Exchange Blog Cryptocurrency Blog

saiansh23

-

Posts

21 -

Joined

-

Last visited

Posts posted by saiansh23

-

-

Money bookers is very reliable payment processor and its growing day by day I have made some withdrawls form moneybookers to my bank account Because it is one the payment processors that allow transfers in India.

-

netteller is good service I think it will expand globally by the end of 2013 . Would be looking forward that if it is accepted in India First paypal was not but now it is the only electronic transfer than transfer to banks directly and Payza

-

Intereing one though

-

This is another HYIp will decide to look at it and then will decide which one is best to join and stable after monitoring peoples view here at moneytalk

Thanks for the offer

-

Is is confirm that you will get paid I have some sites like this come and run after few weeks or months. I have seen this happen to too many people. How about this one

-

Matrix what is matrix I dont have any idea is it like networking and gathering people to invest any get commission out of them upto some levels .

Am i right ?

-

I have opened an account with FBS and getting ideas daily but have not yet deposit money to account I am looking here and there for best broker around which can guide me through the trading education

This site is amogst top 3 of the brokers I have in MInd

-

Even I am wandering that this site has good revenue share and seems promising I am pending somepayouts surely will love to invest some here

Thanks

-

Is it really worthit to invest at HYIP sites Dont have any idea from where they pay such huge interestes. Can anybody guide

Thanks

-

You need to understand one thing fx is not a magic it wont solve everything in days. First have some experience and have some good funds and time is must and start learning i would advice a professional Institution as they can guide you through everything and you should be willing to learn. Otherwise open the chart attach few indicators to it start buy and sell in overbought and oversold situations

Rgds

-

Ya well said implemention is more important than having a plan . If we cant execute what we think overnight and learn from over mistake then we should not doing anything. Forex is quick money but really when somebody sell you buy but who sells you dont know it is as simpler as it get but some as difficults as anything in the world.

-

Trading the Forex market can be profitable, however, it can be just as costly without the proper management over your capital. Generally with each trade, stop losses are placed to ensure that a trade that goes against you does not completely devour your invested capital.

A stop loss is a preset target where your trade will close out. Setting proper stop losses are important to ensure that your losses are minimized. For traders that don’t want to sit in front of their computer every minute they have positions opened, stop losses are your best friend.

Setting the amount you are willing to lose per trade is subjective. Generally, risk levels are set at between 1% and 5% of your trading accounts total balance. This means at a risk level of 5%, you can place 20 losing trades before you lose all your funds. If you find that you often lose 100% of your funds, you may wish to back track on your strategy.

Say for example, you deposited an initial amount of $1,000. To risk 2% per trade would be to set a stop loss which will close the trade for you should a single trade lose $20 ($1,000 x 2% = $20).

Make sure that you manage your risk, as this is one of the pivotal aspects in long-term trading success.

Trading Psychology

Managing your emotions

Quite often, the greatest opponent you have while trading is not the market but yourself. When trading, greed and fear often limits the potential returns from profiting trades and on the opposite side of the spectrum can result in greater losses than necessary or turn potentially profitable trades in to losing trades.

All traders (successful and unsuccessful) can attest to holding on to losing trades for far too long for no other reason than the “hope” that they become positive again. This is otherwise known as being too greedy.

Alternatively, the fear of taking profits too early or closing at a small loss when they can potentially be profitable is also another emotional response that needs to be adjusted. Good traders strictly follow a complete trading plan that incorporates money and risk management, entry, exit rules and do not let emotions influence their trading.

perfect example But newcomers like me dont have that much inf influence I risk 30 dollars on a single trade of 100 dollars account. But now I have a plan I never set a stop more than 30pip but i still need few more books on money management as i am getting myself prepared

Thanks & regards

-

High yeild investment program (HYIP) do you guys can explain from where they such big amounts to pay they stay here for two three months and walk away with everything. I dont trust them really I have lost a lot

But if anybody can recommedn then i would really be eager to join

-

Admin is really very experienced and really has pay lot of attention to the forum and succefully takes this forum to higher levles as this fourm really helping newcomers who want to earn online a way to start

hats off to admin keep doing the good work

-

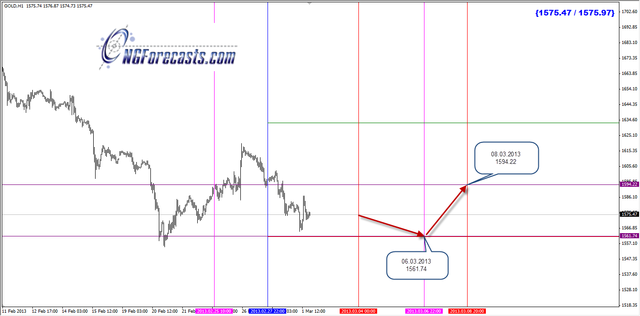

This really nice information but not too many traders around to take benefit of these setups

Thanks & regards

-

Every who has the strategy and can survive here should trade. But which strI ategy should we follow The important question is I am followign elliott wave for taking long trades and fibos and fractals for scalp and I have delvopmed my own system and it is reliable because it can avoid you from basic whispaws. Now you should be good enough to built a system Because custom indicators are lagging but every time a trend is devloped indicators start showing positve sign and then we came to know that it is right. So avoid use of excessive indicators. But fractas are very good because it is natural Will post some charts if i am allowed to do so to show ho fractas and fibos works in forex

Regards

-

They all are suckers I have wasted thousands of dollars into hyips and one of then is forexcompanyonline.com dont get stuck into

This is my advice even JRR trippler kicks everybody

Advice

REgards

-

This is good but I rely without doubt on http://xmlgold.eu and made more than 30 exchange in one month webmoney and liberty reserve instantly and paypayl or trasnfer 24 hours

REgards

-

You have to be experienced enough i dont think if a person who does not have a trading experience of more than 4 years can rely on daily trading I was involved in scalping But now I have move back to position trading and one to two trades a week are good But scalping is a headache tons of hours daily against the screen You are bound to make mistakes and as an elliottician I label the waves on weekends if there is something in it and then only after comfirmations I take trades

thanks for the thread

-

I am really confused you used GANN strategy but I would really look think about with such as strategy with 100 Stop and 50 TP is reliable specailly when you are predicting future price prior to the move. But I would really bet on elliott wave or fractals rather than GANN. I have used so many strategies and master some of them But GANN results are worst of them all. Only one site that reveals the real truth of GANN which GUNNER.com

But it is not an offence and please dont take it criticism I have no intention to insult any strategy It is just my opinion..

Regards

Write Alexa Review & Get Paid $0.50 - 5 Mins Work.

in Closed Contest

Posted

This is good that site is paying and trusted and honest admin what else do you want for a site to pay for your hardwork and it is doing

Truly reliable

Thanks