Exchange Blog Cryptocurrency Blog

All Activity

- Today

-

Technical Indicators Suggest Gold Price Correction Incoming XAU/USD, commonly known as Gold, is among the most traded forex pairs in the financial markets, renowned as a safe-haven asset especially during periods of economic uncertainty. Today, traders are closely watching several key economic indicators from the United States, including Initial Jobless Claims, the Philadelphia Fed Manufacturing Index, the Conference Board Leading Index, EIA Natural Gas Storage, and TIC Net Long-term Transactions. Stronger-than-expected data in these areas could bolster the USD, potentially weighing on gold prices. Conversely, weaker economic indicators could enhance Gold's appeal as a safe haven, pushing XAU/USD higher. Image Chart Notes: • Chart time-zone is UTC (+03:00) • Candles’ time-frame is 4h. Analyzing the XAU/USD 4-hour chart, the pair has been trending bullishly, consistently setting higher highs and higher lows. However, a negative regular divergence has emerged in recent candles, signaling a potential reversal which has already begun. With key support identified at the level of 3634.52, the price action could see a pullback to this area. Conversely, bullish momentum recovery might lead prices toward the resistance level at 3699.04. The MACD indicator currently shows a bearish sentiment with the histogram at -2.05, the MACD line at -0.98, and the signal line at 1.08, suggesting weakening bullish momentum. The Stochastic indicator with K% at 35.07 and D% at 44.19 indicates an oversold market condition, possibly foreshadowing a near-term reversal upward. Bollinger Bands have expanded, reflecting increased market volatility, implying potential sharp price movements ahead. •DISCLAIMER: Please note that the above analysis is not an investment suggestion by “Capitalcore LLC”. This post has been published only for educational purposes. Capitalcore

- Yesterday

-

Date: 17th September 2025. Gold Analysis Ahead of Tonight’s Fed Rate Decision! Gold prices continue to rise, pushing the commodity to a new all-time high. Investors are watching closely the upcoming Federal Reserve Rate Decision and Press Conference thereafter. Due to this event, market participants are not adding to their exposure levels until further clarity is obtained from the Federal Reserve. As a result, Gold prices are forming a similar retracement to that seen on the 9th. What will determine if Gold’s trend will continue or if traders will start to lock in profits? XAUUSD (Gold) 12-Hour Chart The Federal Reserve Driving Gold Prices Analysts widely expect the Federal Reserve to cut interest rates by 25 basis points. The Chicago exchange is currently placing a 0.25% cut as a 96% possibility. If we follow traditional economics, the cut can cause only a short-term weakening of the US Dollar, as the market has largely priced in this scenario. Some economists advise that the cut alone cannot create volatility, as it is already fully priced. However, trends will depend on updates to economic forecasts and the tone of remarks from Chairman Jerome Powell. Investors will be scrutinising Mr Powell’s press conference to obtain indications of how many cuts we will witness in 2025. The press conference will take place at 18:30 GMT. If Powell emphasises the risks of rising inflation and that the committee is neutral on future cuts, it would signal a more cautious approach to monetary easing. Conversely, if his focus is on cooling labour and housing markets, it could suggest a more ‘dovish’ stance. If so, the market would expect a further 0.25% cut in October and again in December. There is a 74% chance of 3 rate cuts by the end of 2025. Citibank is the latest to advise that they no longer expect a 0.50% cut tonight. Instead, the bank expects a series of cuts throughout the rest of 2025. Some officials are considering the risk of higher price pressures a greater concern than current employment trends. As a reminder, the Consumer Price Index rose 2.9% in August, up from 2.7% in July, reaching its highest level since January. On the other hand, many members of the Federal Open Market Committee are concerned about the employment sector, where the unemployment rate has again risen. Economic data in the US is not currently painting a clear picture, with conflicting data. For example, the US Retail Sales from yesterday rose above expectations, boosting confidence in the US economy. In addition to this, the recent PMI reports also rose above expectations. However, other data gives a real cause for concern. For this reason, the Federal Reserve is largely concentrating on Inflation and Employment Data. Other Central Banks and Gold Contracts Markets are also closely watching the Bank of Canada’s meeting today at 15:45 (GMT+2), where the central bank may cut its rate by 25 basis points, from 2.75% to 2.50%. Tomorrow, the Bank of England meets on Thursday at 13:00 (GMT+2), followed by the Bank of Japan on Friday. Neither is expected to change policy, but the press conference will again be key. Furthermore, according to the latest report from the US Commodity Futures Trading Commission (CFTC), positions backed by real money stood at 199.305 thousand long versus 32.888 thousand short. During the week, bullish traders closed 2.491 thousand contracts, while bearish traders closed only 0.046 thousand. Further, the bias remains in favour of an upward trend, but profit-taking amongst buyers outnumbers sellers closing their short positions. Key Takeaways: Gold prices continue to rise as investors await the Federal Reserve’s rate decision and press conference. However, a retracement forms as investors are aware of the Fed clarification. Analysts expect a 0.25% cut, but Gold trends will depend on Powell’s tone and economic forecasts. These include inflation and employment risks. Gold buyers are hoping for a further 0.25% cut in October and again in December. There is a 74% chance of 3 rate cuts by the end of 2025. According to the CFTC's latest report, a bullish bias remains as ‘long’ contracts outnumber sellers. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Michalis Efthymiou HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

-

Payeer: Date: 2025-09-17 00:19:06 ID: 2259555945 Details: P1127547024 > P1050055 Amount: 0.50 USD Comment: RAMONA

-

ePayCore: Date and time 17/09/2025 at 16:59 Top-up + 9.29 usd Payment system ePayCore E054677 Batch: 2853800 Comment Payment via AiTiMart for invoice 659731919438 USDT-TRC20: e77de2aba82d3098f74e10dec811c7802aa1b499c604aba01cab58019208bf65 2025-09-17 12:26:39 (UTC) 12 Tether USD

-

Crypto Botics Limited - cryptobotics.net

SQMonitor.com replied to SQMonitor.com's topic in HYIP Section

ePayCore: Date and time 17/09/2025 at 17:54 Top-up + 0.99 usd Payment system ePayCore E029772 Batch: 2853837 Comment Withdraw to sqmonitor from Crypto Botics Limited -

ePayCore: Date and time 17/09/2025 at 12:59 Top-up + 1.53 usd Payment system ePayCore E059497 Batch: 2853479

-

Bitbillionaire Limited - bitbillionaire.net

SQMonitor.com replied to SQMonitor.com's topic in HYIP Section

ePayCore: Date and time 16/09/2025 at 22:21 Top-up + 1.5 usd Payment system ePayCore E058151 Batch: 2853293 ePayCore: Date and time 16/09/2025 at 22:18 Top-up + 0.5 usd Payment system ePayCore E058151 Batch: 2853288 -

ePayCore: Date and time 16/09/2025 at 22:10 Top-up + 0.23 usd Payment system ePayCore E058128 Batch: 2853269

-

Project conditions and design update: Investment Plans: 10% daily for 12 days | 17% daily for 10 days | 300% after 7 days | 450% after 5 days Principal Return: Included in % Charging: Calendar days Minimal Spend: $10 Maximal Spend: $100,000 Referral: 6%, 2%, 1%* Withdrawal: Manual (up to 24 business hours) Minimum Withdrawal: $0.1 ePayCore, $5 TRX, $10 other cryptocurrencies Payment systems: ePayCore | Tether ERC20 | Tether TRC20 | Tether BEP20 | BNB.BSC | Bitcoin | Bitcoin Cash | Ethereum | Tron | Ripple

-

- 62 replies

-

- ptc

- offerwalls

-

(and 3 more)

Tagged with:

-

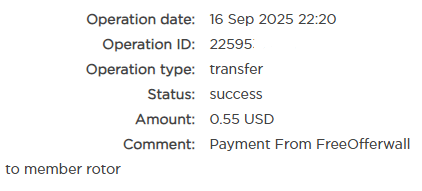

Newest payment I have received:

- 62 replies

-

- ptc

- offerwalls

-

(and 3 more)

Tagged with:

-

Operation ID: 2853511 Operation Date: 17.09.2025 Status: Proceed Immediately Sender's Account: ePayCore E029772 Amount: $9.92 USD Note: Withdrawal to HyipsClub from Crypto Botics Limited