have a proper and systematic way to track your trades and your success.

So that you can see if you are on the right track to success or if you are not even on the track..

Forex Trading Strategies – How to be consistently profitable in forex trading

Here are some simple ways to track your forex trades:

Firstly, you have to just focus on just 1 forex trading strategy at 1 time.

You cannot trade different forex trading strategies together at 1 time, at 1 account.

If you do that -

My question to you is:

How do you know which forex trading strategy is working for you? And which is not working?

Therefore, start trading 1 strategy at 1 time.

Be specific on the strategy and do not deviate or change random stuffs.

Eg. changing the way you enter, exit trades etc.

It has to be consistent all the way.

So run this strategy trades for 20 trades.

At the end of the test, what is your account status?

Are you profitable, breakeven or negative?

Then ask yourself, did you change anything along the way, among the different trades?

eg. the lot size is different, or you should not have entered a certain trade, but you entered anyway.

If there is a deviation – a change,

then you have to restart the entire test.

By using this method of tracking, you will be able to clearly see whether the forex trading strategy you are using is working for you.

Forex Trading Strategies – How to be consistently profitable in forex trading

Besides, i will recommend you to take screen shots of the trades you entered.

This way, you can review all the 20 trades you have entered once the test is completed.

And you can clearly see what are the mistakes you have made on some trades and what are the things you did right on certain forex trades.

This method will prevent you from repeating the same mistakes again.

Ezekiel Chew

-

Forex Trading Is Like stacking a Pack of Cards.

Have you ever tried stacking a pile of cards? If you haven’t perhaps you should try it now.

Placing every piece of card, trying to find the precise angle, and with a calm collected touch is the key to building your stack of cards.

First you must have a solid and stable ground

Next you must have got the surroundings covered. No open windows – in case the wind blows, no direct fan blowing at you. etc

Whilst placing that card, you must keep all distractions at bay.

With a cool & calm collected mind, you will be playing it off better than someone who is anxious and excited.

Now while you have built your first layer of cards, you begin to gain confidence. Confidence is good, it shows that whatever you have been doing all this while is working.

However, confidence usually leads to being conceited. And that’s when the trouble begins.

As you begin to feel conceited and feel that this is easy stuff. You tend not to disregard the basis you have put in at the start that had built your base (first layer).

You begin placing the cards faster, with lesser precision and with a conceited heart. No longer calm & compose as you feel that this is a piece of cake and you are able to get the stack of cards growing faster than it should.

You lose the consistency that brought you this far, and with one slight wrong movement.

- Be it the lack of precision – placing it at the wrong angle.

- The lack of planning, without looking at the overall stack to see if the fundamentals are firm enough.

- The speed of the anxious & conceited hand that placed the card.

You let distractions come to you because you thought you had it already.

You let the wind in because you thought it wouldn’t matter.

If either one of the above happens, with one wrong move. You would have caused your whole stack of cards to tumble and fall.

Do the above scenarios sound familiar?

This is the same thing that happens to most traders. Traders always forget what got them winning in the first place. They let the same things to happen to them which eventually caused them to lose it all. Even their initial capital.

Here’s how it relates.

Be it the lack of precision – placing it at the wrong angle.

- In forex trading: It could be entering the trade just based on gut feel, no price action confirmation, trading against the main trend.

The lack of planning – without looking at the overall stack to see if the fundamentals are firm enough.

- In forex trading: Lack of planning would refer to not planning your stop loss, target profit, money management and risk reward ratio.

The speed of the anxious & conceited hand that placed the card.

- In forex trading: It refers to trading psychology and emotions. That’s the key component that caused majority of traders to fail. Greed, fear of loss, getting revenge on the market, afraid of missing a good trade. All this will blind the judgment of a proper trade least say a good trade.

You let distractions come to you because you thought you had it already.

- In forex trading: You let lose of your sight on goal, you bit the hand that had feed you. You begin concentrating on other things – other than forex. You begin boasting on how good you are. You watch the tv while placing a trade. Etc.

Remember: Successful forex trading is mastering all of the above. Its about being consistent on all trades, and not to forget the fundamentals that got you going.

Look forward to seeing you in our group,

Ezekiel

-

Forex Trading Strategies – How I Turned a Losing Trade to a Winning Trade.

Forex trading pair: GOLD = XAU USD

This is an interesting trade on the forex pair XAU USD.

In the chart above, we see a series of forex price action inside bars. (Highlighted in the blue box)

Meaning bars that are smaller than the previous bars.

When a series of inside bars like the above happen.

It means that price is having an indecision of where to go.

It’s like it is gathering momentum, for a burst out of either side.

Which could either be up or down.

So what happened in this scenario is that we placed 2 pending orders. A buy and a sell.

These 2 orders are marked by the gold line (entry) and the red line (stoploss).

So the buy order triggered. (Gold line -Entry) and we got in on a buy trade.

With that, i took away the pending order for the sell trade and made it a stoploss for the buy order.

Forex Trading Strategies – How I Turned a Losing Trade to a Winning Trade

When i trade, i would usually have 2 take profit targets.

So that when take profit 1 is hit. Which is marked by the purple line. I would have taken my first profit off and shifted my stoploss for position 2 to break even.

By doing so, i am also on the “SAFE” side. As price may hit Take profit 1 and reverse back down.

And as i have taken profit a TP1, my 2nd position’s stoploss is shifted to breakeven.

So i am in a FREE trade.

So whether or not it may hit TP2. I have already gotten profits.

In this scenario, i have taken profit at TP1 and my 2nd position has hit my stoploss for breakeven.

So i’m out for this trade.

From this scenario you can see that i am not always perfect.

No one is.

By trading on the above method, we are sure that our account size will grow consistently.

Forex Trading Strategies – How I Turned a Losing Trade to a Winning Trade

Lets look at what happen next.

Price went right down after which.

So if i hadn’t had a TP 1 and TP2 method.

I would have kept my stop loss at the red line.

And made a loss on this trade.

BUT By doing playing the above method.

Instead i have gotten profits..

I hope you gain something from this post. Let me know if you did.

Ezekiel Chew

-

Forex Breakout Strategy: Simple Trade, Simple Profits.

FOREX BREAKOUT STRATEGY

Forex Pair: Usd Chf

In Forex trading, there are various forex trading strategies.

I would like to show you a forex breakout strategy as shown in the chart above.

It is simple yet highly powerful.

In the chart above, we see a series of bearish bars (red bars) -> marked by the yellow arrow pointing down at the top of the

picture.

This series of price action bearish bars represent the selling momentum in the market. And the selling is gaining momentum

with the increasing number of bearish bars.

Therefore, we will be watching the chart for a chance to trade it down, considering that the trend MAY have change from an

uptrend to a downtrend.

Forex Breakout Strategy: Simple Trade, Simple Profits

Soon after, it formed a big long price action bearish outside bar as marked by the yellow circle.

(This confirms the downtrend as it has broken the previous lows of the previous uptrend)

With the big long price action bearish outside bar, and the previous series of bearish bars.

- It confirms the selling momentum in the market is very strong.

Immediately after the bearish outside bar, it forms 2 smaller inside bars after which.

Forex Breakout Strategy: Simple Trade, Simple Profits

What i see here is a setup for a forex breakout strategy trade.

- Since the selling momentum is so strong, and with a price action bearish outside bar. We can place a pending sell order

below the bar.

Therefore, i will place a pending sell order as marked by the yellow dotted line.

And my stop loss is above the previous bars opening and closing. (marked by the orange line SL)

Our First take profit target will be the previous low (marked by the orange line TP1)

And our final take profit target will be at the next low (marked by the orange line TP2), which also coincides with our 150

ema.

Forex Breakout Strategy: Simple Trade, Simple Profits

Forex Breakout Strategy

Pls read through the explaination while looking a the charts for at least 2 times to fully understand what i meant.

I hope you’ve learnt how i would have entered on the above situation (forex breakout strategy) and how you can add this

method to your future trading methods.

Do sign up above for our newsletter if you have not done so already as i will update you via email constantly with new forex

trading strategies.

Ezekiel Chew

-

Learn FX Trading -> Your Forex Work Station

Many fx traders are always busy finding the holy grail. Largely because they are still not making money in forex trading.

Or to put it blatantly, they are losing money!

So they push it all to failing to find the right forex trading strategy / forex trading system.

It may be true.

But they probably also missed out a seemingly unimportant factor.

Their work station.

When i first started trading, of course i didn’t had my own study/work room.

I had my television, computer, bed, snacks .. everything in the same room.

So as you can see.

The ENVIRONMENT is already not right for trading/ working / studying..

Learn FX Trading -> Your Forex Work Station

Learn Fx Trading

I used to always had my television on at the same time whilst my trading.

There were so many distractions in place.

I could not really focus on trading nor being able to detect what went wrong in my trading.

Is it because of my emotions?

Is it because i neglected a certain point in my forex trading strategy?

How can i tweak my trading to better?

All i did was to trade and trade and trade.

And i did not had the time, nor the energy to focus on what was going wrong.

So this seemingly small issue: My work station

Is actually an important issue that one needs to address.

We need to have a CLEAR, UNCLUTTERED WORK STATION.

With Little Distractions.

Learn FX Trading -> Your Forex Work Station

LEARN FX TRADING

Preferably – You have a room solely for working / trading.

You then will need to have a good solid working chair. (arm chair) – Well, you are going to sit on that chair all day long, shouldn’t you have a proper chair so that your posture & comfort is not an issue in the long run?

You need not have tons of multiple monitors. Depending on your forex trading strategy. Usually 2 – 3 monitors is more than enough.

You make it clear to yourself that when you are in the working room, you work, you trade, and you do not do other crappy useless stuffs that will practically waste your time away. eg. surfing through facebook

You are ALWAYS THINKING! ( I can’t stress how important this is, probably i will write an article on this topic alone)

One of the major factor that attribute to my success is that i am ALWAYS THINKING.

I am always thinking how to make things right, make things better.

I am always thinking of new ideas, rationalizing them.

And eventually putting them into action.

So guys, if you take my word for it.

Starting revamping your workstation now!

You will see the difference!

Ezekiel Chew

-

i can just LOL on that post.

-

Price Action Forex – Why Forex Trading is Easy with Price Action?

There are many answers to why PRICE ACTION is king in forex trading.

And why price action in fact is the easiest to trade with in forex trading.

Let me give you an easy explanation with the chart above.

In the pair above: Eur Gbp

It shows the pair in an uptrend.

And if we look into the pair, we can easily spot 5 price action entries for us to ride the trend and to profit on.

Price Action Forex – Why Forex Trading is Easy with Price Action?

Price action (blue box no. 1)

It is a pin bar as well as an bullish outside bar (in combination with the bar on the left hand side)

It is a good indicator for us to take it long with a buy order.

Price action (blue box no. 2)

It is another pin bar for us to enter a buy order had we missed the first pin bar.

This is also a confirmation pin bar to tell us that the trend is indeed going up.

So off it went…

Price action (blue box no. 3)

It forms a bullish outside bar. Look at the long green bullish bar wrapping the previous smaller bar.

Another good price action bar to tell us to take it long.

And so it went further…

Price action (blue box no. 4)

Price move sideways and to form another bullish outside bar.

This bullish outside bar indicates that price is possibly going to breakup from it’s sideways trend.

And so it did.

Price action (blue box no. 5)

Price went sideways again to form another price action pin bar.

Another indicator to state that it is going to breakup from it’s sideways trend to move further up.

Price Action Forex – Why Forex Trading is Easy with Price Action?

So you see, in just a pair. We can spot so many price action bars for us to take an entry long.

The trick towards trading price action is simple.

We usually take price action bars that is together with the trend.

So in this scenario, the pair is in an uptrend.

Therefore we only take price action bars that is going up.

If you look into the chart, you will see price action bars that points down.

Those are reversal bars. And we usually skip them. (unless you have enough experience, stay away from reversal price action bars)

And you will be glad you stayed away from them as you see, most of the reversal bars did not work out.

Price Action Forex – Why Forex Trading is Easy with Price Action?

So you see, forex trading is not difficult with price action.

The power of price action, in combination with a proper forex trading system, trading psychology & money management = Consistent Profits

Ezekiel Chew

-

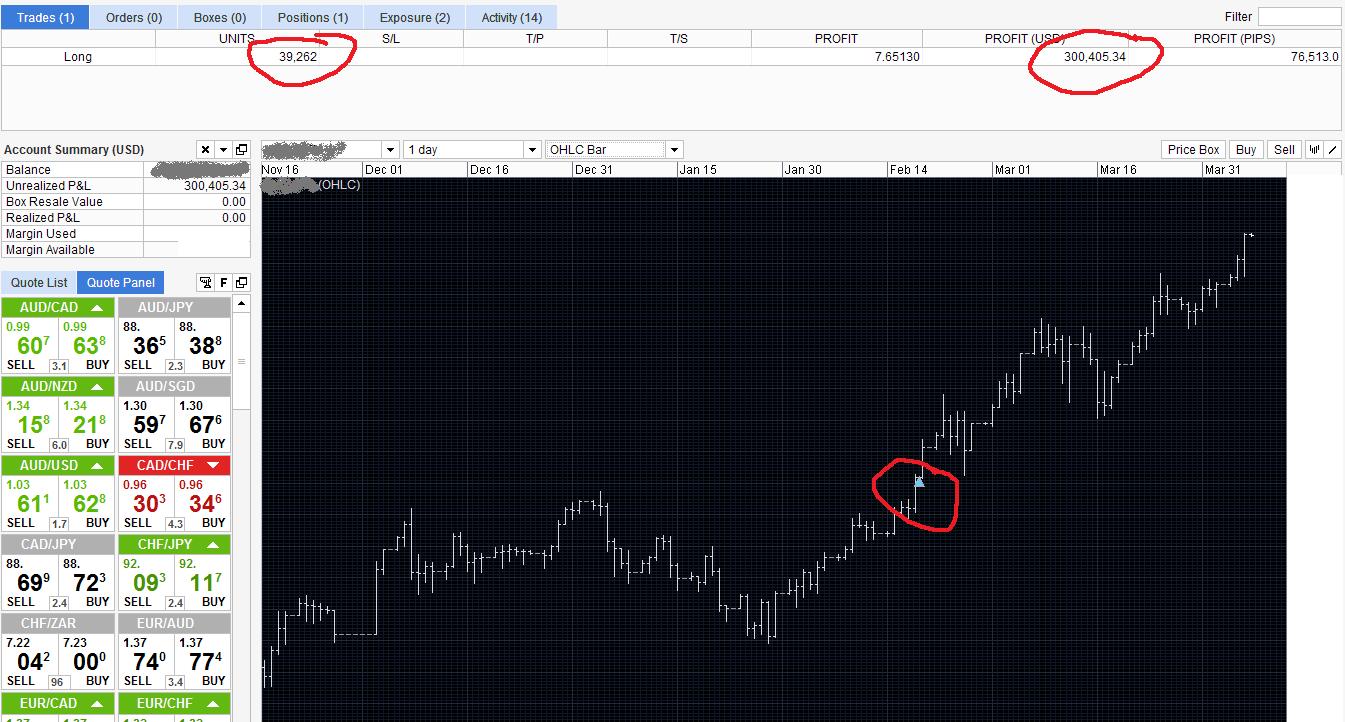

A CRAZY FOREX TRADE I TOOK RECENTLY – 950% GROWTH IN 2 WEEKS

FREAKING 950% GROWTH IN 2 WEEKS!

This is one of the fantastic forex trades that i took recently.

Capital Risked for the trade $24k

Profits to date $190K!

950% Growth in 2 WEEKS and GROWING!

This is one of the reasons why i LOVE forex trading so much.

A downpayment for another house? a flashy car? or a good meal with the family and friends

I’ll be keeping the trade and trailing it to see if i could make a million dollars out of this single trade.

Just a crazy thought, but a nice one!

And if there is the last bit of thing that you need to give you a kick in the butt for you to enter forex trading, i hope this is it!

I’m not implementing that forex is a get rich quick scheme.

I’m not implementing that forex is a get rich quick scheme.

but if you know the how’s, it is very much possible and realistic.

Follow up: One Month Later

Alot of guys has been asking me on how’s the progress or result of the trade that i took.

So the a month later from my last post,

My Profits has grown to: $300K

Capital Risked: $24k

$300k – $190k = $110k for a single trade in a month. Thats not too bad.

Still trailing to see if i can make a million dollars out of this single trade. LOL!

I looking forward to seeing you in our group where i teach the full forex system that made it possible -

AFM Winning Forex Course

See you on the other side my friend,

Asia Forex Mentor

Ezekiel Chew

Asia #1 Forex Mentor

www.asiaforexmentor.com

-

The Forex: Gold Rises As Fed Extends Its Plan To Keep Interest Rates Low

THE FOREX

In the forex market, American dollar gained again the euro after mixed economic data. According to Commerce Department data, bookings for long-lasting goods advanced 3% after rising 4.3% the prior month, this is the biggest back-to-back gains in almost a year. Figures from the Commerce Department showed Purchases of single-family properties decreased 2.2% from the prior month to a 307,000 annual pace. Latest report released by Conference Board indicates that the U.S. economy will keep growing, the index of leading indicators rose 0.4%. Data from the Labor Department showed jobless claims rose by 21,000 to 377,000. Even though there are some improvements, the Federal Reserve is still cautious. In its latest statement the Fed said “Strains in global financial markets continue to pose significant downside risks to the economic outlook”.

The Forex: Gold Rises As Fed Extends Its Plan To Keep Interest Rates Low

THE FOREX market investors shifted their interest to safer assets. Uncertainties in the global economy have been increasing the demand for gold. The commodity currencies have been getting stronger as well. The day after the Federal Reserve’s announcement, gold jumped to its biggest one-day rise in three months. Gold prices are also getting support from options traders. Meanwhile, A poll carried out by Reuters showed most of the economists expect gold to continue its bull run in 2012. Commerzbank analyst Daniel Briesemann said “At the moment everything points to even higher prices, given the strong risk appetite, the better mood among market players, the strong equity markets and the weak dollar”. Analyst at Barclays Capital, Suki Cooper said “Coupled with continued central bank appetite for gold, the broader macro backdrop remains conducive for gold price gains, given negative real interest rates, concerns over longer-term inflationary pressures and uncertainty surrounding the financial markets and economic outlook”.

The Forex: Gold Rises As Fed Extends Its Plan To Keep Interest Rates Low

As fears mount that the eurozone debt crisis could trigger a global recession, all eyes are on Germany to take an even stronger lead in the rescue efforts. European leaders and the International Monetary Fund want Germany to increase its contribution to the European Stability Mechanism. But lately German Chancellor Angela Merkel disappointed these expectations. Neither eurobonds nor more stimuli that would see the ECB print more money are acceptable options for Germany. The forex market investors think the problem is that the austerity that Germany wants will push Europe into a deflationary death spiral, then the EU economy will contract and tax revenues will fall.

The Forex: Gold Rises As Fed Extends Its Plan To Keep Interest Rates Low

By gaining direction from the fundamentals in the economy allows us to enter trades with a solid understanding.

Gold in the forex market is known as XAUUSD.

It is paired with the USD. Therefore when the US release such news in regards to it’s interest rates. We can expect pairs that is paired with the USD to rise. Especially GOLD.

Ezekiel Chew

Asia #1 Forex Mentor

www.asiaforexmentor.com

-

FOREX TRADING: IMPORTANCE OF STOP LOSS PLACEMENT

A lot of traders do not believe in stop loss placement.

Some believe in mental stop loss placement. meaning that when they feel that a trade is not going their way, they will then cut it off.

That is so terribly wrong. Stop loss placement is one of the most crucial key if you want to make forex trading profitable.

Another mistake traders make is that they shift their stop loss. They shift it backwards, thinking that the trade will just go back a little more and will come back their way. And sure enough, most of the time, they took more losses than they would have if they stayed on their initial stop loss.

In the chart above, is an example of the importance of stop loss placement.

Usd chf h4

In the highlighted box, thats a pin bar. When some guys see this pin, they will naturally take it down and the ideal place for their stop loss is the horizontal line in orange that is drawn.

Scenario A) if the trader did not place a stop loss, or a mental stop loss – look at how high the usd chf pair went upwards. Their account will be blown or had a huge huge loss.

Scenario

Trader shifted their stop loss backwards from the initial orange line thinking that the trade will go back down. They would have taken a huge loss as the move went up terribly fast and would have gotten a big blow to their account

Trader shifted their stop loss backwards from the initial orange line thinking that the trade will go back down. They would have taken a huge loss as the move went up terribly fast and would have gotten a big blow to their accountScenario C) Trader sticked to their initial stop loss, they would have just gotten a standard loss of the % risked in their account, based on their money management. And this is just one of the trades among the plenty, therefore this loss is not a big deal.

I hope you guys can see the importance of placing and sticking to your stop loss. Or else your account will be blown before you know it.

Ezekiel Chew

Asia #1 Forex Mentor from www.asiaforexmentor.com

-

13

13

-

-

Forex Market: Mass Ratings Downgrades Fuel Debt Crisis Concern

Markets are going to remain nervous for some more time as S&P ratings agency punished nine eurozone countries with downgrades and to striped France and Austria of their triple-A ratings. Even though S&P said that Germany’s rating is in excellent condition, the downgrading is likely to have direct consequences for country. EUR/USD had fallen sharply after the statement. FOREX MARKET investors should be cautious as the bad news will have more impact on the financial markets.

S&P said “We have lowered the long-term ratings on Cyprus, Italy, Portugal, and Spain by two notches; lowered the long-term ratings on Austria, France, Malta, Slovakia, and Slovenia, by one notch; and affirmed the long-term ratings on Belgium, Estonia, Finland, Germany, Ireland, Luxembourg, and the Netherlands. All ratings have been removed from CreditWatch, where they were placed with negative implications on Dec. 5, 2011 (except for Cyprus, which was first placed on CreditWatch on Aug. 12, 2011)” in its statement. We believe that the negative outlooks for virtually every eurozone country suggest that the debt crisis will remain an issue for the forex market throughout this year.

Forex Market: Mass Ratings Downgrades Fuel Debt Crisis Concern

EU leaders have to act faster and regain investors’ confidence in order to control the ongoing crisis. However, it seems that eurozone chiefs will continue to rely on state level solutions like fiscal union and debt brake. In addition, the downgrade of the nine countries will increase pressure for all of the eurozone countries to solve their budget and debt problems. Some forex market investors think that relations among the eurozone members are likely to become more difficult after this point.

Forex market has been expecting downgrades of France and other European countries, but it is hard to tell how much the downgrades have already been priced in. director of the European Centre for International Political Economy, Fredrik Erixon said “The U.S. is still rightly seen as a safe haven. The U.S. is a big liquid economy with a strong tradition of honoring its debts in modern times and a central bank pledged to take action if needed. It’s different with France in the sense that they cannot rely on strong central bank policies”.

Forex Market: Mass Ratings Downgrades Fuel Debt Crisis Concern

Forex Market

What we can take away from the above analysis is that. With more possible downgrading to come on other European Countries. We will remain bearish when trading the Eur. And to look for opportunities to enter on rebound of the Eur/Usd.

Ezekiel Chew

Asia #1 Forex Mentor

-

Let’s Make Year 2012 a Great Year

Wow! Can’t believe it but we are now in Year 2012!

How time flies, and it was only like a day ago =P(truth is a year ago) where i asked What’s your new year resolution?

Read this post: http://www.asiaforexmentor.com/whats-your-new-year-resolution/

SO!

Have you achieved your Goal last year?

Or did you NOT set any Goals last year?

Nevertheless, i will sincerely stand up and applaud you if you have achieved the goal you have set last year.

Because, you are an achiever. A DOER!

You make things happen. You are one who recognises that opportunities are created and goals are achieved all through sheer perseverance and discipline.

The very same applies in Forex trading.

Which is why forex trading is very VERY closely related to our daily lives.

The emotions we expose outside of the forex trading world, WILL be the same emotions we have in our forex trading.

So would you wish and strive to make yourself:

- CALMER and more compose

- Reduce your bad & hot temper

- Reduce your greed level & impulse level

- Increase your discipline

- Reduce your laziness and procrastination

If you can achieve the above in this year 2012!

It will not only aid in the real world you live in, it will also largely aid in your forex trading.

By achieving the above goals – You WILL be a better person.

And NOT only that.

You will be someone that achieves GREAT THINGS!

So come on,

Read the above GOALS again and make sure you will improve on all of the above this 2012.

This slight improvement will pave the road for greater things from now on!

DO IT!

Ezekiel Chew

Asia #1 Forex Mentor

www.asiaforexmentor.com

Forex Trading Strategies – Its all about Boxes

in Forex General Discussion

Posted

Forex Trading Strategies – Its all about Boxes (Forex Trading Strategies)

Forex trading pair: Usd Chf

The forex trading strategies | strategy above is an interesting way to look at forex charts.

I have highlighted blue boxes in the chart.

As we can see, when price is NOT trending. It moves in boxes. Just like the chart above.

Do not neglect the simplicity of this! I use this often as one of my trading arsenal.

What we can notice from the chart is that price consolidates in the boxes and to eventually break out from the box to form another box.

So price move in boxes when its not trending.

How can we benefit from this Simple yet Powerful knowledge?

Forex Trading Strategies – Its all about Boxes (Forex Trading Strategies)

By drawing the boxes, we are able to predict where price might head to on the next box after the breakout.

And besides that, we can just trade inside the box just like this:

Forex trading strategies: Look at the first red arrow in the chart above. That indicates the marking of the low of the box.

So we can expect the next time price reaches the area. We can buy at the area. Which is marked by the white arrow on the second time.

The same follows on the 2nd box.

The red arrow pointing down marks the high of the blue box. So the next time price reaches the high. We can sell it off immediately (as marked by the white arrow)

And we are seeing that happening right now in the latest blue box. Price has hit the bottom of the blue box which has now retraced back up. Therefore we can place a buy order right at the bottom of the blue box to profit from this.

Forex Trading Strategies – Its all about Boxes (Forex Trading Strategies)

Do you see the power of this forex trading strategies | strategy?

It is so simple yet powerful.

As i always say, Forex trading can be plain, simple and clear cut. By using simple clear cut strategy just like this box strategy, forex trading will no longer be difficult.

I hope you like this and pls click on the like button and drop a comment below to let me know how you feel.

This is just one of the ways we trade, Check out our Winning Asia Forex Mentor Price Action Forex Course where i teach you the exact FULL Forex Trading System that i personally use.

See you on the other side my friend,

Ezekiel Chew

Asia's #1 Forex Mentor