Exchange Blog Cryptocurrency Blog

All Activity

- Past hour

-

Payeer: Date: 2025-09-17 00:19:06 ID: 2259555945 Details: P1127547024 > P1050055 Amount: 0.50 USD Comment: RAMONA

-

ePayCore: Date and time 17/09/2025 at 16:59 Top-up + 9.29 usd Payment system ePayCore E054677 Batch: 2853800 Comment Payment via AiTiMart for invoice 659731919438 USDT-TRC20: e77de2aba82d3098f74e10dec811c7802aa1b499c604aba01cab58019208bf65 2025-09-17 12:26:39 (UTC) 12 Tether USD

-

Crypto Botics Limited - cryptobotics.net

SQMonitor.com replied to SQMonitor.com's topic in HYIP Section

ePayCore: Date and time 17/09/2025 at 17:54 Top-up + 0.99 usd Payment system ePayCore E029772 Batch: 2853837 Comment Withdraw to sqmonitor from Crypto Botics Limited -

ePayCore: Date and time 17/09/2025 at 12:59 Top-up + 1.53 usd Payment system ePayCore E059497 Batch: 2853479

-

Bitbillionaire Limited - bitbillionaire.net

SQMonitor.com replied to SQMonitor.com's topic in HYIP Section

ePayCore: Date and time 16/09/2025 at 22:21 Top-up + 1.5 usd Payment system ePayCore E058151 Batch: 2853293 ePayCore: Date and time 16/09/2025 at 22:18 Top-up + 0.5 usd Payment system ePayCore E058151 Batch: 2853288 - Today

-

ePayCore: Date and time 16/09/2025 at 22:10 Top-up + 0.23 usd Payment system ePayCore E058128 Batch: 2853269

-

Project conditions and design update: Investment Plans: 10% daily for 12 days | 17% daily for 10 days | 300% after 7 days | 450% after 5 days Principal Return: Included in % Charging: Calendar days Minimal Spend: $10 Maximal Spend: $100,000 Referral: 6%, 2%, 1%* Withdrawal: Manual (up to 24 business hours) Minimum Withdrawal: $0.1 ePayCore, $5 TRX, $10 other cryptocurrencies Payment systems: ePayCore | Tether ERC20 | Tether TRC20 | Tether BEP20 | BNB.BSC | Bitcoin | Bitcoin Cash | Ethereum | Tron | Ripple

-

- 62 replies

-

- ptc

- offerwalls

-

(and 3 more)

Tagged with:

-

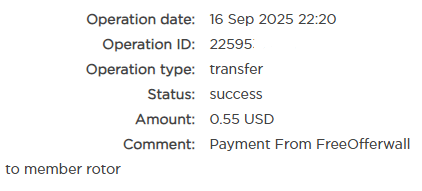

Newest payment I have received:

- 62 replies

-

- ptc

- offerwalls

-

(and 3 more)

Tagged with:

-

Operation ID: 2853511 Operation Date: 17.09.2025 Status: Proceed Immediately Sender's Account: ePayCore E029772 Amount: $9.92 USD Note: Withdrawal to HyipsClub from Crypto Botics Limited

-

Crypto Botics Limited - cryptobotics.net

Secure Investment.Net replied to SQMonitor.com's topic in HYIP Section

Payment Confirmation Your withdrawal has been processed instantly. Transaction ID: 2853426 Date: 17.09.2025 Amount: $12.92 USD Note: Withdrawal to SecureInvestment from Crypto Botics Limited. - Yesterday

-

Funds have been credited to your balance. Transaction ID: 2853350 Date of transaction: 16.09.2025 22:25 Amount: 20.1 USD Payment system ePayCore E054676 Note: Withdraw to XtraProfit from bitbullpro. net

-

AUD/CAD Consolidates Near Key Levels The AUD/CAD forex pair represents the Australian Dollar against the Canadian Dollar, reflecting the economic interplay between two resource-driven economies heavily influenced by commodities and global demand. On the Australian side, traders are watching the Melbourne Institute’s Leading Index, which tracks shifts in consumer confidence, housing, and commodity prices, though its muted impact stems from reliance on previously released data. More attention, however, is on RBA Assistant Governor Brad Jones, who is scheduled to participate in a fireside chat on "The Future of Money," where any hawkish signals could support the Aussie. Meanwhile, Canada’s focus lies on foreign securities purchases data, a key measure of international capital inflows, and upcoming Bank of Canada events, including its interest rate decision and policy statement later this month. With both central banks in the spotlight and commodities driving sentiment, today’s session could see heightened volatility in AUD-CAD as traders weigh shifts in economic outlook and monetary policy direction. Image Chart Notes: • Chart time-zone is UTC (+03:00) • Candles’ time-frame is 4h. Analyzing the AUD/CAD H4 chart, the pair recently pulled back from its highs around 0.9220 and is now consolidating near the 0.9180 level. The Ichimoku Cloud shows that price is still trading above the Kumo, reflecting an overall bullish structure, though momentum is being tested as candles hover close to the conversion and base lines. A sustained move above the blue Tenkan-sen could reignite bullish momentum, with resistance at the 0.9200–0.9220 zone as the immediate upside target. On the downside, a break below the red Kijun-sen may expose the top of the cloud around 0.9150 as the next key support. The RSI is sitting near 52, just above the neutral 50 level, highlighting market indecision and signaling that neither bulls nor bears have firm control. Traders should monitor whether AUDCAD holds above the Ichimoku support zone for a potential continuation higher, or whether weakening momentum leads to a deeper correction into the cloud. •DISCLAIMER: Please note that the above analysis is not an investment suggestion by “Capitalcore LLC”. This post has been published only for educational purposes. Capitalcore