Exchange Blog Cryptocurrency Blog

-

Posts

72 -

Joined

-

Last visited

Everything posted by LQD Markets

-

Electronic communication network An Electronic Communication Network or ECN is a term used for a computer system that facilitates forex trading of currency pairs or stocks. This entire process is conducted without bringing the stock exchanges into consideration. ECN is also termed as the Alternative Trading Systems or Network. The concept of ECN was first introduced in the year 1969. Since then, it has gained a lot of popularity and is now being used by a large number of organizations such as Liquids Markets. ECN increases the competition level that exists among companies because it decreases costs while giving clients complete access to all their orders. Moreover, clients are also capable of placing an order at any time during the day. Don’t miss out on this great article here: http://www.lqdmarkets.com/blog/electronic-communication-network/

-

Forex Broker Liquid Markets Offers Interest on Deposits Liquid Markets is happy to announce that it is now offering investors deposit interest rates based on their cash deposit and day-to-day volume regardless of margin usage. Investors can earn up to 5% interest on deposits – it is a unique service in the trading world, and Liquid Markets is very proud to be the only broker offering this service. Read the full Press Release:http://www.prweb.com/releases/2013/5/prweb10740120.htm

-

EARN UP TO 5% INTEREST ON YOUR DEPOSIT! We have all seen numerous FX brokerage companies desperately trying to attract new clients by luring them with all sorts of welcome bonuses. Usually it’s a monetary bonus but we’ve seen brokers offering anything from formula one tickets to sports cars to a small yacht! Now we don’t want to spoil the dreams of any people out there but the simple truth is, no one actually ever receives that 5000 USD bonus or that brand new Maserati. There are always clauses that prevent the account holder from ever actually profiting from what’s being offered. At Liquid Markets we like to deal with reality, facts and not fiction, and we do not think that making empty promises is the right way to start off a business relationship with any client. Instead of a bonus, which you will never receive, Liquid Markets will pay interest on your account balance, every single day. We’ll pay you the base currency interest rate even if you don’t trade on your account (a LIBOR proxy interest rate), but if you do trade you’ll receive a much higher interest rate, in fact, the more you trade the higher the rate all the way to LIBOR +5%. Additionally, even the margin you’re using to trade is paid interest on, so even if you have open positions, you’ll still receive the associated interest payment on the margin you’re using. As opposed to any bonus scheme, there are no strings attached, you can withdraw your interest payment at any time, at a moment’s notice. As a financial markets participant, we want to provide you with a true interbank money markets environment. In that respect, we are offering daily deposit interest rates based on your cash equity and your day-to-day volume. Let your money work for you with these unique interest-bearing daily deposit rates. For a more detailed account of our exclusive service, please visit our new Interest Rate on Deposits page: http://www.lqdmarkets.com/Trading-Products/Interest-Rate-On-Net-Equity Feel free to contact our support team for further information. Our Customer Support is available via live chat, phone +357 25 200 925 or email support@lqdmarkets.com if you require further assistance.

-

Currencies Outlook The markets seemed to be triggering more impulsive moves for various currency pairs since the beginning of the week with most fingers pointing to Japan. Today’s news headlines read “Markets could be on a verge of a blowup, thanks to Japan”. For FX traders, what would you think the sentiments are in the markets at present following that statement? I would say, chaos flooded with an increased amount of uncertainties would describe the present market conditions. Despite the Bank of Japan’s previous move of flooding the markets with printed money and the given impact on the market today, the Governor of the Bank of Japan, Haruhiko Kuroda, made a statement saying that the rising stock prices does not present a bubble at the moment. Full technical analysis here: http://www.lqdmarkets.com/blog/category/technical-analysis/

-

Exploring Automated Forex Trading Systems Automated forex trading systems are platforms through which foreign currencies are traded using a software application that is designed and programmed according to an algorithm that will help you decide if you should purchase or sell currency at any instant. The program makes decisions on the basis of signals that have been derived by technically analyzing the various charting tools available. The signals can then indicate a purchase or sale if their direction is the same Interested in automatic trading? Read the full article and get started here: http://www.lqdmarkets.com/blog/exploring-automated-forex-trading-systems/

-

Forex Information for Beginners: Essential Steps Are you new to the forex market and have no idea about how to get started? Or are you a novice in forex trading and have not yet been able to make a successful trade? In both these cases, there are a couple of things that you need to know. Here are the basic steps that you must go through prior to making your first ever trade. View the full steps here: http://www.lqdmarkets.com/blog/forex-information-for-beginners-essential-steps/

-

Midday Currency In Asia, activities concerning the major currencies seemed to be on a halt or on a sideways backburner for now. Hence, it would be wise to explore the other continents particularly the euro zone for possible trading opportunities. Yesterday, we witnessed the euro’s rally against the dollar which was backed up by some fundamental drivers starting with some “positive” developments following the formation of Italy’s government. Get the full analysis here: http://www.lqdmarkets.com/blog/midday-currency-outlook-30th-april-2013/

-

Social Trading Social trading is a relatively new concept in the world of forex trading that offers excitement and rewards while giving you complete access and insight into the forex market. It connects all the traders from around the globe onto a single platform. Thus, every individual can take advantage of other traders’ skills, and implement the same strategies as them for a smarter currency trading experience. Obviously, this increases your abilities and allows you to take your trading to an entirely different level, which means more profits in the long run. Read More: http://www.lqdmarkets.com/blog/social-trading/

-

Choosing between fixed and floating spreads When it comes to trading forex, brokers offer traders two types of spreads to choose from: fixed spread and floating spread. So, which one is better out of the two? This depends solely on you, and only you can make a suitable choice for yourself. You can consider your trading strategies and your experience to come to a good decision. Read More: http://www.lqdmarkets.com/blog/choosing-between-fixed-and-floating-spreads/

-

Gold Forecast Let us begin this week with gold’s movement in the market and match it with its recent performances from a technical or chart patterns point of view. Gold, after its 26 month low, rallied last week driven by retail shoppers in India and China who were shopping for physical gold and jewellery. Read More: http://www.lqdmarkets.com/blog/gold-forecast-29th-april-2013/

-

EUR/JPY Forecast As we look back at last week’s US economic data, results were overwhelmingly short of expectations. Would the overall bearish sentiment for both the US dollar and the various correlated instruments carry through next week? The implications onto the market from previous as well as upcoming data would most probably show a clearer picture after next week’s Core Consumption Expenditures data. As for the euro zone, Germany is waiting for its’ Consumer Price Index (CPI) figures which would add to the weight of either continuing existing trends or becoming a catalyst to the change of direction. Read More: http://www.lqdmarkets.com/blog/eurjpy-forecast-26th-april-2013/

-

What is a True ECN Forex Platform? ECN stands for Electronic Communications Network. If your forex broker offers ECN forex, it means that the broker does not use a dealing desk. Instead, the broker provides you with access to a marketplace where there are multiple makers, traders and bankers. Anyone can enter in any competing bid or offer and have his forex trade filled by several liquidity providers in a completely anonymous environment. What this means is that whichever trades you make, you will not do it in your name, but instead use the name of your broker. This lets you remain completely anonymous while you make as many trades as you like. Read More: http://www.lqdmarkets.com/blog/what-is-a-true-ecn-forex-platform/

-

Simply open and fund your Currensee Trade Leaders™ Investment Program account by May 3, 2013, and we’ll cover any losses you incur up to the value of your initial investment starting May 4, 2013 - May 31, 2013.* This means you can experience our revolutionary autotrading program that delivers the performance of a select group of Forex traders. The Currensee Trade Leaders difference Access to a select group of foreign exchange managers called Trade Leaders • Ongoing rigorous performance and risk management due diligence for each Trade Leader – only those who pass strict criteria become and continue to be Trade Leaders • Ability to participate in the Forex market without having to trade yourself • Robust leverage and risk management controls • Real-time performance and trade execution data • Complete control of your investment, 100% liquidity, no lock up period GET STARTED: http://www.currensee.com/liquidmarketsKYP

-

EUR/JPY Forecast Today, despite being two days prior to the close of the trading week, speculations surrounding the possibility of the European rate cut continues to intensify. Similarly, fear of a double recession is supposedly no laughing matter for the UK as it waits for the GDP figures due out later on this afternoon. What a concoction of emotions and with it being a Thursday, does spice up situations even more as traders with open positions would wonder whether their TP level would see to some returns while those itching to trade would feel equally as guilty, despite whatever their decisions were. Read more: http://www.lqdmarkets.com/blog/eurjpy-forecast-25th-april-2013/

-

Fixed Spreads vs Floating Spreads Before you select a forex broker for yourself, you should be aware of the types of spreads that the broker will offer you. Your chosen spread will affect your forex trading strategies, methods and even the times at which you trade. Thus, you should make a decision wisely so that you can choose a proper spread for yourself. This is particularly important if you are involved in other jobs, and can trade only at limited times of the day. So unless you indulge yourself in mobile trading, the spread you choose can greatly affect your success or failure in forex trading. If you know the basics of both the spreads, you will be able to make good decisions. Read More: http://www.lqdmarkets.com/blog/fixed-spread-vs-floating-spread/

-

EUR/JPY Forecast Friday again, that’s right and whilst wrapping the market for the week, we are still wondering whether volatility for various instruments would provide the persistence in momentum either towards trend continuation or trend reversals. As for today’s Economic data, we are awaiting Bank Of Canada’s (BOC) Consumer Price Index due later on today. However, it would be wise for us to monitor how stocks and the equities markets are performing. Saying that, the S & P 500 which is giving more hints in its’ breakout downwards concluding a Risk Aversion move. Read More: http://www.lqdmarkets.com/blog/eurjpy-forecast-19th-april-2013/

-

How to trade Forex? The thrill of trading forex is unmatched. It can keep a person constantly on edge. Traders have to apply their skill and common sense while trading to make profits. The main objective of this activity is to exchange one currency with another in an attempt to make a profit due to price changes. Read More: http://www.lqdmarkets.com/blog/how-to-trade-forex/#more-725

-

Earn Interest with Overnight Swaps We are happy to announce that we are now offering you even better swap rates. Liquid Markets is one of the most competitive brokers with regards to swap rates in the forex market. Our overnight swaps are Institutional Grade and are on par with Tier 1 liquidity providers. A ‘Swap’ or a ‘Rollover’ is the interest paid or earned for extending a position at the end of the day (5pm ET) without settling. The swap rate converts net currency interest rates, which are given as a percentage, into a cash return for the position. Take advantage of the global markets today! http://www.lqdmarkets.com/Trading-Products/swap-rates

-

Yesterday, most traders were hoping for a single answer as to why Euro plunged but that one question may have multiple answers. As mentioned in my previous analysis, comments made by Draghi unfolded bearish sentiments while members of the European Monetary Board (EMU) didn’t sound like they would long the Euro if they were to trade it. Following more news and comments later that evening, German Central Bank’s Jean Weidmann contributed to the further fall of the Euro after hinting the possibility of a ‘rate change’ by the ECB. Read More: http://www.lqdmarkets.com/blog/currencies-outlook-18th-april-2013/

-

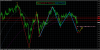

EUR/USD Forecast The German ZEW report released yesterday missed expectations by 3.2 basis points (a lower expectation), which contributed to the euro falling right after the announcement to levels forecasted following the bearish ‘W’ pattern. As for the euro zone’s CPI for March figures settled at 1.2% MM poses a neutral sentiment with no break above or lower to these levels. For a bigger picture on what is in store for the euro zone, it’s best to see what we concluded from Draghi’s speech based on the following mentioned topics: 1) Updates in Areas of Economic and Monetary Policy– Generic Outlook/ Current Status Initially, Draghi sounded like a broken record during his speech where he talked about the start of the euro’s recession in 2012, contributing to its unprecedented unemployment levels especially amongst young people. The key point for traders to consider is that gradual recovery is expected but Downside Risks governs. In summary, bearish sentiments are expected and we need to see governments efforts working in synergy with the banks as opposed to just a name and blame game. Read More: http://www.lqdmarket...7th-april-2013/

-

Exploring Forex Trading Platforms A trading platform is software that allows traders and investors to manage market positions and trade currencies. It is an interface that enables users to see a pictorial representation of pricing fluctuations and market actions. The patterns and trends of the forex market are clearly visible in these charts and help traders make decisions regarding trading transactions. The rapid popularity of forex trading in the last few years has led to the introduction of many online trading platforms. There are various types of trading platforms. Some are browser-based, some desktop-based and now there are also platforms that are compatible with smart phones. This can help people stay updated with the market at all times and anywhere. Some of the main forex trading platforms include: Read More: http://www.lqdmarkets.com/blog/exploring-forex-trading-platforms/

-

Key Benefits of Forex Trading The forex market, in comparison to other markets, is very attractive and appealing to traders. This is the reason that the forex market has gained excessive popularity over the past few years. The liberty given to traders in this market along with the negligible costs associated with trading, make forex trading very lucrative and interesting. Below are some of the key benefits of trading in the forex market. Read More: http://www.lqdmarkets.com/blog/key-benefits-of-forex-trading/#more-661

-

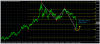

EUR/USD Forecast Despite some high-impact data due to be released today, the deadly Boston Marathon blasts has contributed to the decline of the Asian markets together with Japan’s stock indexes falling (approx.2% drop) as did the whole lot including Aussie’s , Oil and Gold prices .This would mean that investors would be more risk averse and be worth for us as traders giving a lookout for less risky currencies seen as safe heavens like the USD, JPY and CHF. Saying that, is this the reason for the short term fall for the euro as in both the 15 min and 1Hr charts below? http://www.lqdmarkets.com/blog/eurusd-forecast-16th-april-2013/

-

A Guide to Comparing Forex Brokers When you enter the world of online Forex, you will find many Forex brokers offering their brokerage services. Each broker will claim to provide you with the most useful tips to help you earn profits. Selecting a Forex broker for your online trading needs can be quite difficult. However, once you find a good broker, you will be able to trade lucratively in the currency market using their knowledge, insight and experience. Here is what you should do to compare the various brokerage services available online. Read More: http://www.lqdmarkets.com/blog/a-guide-to-comparing-forex-brokers/

-

New CFDs to trade at Liquid Markets We are pleased to announce that we are now offering you more CFD trading instruments, including CFDs on stock indices, bond and commodity futures using our friendly, innovative MT4 trading platform. In addition, we have revamped our CFDs trading page, complete with the entire list of CFDs we offer and content that’s easy to understand. Read more: http://m.lqdmarkets.com/HS?a=ENX7Cqjj6QL_8SA9MKJtOb3nGHxKLjattfcStGb5lw8W0bBhOG5mpqVsje_HhdB74lKO